updated: 10th April 2025, 12:25 pm

Over the last few months, I wrote 5 articles in National newspapers, covering the Micro-finance sector.

When I asked my editor if I should write a 6th article? He politely replied,“Boss, your micro-finance stocks are not moving. There is no interest”

THIS is the 6th article.

That’s why when you subscribe, you’re enabling in-depth, insightful research on ignored sectors in the Indian stock market.

News media & brokerage research reports will never encourage this…

Let me begin by saying Micro-finance is a VERY RISKY SECTOR.

Nothing you read here is a recommendation.

Cool? Let’s start.

8 out of 13 listed players we track in Micro-finance sector have released a Business Update for Quarter ending March 25.

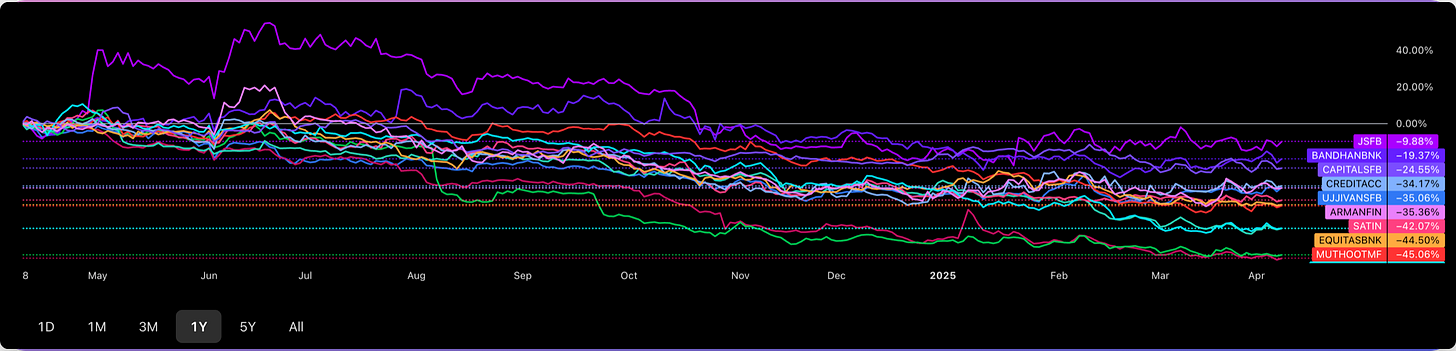

For context, Micro-finance sector had been going through its own bear market since December 2023.

Most stocks in the sector are down 50% since then.

Trump tariffs can do the sector no harm. It’s perfectly capable of imploding itself.

These 7 players include :

Equitas SFB

Ujjivan SFB

Utkarsh SFB

Capital SFB

ESAF SFB

Suryodhyay SFB

CAG - CreditAccessGrameen (NBFC-MFI)

Satin CreditCare (NBFC-MFI)

SFB - Small finance Banks.

Their updates range from segment-wise growth tables (Ujjivan) to granular state wise NPA numbers (CAG) to single page formalities (Satin).

I read somewhere that an estimated 70-80% of human communication is non-verbal.

Similarly, investors can learn a lot about a business by paying attention to what the management is saying and what it’s not saying.

Some call it “reading between the lines”, some call its “Investor relations”, some call it “PR”.

Bottom line is companies try to manage how stakeholders perceive them. Just like humans do. And it’s not always malicious.

Here’s a small example.

I’ve rarely seen lenders give out a 5 or 10 year historical perspective in their quarterlies.

Primarily, because their past record is crap. It’s a tough business.

High quality players such as Cholamandalam gives a 15 year historical table. Hard flex 💪🏽.

Bajaj Finance, Muthoot Finance, India Shelter Housing, Aavas Financiers & CreditAccessGrameen show numbers ranging from 5-7 years.

Have you noticed a similar pattern? Let me know in the comments below ⬇️⬇️

Q4 Business Update - What are we looking at?

When a sector has been in the doldrums for sometime, we’re looking for some kind of “bottoming out”.

Lead indicators, early signals etc.

These lead indicators could be:

Pick up in Disbursements (Big signal of turnaround)

Improvement in Collection Efficiency

Improvement in collection in Karnataka (Event specific)

Let’s collate all the data (provisional FYI) we got so far.

Disbursements

Granular, segment/state wise disbursement data is available only for Ujjivan & CAG.

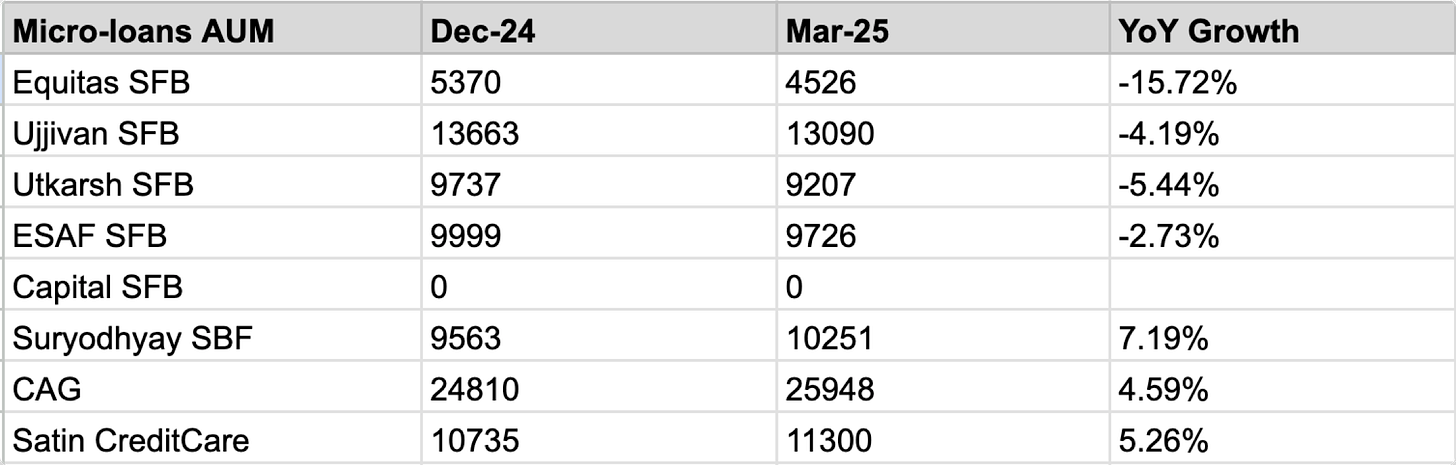

But, as a proxy, we can checkout the Q-o-Q Micro-Group Loans AUM growth :

What we learn:

SFBs are de-growing their JLG (Group) Micro-loans with a passion. This is by design. With the ability to raise deposits, they’re moving “up the risk curve” to secured loans such as Housing, LAP & Gold etc.

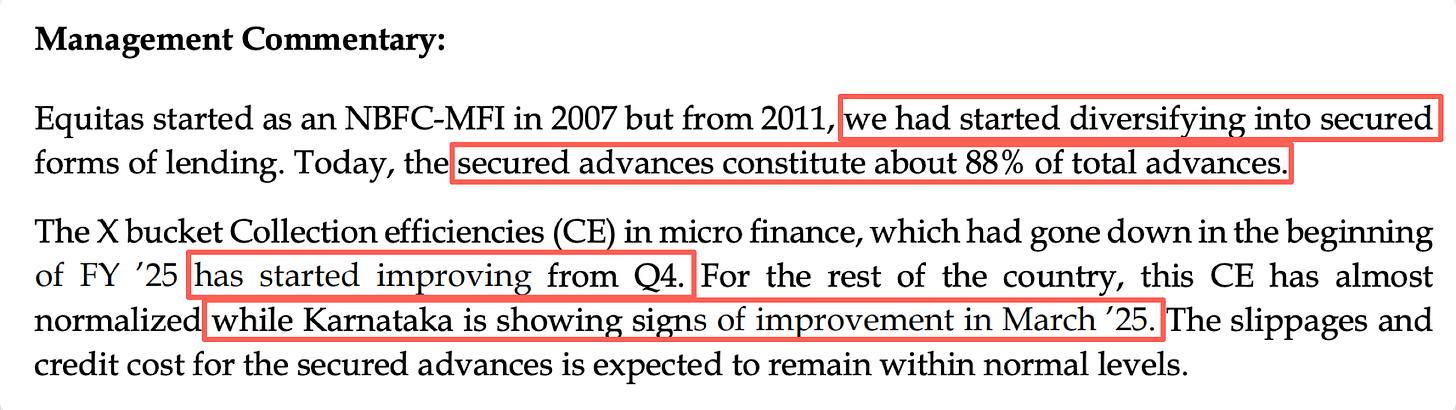

Adding the point above on “perception management”, look at how Equitas is trying to distance itself from being perceived and treated as an MFI player, because it isn’t. anymore.

Equitas also tells us CE has normalised ex-karnataka. Almost every single player we track communicated something similar in Q3 but Karnataka was still a looming threat then because the MFI law came into effect on February 12th 2025.

CAG total AUM grew about 5% q-o-q. Disbursements are higher at 7.2% for non-Karnataka loan book. Perhaps, monthly data will be more telling.

Satin said they grew about 5%. They have sold some loans and written-off some too. So, if AUM grew 5%, disbursements are definitely higher.

Capital SFB is an anomaly. Zero Group MFI loans.

Capital SFB has zero Micro-finance exposure. 99.8% of its book is secured.

It has Zero write-offs in its entire operating history.

It was the first financial institution to receive a Small Finance Bank License.

Capital has been on my to-dig deeper watchlist for a while now. Since it got listed it has been beaten down and ignored, clubbed as an Small finance bank, with the rest of them.

Bottom line is there is no clear signals of sufficient Disbursements pick-up in MFI segment yet, based on the updates we have so far.

but there is a silver lining.

Collection Efficiency

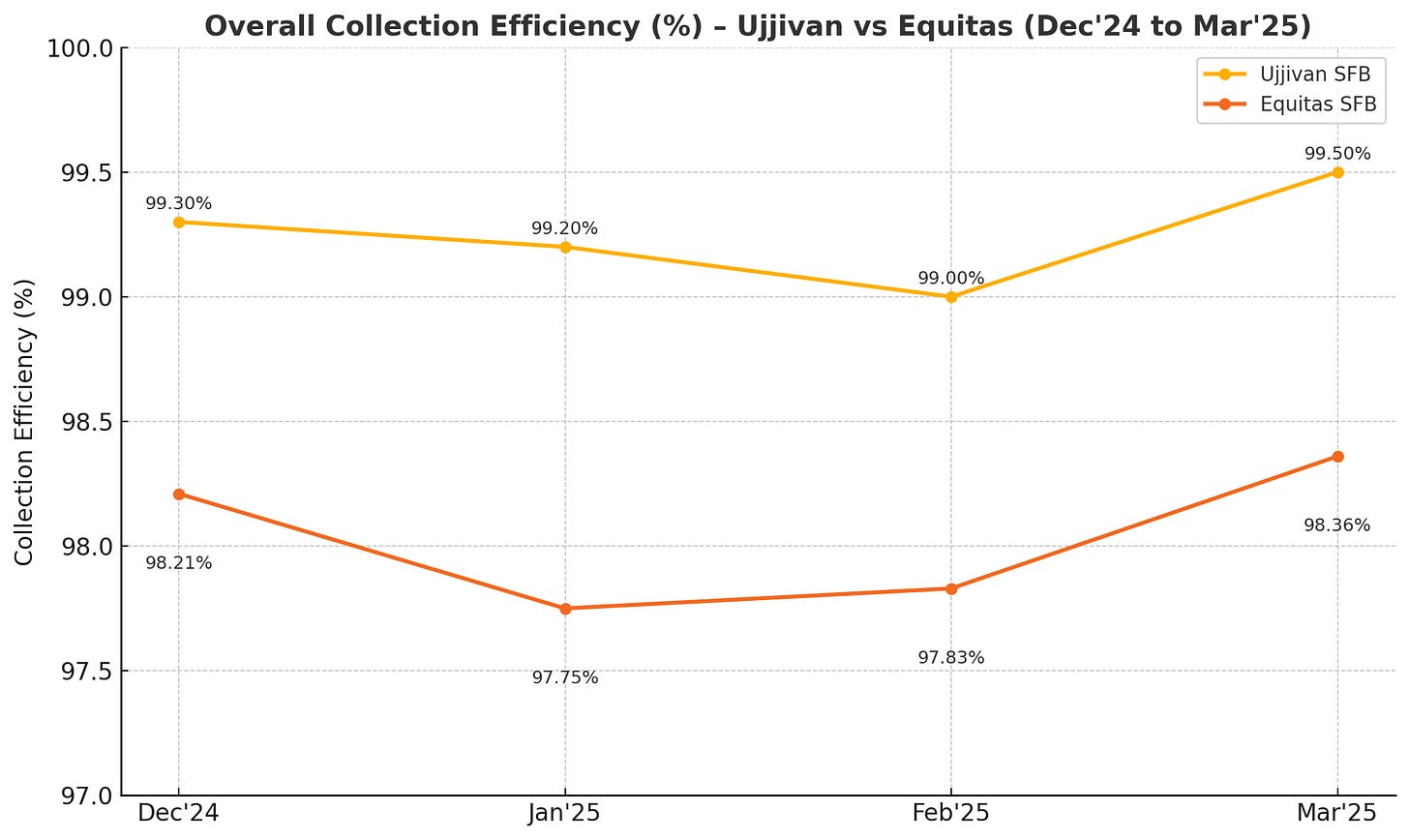

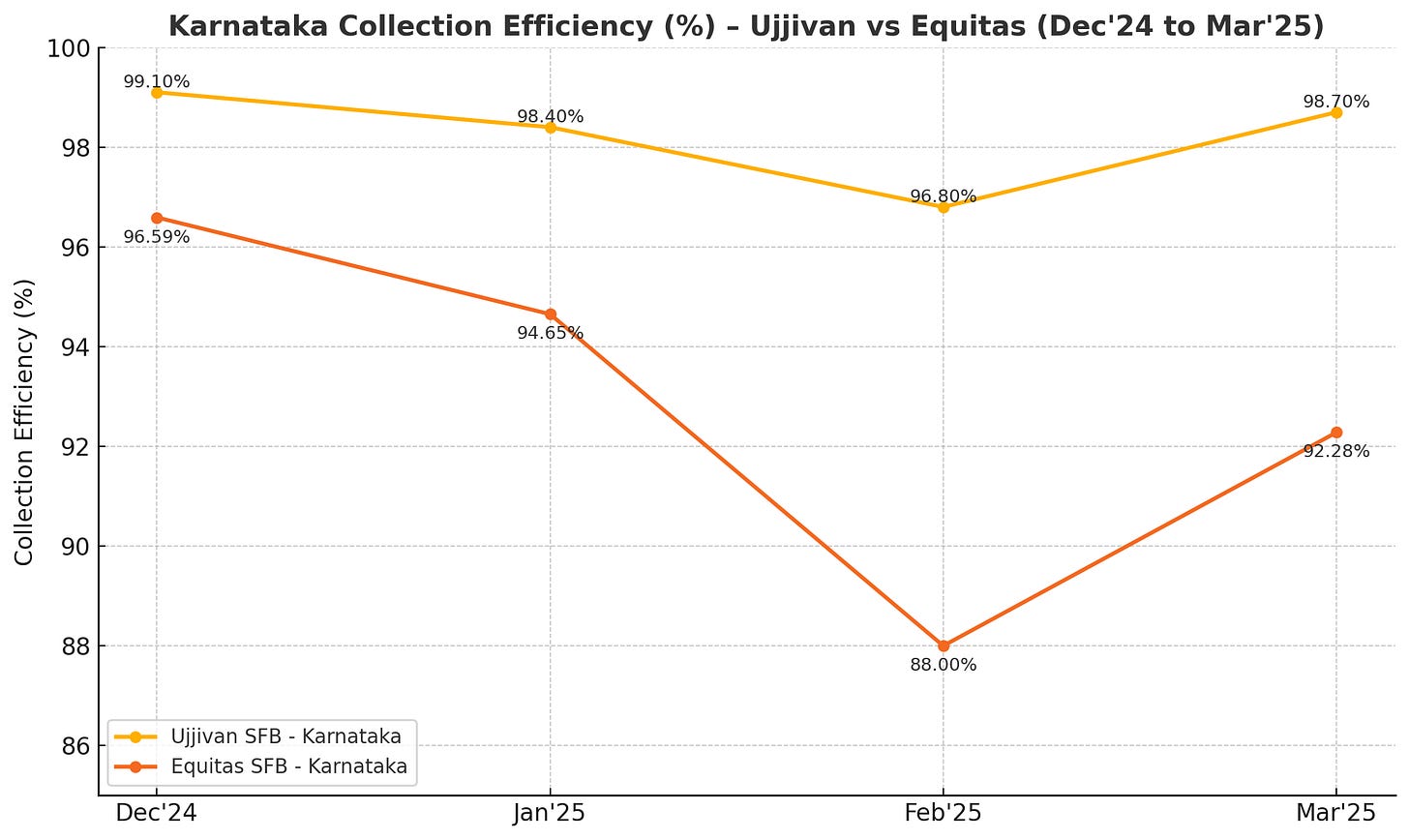

Of the 7 players who have shared a business update, only 2 - Ujjivan & Equitas have given last few months X-bucket collection efficiency.

X-Bucket Collection Efficiency tracks how much of the current month’s dues were collected from borrowers who were not overdue.

It leaves out past NPA accounts and focuses only on fresh payments.

For micro-finance lenders, this is a clean way to spot early stress in the loan book. A figure above 99% is healthy; any dip could signal brewing issues because it means a higher percentage of CURRENT DUES are not being paid on time and could spill-over into 0-90 Days due buckets, and eventually into NPAs.

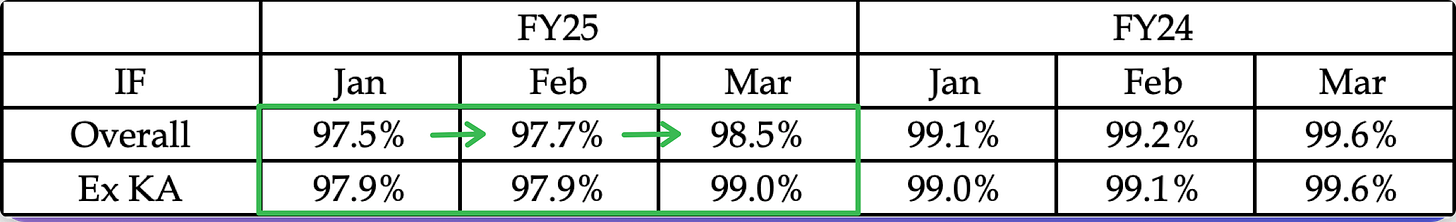

“Overall” numbers i.e - INCLUDING Karnataka, for Equitas and Ujjivan are as follows.

Just Karnataka? Here is the situation.

Although, the trend shows an improvement, it’s too early to say that the impact of Karnataka MFI Law has fully played out.

The remaining players are placed as follows :

CAG says X-bucket collection efficiency (excl. karnataka) is 99.6% and for karnataka it is 98.5% in March-25. It’s signalling improving CE in karnataka too.

ESAF says X-bucket collection efficiency is 99.1% in March 2025.

Satin Creditcare says its 99.8%

Suryodhyay has also indicated an improving trend.

Net-Net, the situation is much more positive but I’m not convinced enough to jack up my positions just yet (Not a Recommendation please)

I won’t believe it until I see the full set of numbers for other players too, especially the better ones such as - Arman Financial (Disclosure: Invested).

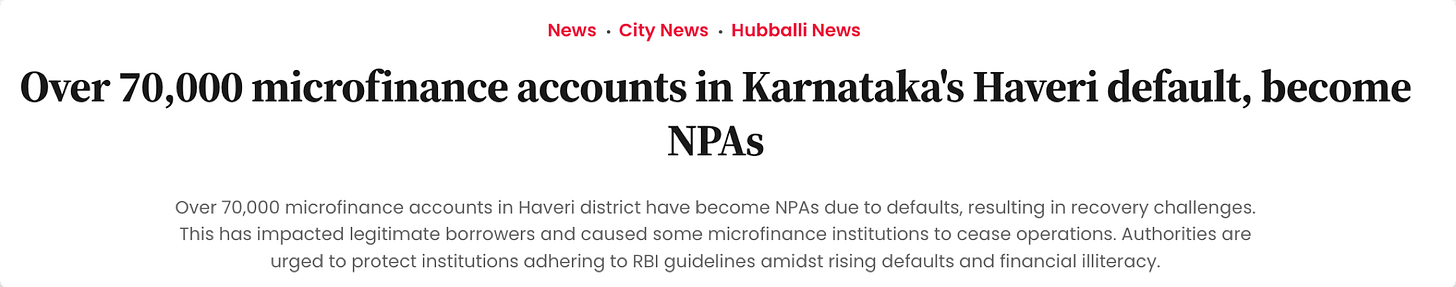

As far as anecdotal evidence on impact of Karnataka MFI Law is concerned, things aren’t pretty down south, especially in a few district.

We’re in wait and watch mode but it’s evident that fresh NPA flows have substantially reduced. Leverage has come down over last few quarters.

Hope this gave you an overview on the sector.

Will be updating it as more business updates come through.

Rahul Rao, CFA

Very nice article. I had been an investor in Satin Credit post Florintree entry, saw a high of 270+ in april 2024 and sadly exited at ~150 levels as in my view the game of microfinance is completely changed now.

1. The game is now tilted towards larger institutions with lower cost of funds specially banks and SFbs who can raise low cost deposits and can offer both asset and liability products. NBFCs MFIs can sell only asset products which makes them less competitive.

2. The self regulation to have only 3 lender for a borrower will shift the game towards the 3 lowest rates providers. NBFC MFIs have cost over 10% in most cases.

3. RBI is clearly unhappy with 25% interest rates. So eventually due to regulations and competition the lending rate for good borrowers will fall below 20% or 20% max. With CC assumption at 3%, cost of funds at 10% and operating cost at 6%, lending at 20% in unviable for NBFC MFIs.

Hence I think you should think again about your Armaan investment as the dynamics have shifted and the NBFC MFIs cannot succeed in current avatar. Either they need to merge with larger banks or start new verticals and scale. The valuations are dirt cheap but the business seems doubtful. This segments will also become big boys club. Gold loan is another segment which RBI want the banks to handle instead of NBFCs it seems. Lets see how it unfolds.

I am a bit skeptic about growth coming back soon.

Putting below few random thoughts and not necessarily in an order. Trying to keep it short as would be self explanatory. Couple of points would be potential reasons as to why growth may take some time to come back.

By growth I am referring to both AUM/Disbursements rising and also Bottomline going up.

1. Latest MFIN Guardrails 2:

Reduces the addressable market for MFIs in short to medium term due to max number of lenders allowed for borrowers.

2. Tightening underwriting norms due to recent stress:

Increased rejection rates.

3. Higher Operating Costs:

Due to:

- To address increase employee attrition and to retain them

- Portfolio degrowth by default increases the opex costs as a %age

- Rationalization of clients per field officer

- Strengthening collection teams and potential investments in IT/Technology/Control Functions

- Segregation of Sales and Credit teams (for MFIs that are still doing this and not done)

- Potential costs involved with diversifying into other segments like MSMEs or LAPs

4. Seasonality impact:

- Q1 and Q2 have low to moderate disbursements compared with Q3 and Q4 (Q1 collection though is normally good due to Post-harvest cash availability (Rabi))

- Q2 collections are normally weaker (Monsoon season affects mobility and collections; lower disbursement due to field accessibility issues)

In short CE may increase and delinquencies may subside but growth may come back only from Q3 onwards at the earliest!

I am also wondering, that if and when growth comes back, would we see a slower pace of growth going ahead compared to last cycle due to reasons like number of lender restrictions, etc.?

P.S. Another potential risk in next few quarters is states going into elections (Bihar, Tamil Nadu and West Bengal) announcing Karnataka type policies.