In this note, we’ll do a simplified analysis of the Gold Finance Industry with a special focus on the two key Competitors of IIFL finance who might benefit from the vacuum its absence will create.

First, a few characteristics of the Gold Finance Industry

Gold Prices have a Strong Correlation with Gold AUM Growth. One reason for this trend is that as Prices increase, the incentive to take loans against Gold holdings increases because you simply get a higher amount for the same weight of Gold.

NPAs are usually not a problem because Gold financiers can sell the Collateralised Gold and make up for the outstanding amount. That’s why credit Costs remain low.

Incidentally, one of the issues RBI had with IIFL Finance was its Auctioning process.

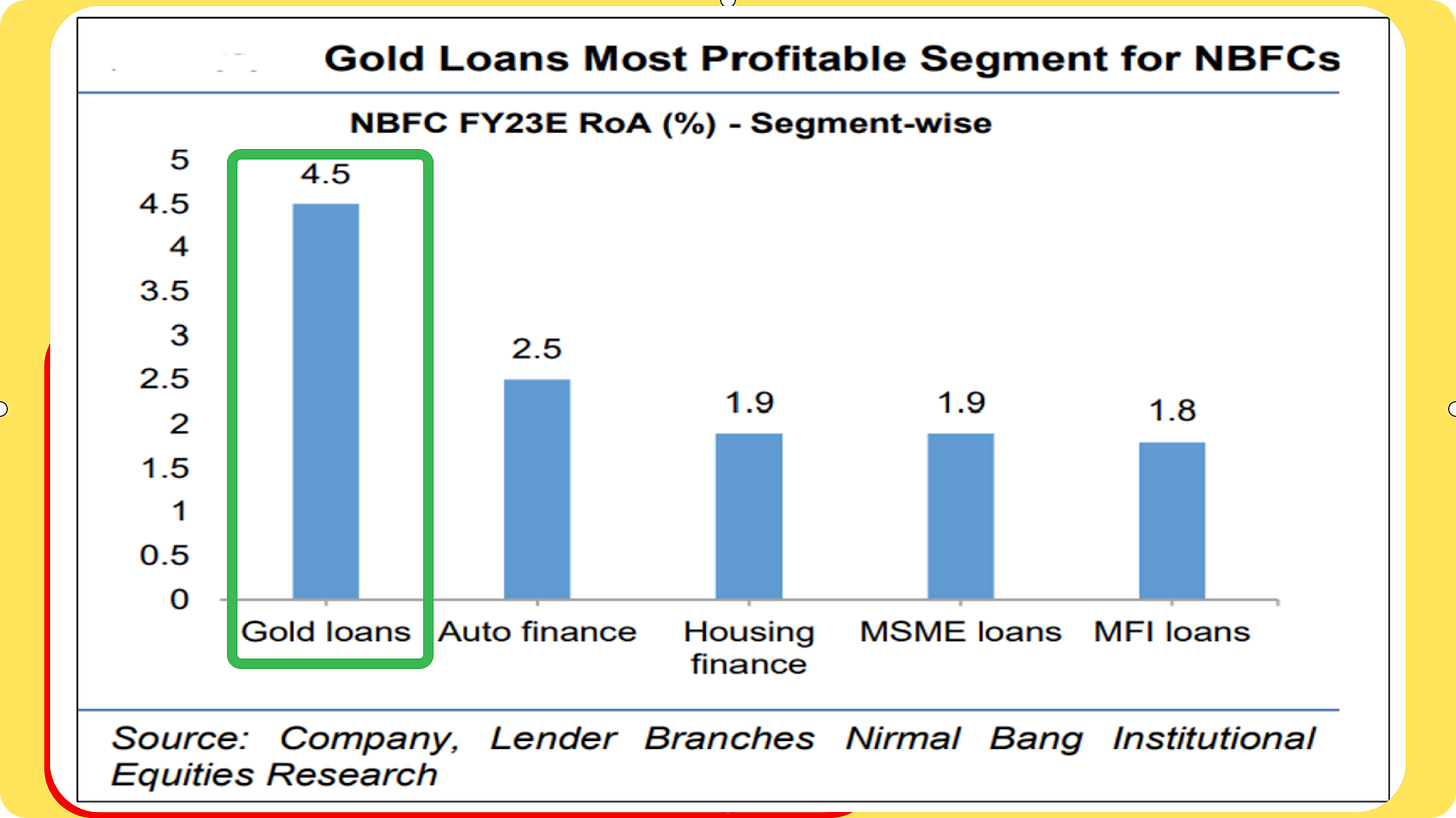

Gold Finance is probably the highest ROE business vs any other type of loan. This is also an invitation for competitors such as Banks. The primary reason for high ROE is that these are Short Term loans with Super High Yields. Operationally it is a very challenging business though, something most competitors only after they have enthusiastically committed to the business. Ask the fintechs, as the Banks.

India holds ~14% of the Total Gold. Less than 7% of that Gold is used for Gold Financing. Out of the 7% of the Gold Loan Market, organised players make up ~30-35% market leaving a sizeable scope for value migration.

Moving on from the basics.

Since this is not meant to be an exhaustive analysis but rather a brief one which hits all the most important angles, let’s talk about what really matters…

ROE

Gold finance peaked out in FY22. During Covid, RBI had pushed Gold loans because it was a collateralised form of raising money. From the peak ROE of 25%, things have returned to a more ‘normal’ 17-18% ROE for Muthoot. Can’t complain !

Manappuram Finance has had a relatively tougher time handling Asset quality issues. A few year ago Manappuram decided to diversify into Housing Finance, Vehicle Finance and MFI. This book ran into some trouble in FY21/22, which pulled its ROE down. Markets invariably punish this behaviour, as is evident by its past and present P/Bx being lower than Muthoot, whose Asset Quality has been much more stable and reliable.

Growth

IIFL’s relatively aggressive growth in Gold AUMs is precisely what alarmed the regulator on the ‘operational issues’ that led to the ban.

In the last one year, however, Muthoot’s Growth has been respectable yoy at 15.7%

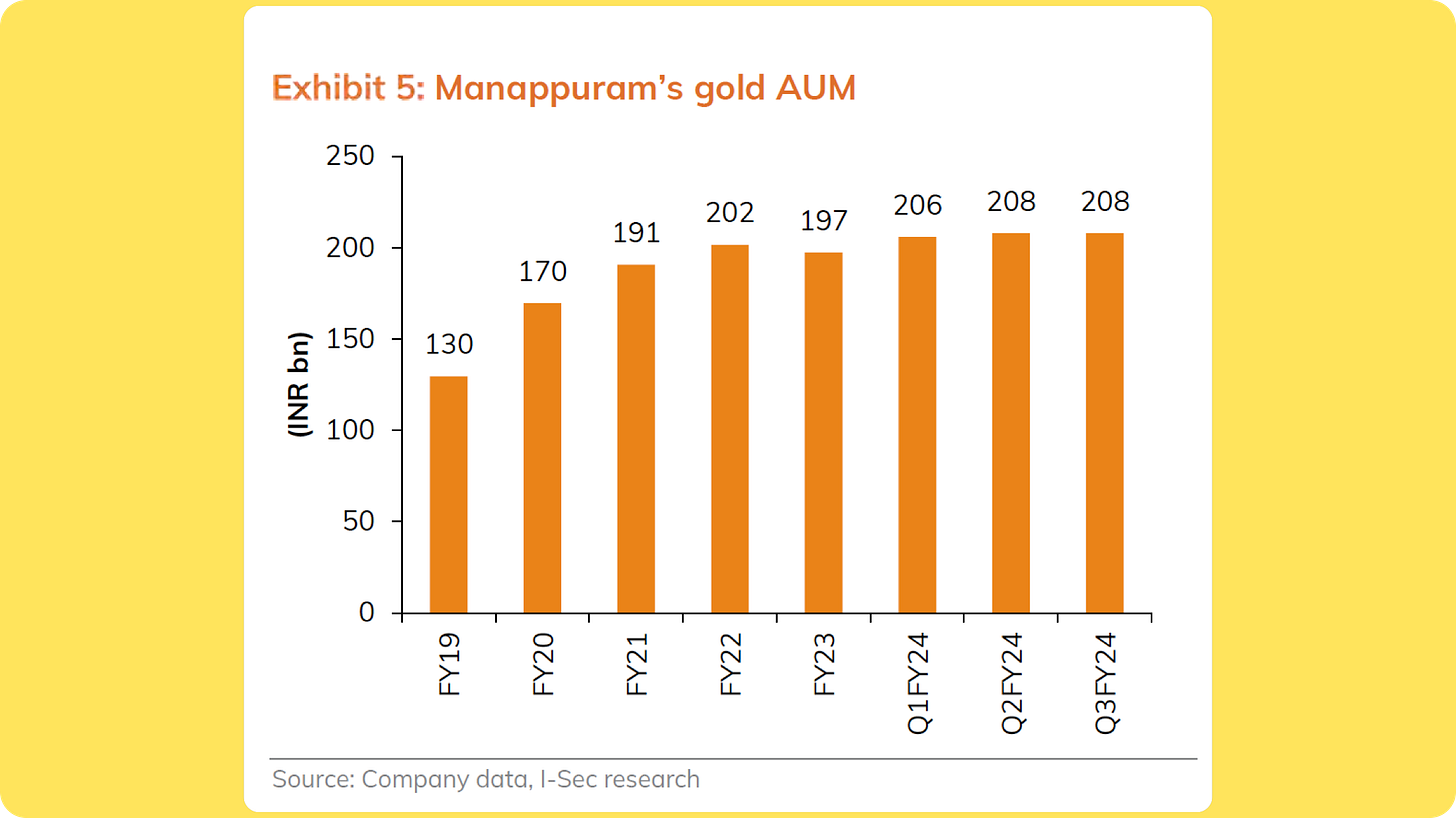

Whereas, Manappuram’s growth has been at low single-digit growth during this period.

Low Growth of Gold AUM and Asset quality issues of the recent past are possibly why Manapurram’s valuation is also the cheapest….which brings us the valuations part.

Valuation (P/Bx)

To interpret P/B x valuations of these 3 players we must look into the following issues for further research :

Both Manappuram and Muthoot have diversified away from Gold Loans over the last few year. Manappuram’s more aggressive de-worsification led to Asset Quality issues ~ FY22 and in the last quarter too.

An Investor must read and understand this aspect before coming to any conclusion. This is also one of the reasons why Manappuram trades at the cheapest valuations.

Eventually P/Bx must reflect Asset Quality, Profitability and growth. While Muthoot is doing well on both Asset quality and profitability, Growth is something to watch out for. With the absence of IIFL Finance, contingent on the length of the ban, Muthoot Finance is best places to capture the market.

IIFL Finance’s falling P/Bx is a function of the continuing developments and at this time I have no opinion on the same.

I believe any serious investor should study at least the last 3 years of all the publicly available documents/filings/results of all the 3 players to have reasonable confidence in the valuations today and what they mean going forward.

Although I am curious and open to further research, the valuations are NOT ‘'hitting me in the face’. Usually, we look for something that just jumps out (so obviously undervalued, it’s hard to ignore). And while Manappuram’s valuations do seem relatively attractive, I would NOT conclude anything without further research.

This is simply a starting point and we would be more than happy to go deeper into the sector. If you’d like that, drop us a comment and let us know.

Regards

Rahul Rao

Senior Analyst

CFA Level 3 Candidate

B.ENG Aerospace Eng.

Investing since 2014

Disclaimer: I am NOT a SEBI Registered Investment Advisor. The above must NOT be construed as investment advice. Your decisions are your responsibility.

Thanks for the nice post - just wondering what is your view on the Gold loan correction post the boom AUM with price.

Would also love to hear your opinion on Globus spirits and Goldiam whenever you get the chance have sent a private message explaining my thesis