UPDATE @5th March 2025 - Ambuja has received an approval for the acquisition + open offer for Orient cements.

The OG write-up on the Orient cement open offer starts here :

I used similar headlines for articles on Ujjivan SFB reverse merger and IDFC First Bank reverse merger (Review note at bottom)

One worked out

The other was a total sh*t show. So yeah, it’s not a foregone conclusion. There are risks.

Ambuja Cements, an Adani group company announced on 22nd October 2024 that it will acquire Orient cements.

Adani’s conviction for fraud in a US court might weaken Ambuja’s ability to raise capital. Additionally, It may be forced to direct such capital to other group companies.

While this is an evolving story, the entire thesis given below depends on whether the acquisition will go through. Please bear that in mind while reading.

The Investment Thesis

Ambuja enters binding offer to acquire Majority stake in Orient cements

Ambuja Cements will acquire a 46.8% stake in Orient Cement Ltd (OCL) for an equity value of ₹8,100 crore, or ₹395.40/share.

The Current share price is Rs. 338/share.

This means that IF :

1. You buy Orient Cements at 338/share

2. Tender ALL your shares in the open offer at 395.4/share

3. Your profit on this transaction is 16.9%

4. Assuming (hoping) this happens in 1 year, short term capital gains tax = 20%.

5. Your post-tax profit equals 16.9*0.8 = 13.52% !

There are 5 variables to this deal.

1. Probability - How likely is it that this deal will happen?

2. Downside - How much can I lose if the deal doesn’t go through?

3. Profit - What percentage of your share will get accepted? (profit will vary accordingly)

4. Timeline - How quickly the cash will be received on this transaction?

5. Best Use - Is this the highest and best use of this capital? i.e - Are there other competing bets for this money?

Think of these as a Pyramid. With the point 1 at the bottom layer.

How likely is it that this deal will happen?

Another way to ask the question is :

How important is this deal for Ambuja?

Is there a reason Ambuja NEEDS this acquisition?

Can Ambuja afford to pay for the deal?

In order to answer these question we must understand the context and intent of the deal.

Consolidation led by Ultratech & Ambuja: The Indian cement industry is currently in a consolidation phase, with major players like UltraTech Cement and the Adani Group (Ambuja Cements) battling to dominate the market. They’re buying out smaller players across regions as a cheaper and quicker way to grow compared to investing in new capacity.

In June 2022, the Adani Group entered the cement business by acquiring Holcim's stakes in Ambuja Cement and ACC.

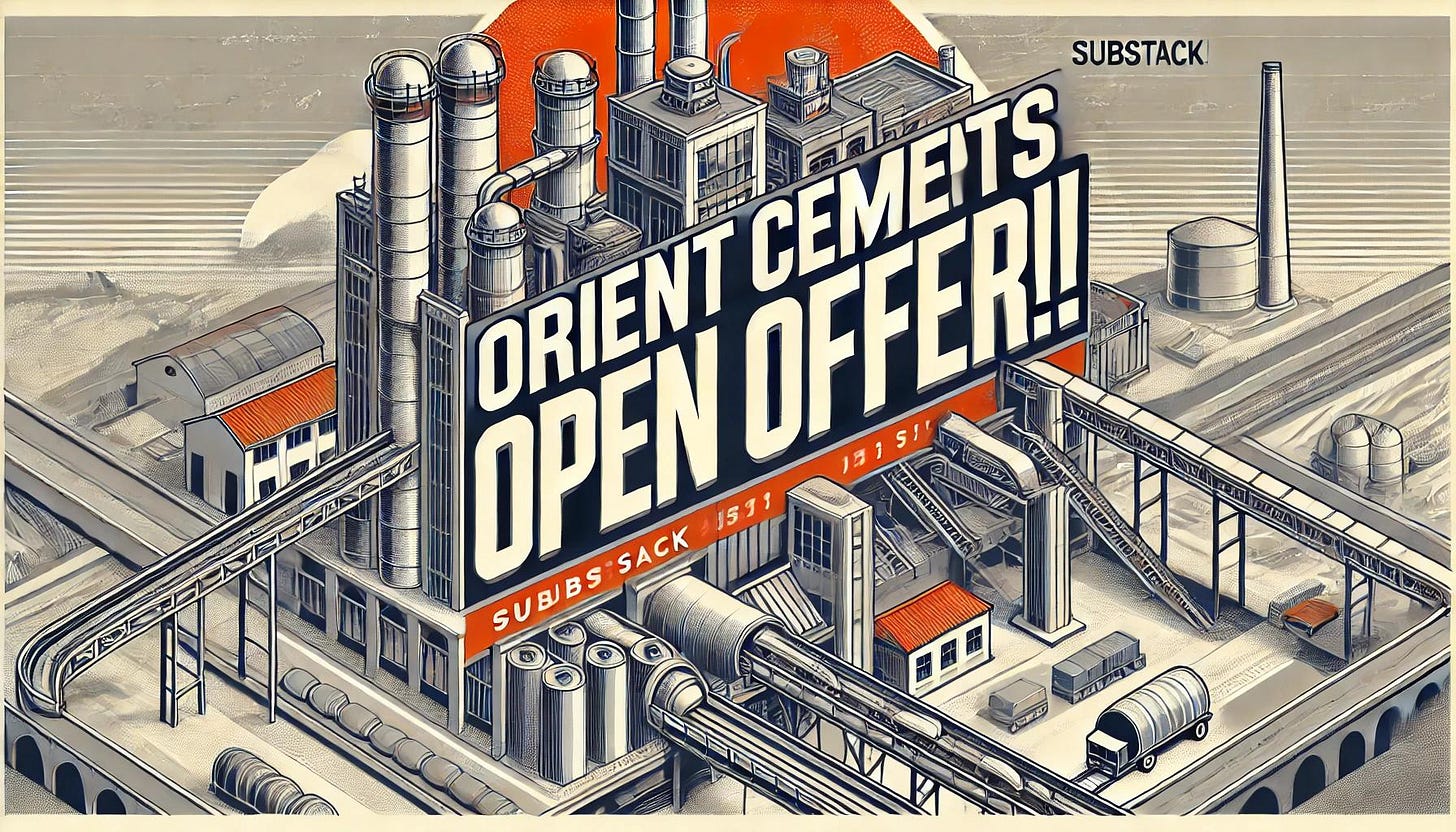

This sparked a wave of consolidation. UltraTech Cement, the market leader, responded by seeking deals to maintain its lead. Since June 2022, Ambuja has acquired close to 22 MT of capacity. This is a part of its larger strategy to reach 140 MTPA by 2028.

According to ICRA, “..There were 15 M&As in the last nine years in the cement industry with the average cost of the M&A ($80/MT) being lower than the cost of setting up an integrated greenfield cement plant ($110–120/MT), thus leading to capex cost savings. This further entails access to readymade capacity, limestone reserves and prevents companies from the hassle of longer gestation periods for stabilisation of operations in case of a greenfield unit. Asset block of 28 MT is in pipeline for acquisition and ICRA expects M&A deals to continue, given the aggressive growth plans of the large incumbent players who want to maintain their market share.

So acquisition over greenfield capacities makes a lot of sense. They’re cheaper and faster. Orient deal is at an estimated $112/ton if consider the operational 8.5 Million capacity. This is at the top end of the spectrum.

According to the merger rationale document Ambuja put out, the deal will be fully funded via internal accruals. The source of funds and ability to pay is a major consideration in judging the probability the deal will go through.

Can Ambuja even pay for this Acquisition?

Ambuja has a net worth of Rs. 49,883 and close to no borrowings (Rs. 779 Cr). Obviously there are other current liability items totalling around Rs. 12,400 Cr. This leaves enough room for borrowings to meet the cash payments if required. Ambuja Cements also has a credit rating of AAA so capital should not be a problem.

CRISIL wrote in their Credit Bulletin note post-merger announcement that :

“Despite such a sizeable payout, the financial risk profile of Ambuja will continue to remain strong owing to its large net worth, healthy liquidity and strong cash accrual. The company is expected to fund the transaction through its cash accrual and liquidity. Even with large capex to the tune of Rs 50,000-55,000 crore (including inorganic acquisitions) over fiscals 2025 to 2028, the company is expected to remain cash positive owing to large cash balance and higher cash accrual from expected improvement in profitability and incremental sales from the new capacity.”

Basically, This deal will cost them around Rs. 5,000 Cr & AMBUJA CAN PAY !

Is there a reason Ambuja NEEDS this acquisition?

Other than the desire to take capacities to 140 MT and being a leader, Here’s why Orient is important to Ambuja’s ambitions. Limestone is the key Raw material for manufacturing cement. Cement is a commodity, therefore the cost competitiveness is gained by :

A. Having Limestones reserves

B. Having limestone reserves close to cement plants

C. Low Manufacturing cost (measured as % of sales)

D. Low Logistics cost (Railway Sidings) etc.

Orient provides all the above.

Although Limestone reserves range between 7-15% of the Total Sales for major, the availability of captive raw material which is closely located to the cement plant is a strategic cost advantage.

Cement companies with Limestone mines are more valuable than those that are not.

Regional Play

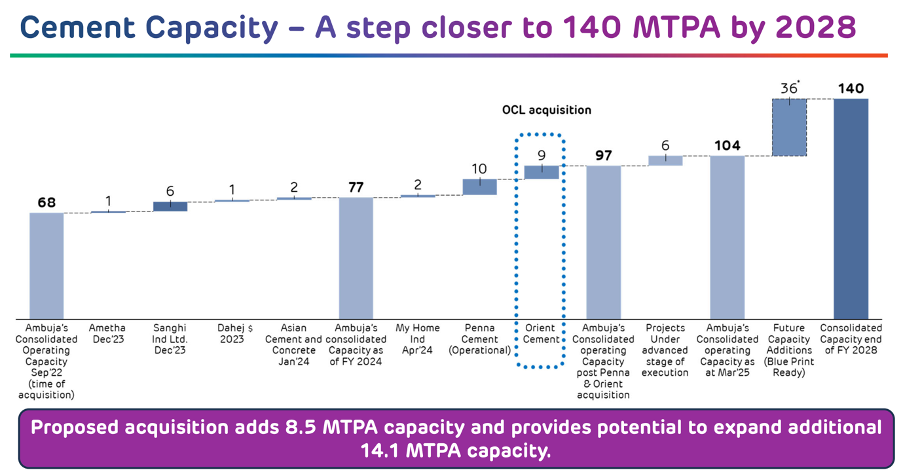

Cement being a weight intensive commodity (realisation per kg is around Rs. 300-350) is a regional play. The southern region has a lower concentration of Top 5 players. This changed when Ultratech acquired Kesoram Industries. Ambuja responded by acquiring Orient Cements.

Southern region also has overcapacity. However, low cost players such as Orient with captive limestones reserves, no debt on their balance sheet are likely to be least impacted.

The biggest risk to the deal now is the US Indictment of Adani chairman and Adani Green Energy specifically. The ripple effect may impact Ambuja’s ability to raise capital and/or be compelled to direct capital to other group companies.

Acceptance Ratio

Because Ambuja is buying around 46% of the company, it is also liable to give the other shareholders the same offer i.e – The deal has triggered an open offer to acquire and ADDITIONAL 26% to shares from public shareholders.

Of the 100 – 46.5 (Promoter selling) = 54.5% shareholding, Ambuja MUST acquire 26%.

That’s about 50% of the public shareholding. This means the Acceptance Ratio should be 50% at least. There are 2 legs to this.

Leg 1 : The Acceptance Ratio

Leg 2 : The Non-accepted shares.

The net effect is what will determine the final IRR outcome.

If Acceptance is 50% and the remaining shares can be sold at 338/share (this is a BIG If btw), the return should be 8% pre-tax (50% of 16.9% we originally calculated.

But the timeline in which the deal closes will determine the actual IRR. If the deal closes in 2 years it’s a total shit show. If it closes in 2 months, even that 8% is stellar.

Timeline

Ambuja Acquisition of Penna Industries completed in 2 months since announcement. But penna is NOT a listed company.

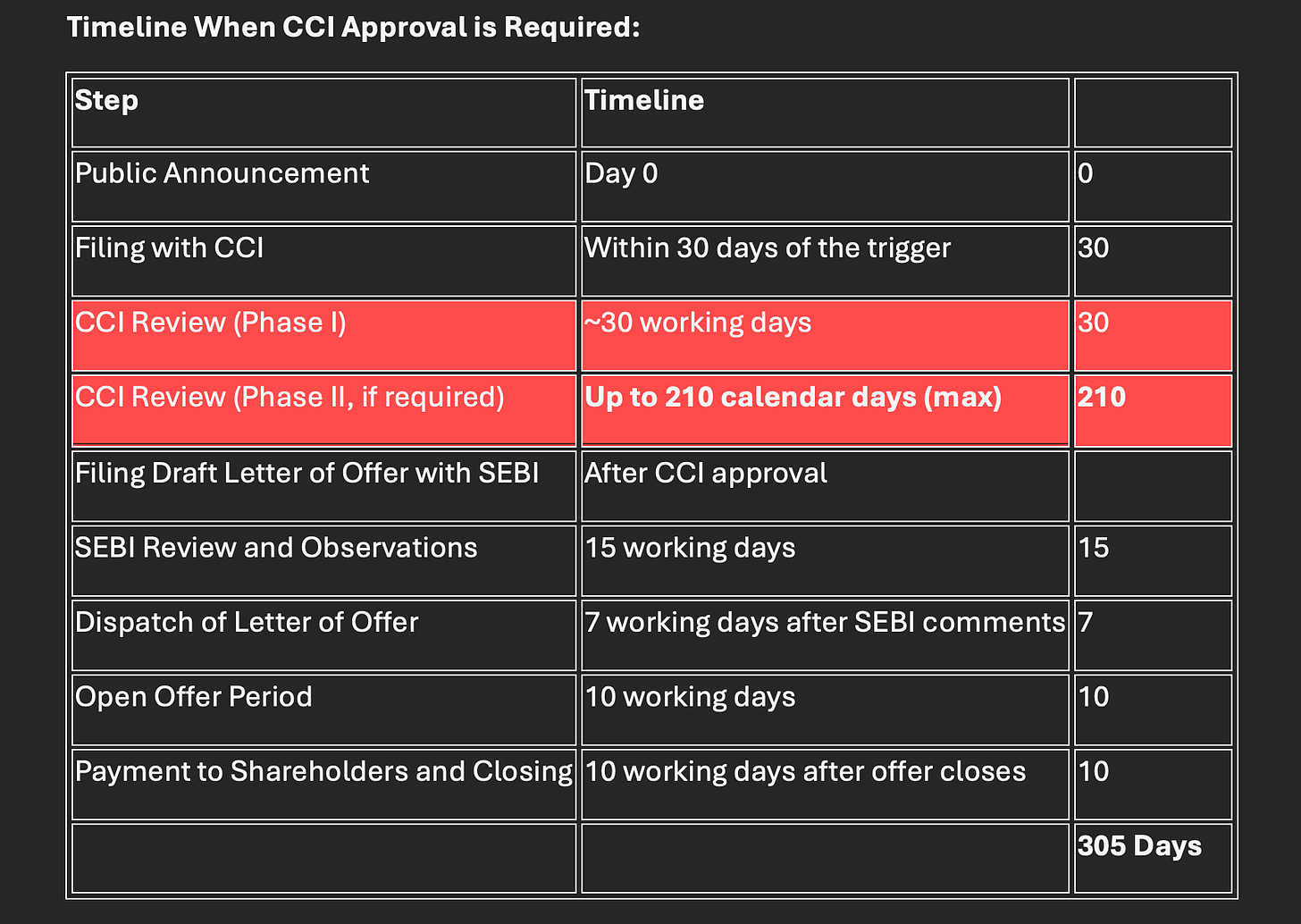

Ultra Tech acquisition completed in about 10-11 months (November 23 – September 24). This could be because CCI approval was required for this deal given Ultratech is the market leader and CCI must vet whether the acquisition will create an unfair advantage for the company.

If CCI approval was not required, the process would be shorter by at least 240 days and much more profitable from an IRR perspective.

According to the Acquisition letter filed with the exchanges on 22nd October, Ambuja cements stated that the acquisition “will be completed within 3-4 months according to provisions of the SAST Regulations”

Our general estimate is that the open offer might close anywhere between 3-12 months.

This wide timeline and uncertainity around when exactly it will happen is primarily why the discount to the open offer price (Rs. 395.40) exists. Not to mention the OG risk that the deal might not close at all, especially given the additional trouble Adani is getting into with the US Government.

BEST USE

Is this the highest and best use of my capital?

More than anything else, this is the most concerning of all the pointers. Do I not have better use of this capital?

This is why borrowing for such bets makes sense, depending on how sure you are and whether you can hedge your bets. Since with the recent development, there is more uncertainity on the acquisition itself and the fact that Orient does not have options that can be used to hedge the bet, I’m beginning to seriously doubt whether this is really the highest and best of my capital.

The answer maybe different from you. You do you my dear reader but I hope this gives you some clarity on how to think about such bets.

Yours truly

Rahul

Note: We have relied on data from documents filed by Orient Cements and Ambuja cements. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educative purposes only.

Rahul Rao has been Investing since 2014. He has helped conduct financial literacy programs for over 1,50,000 investors. He helped start a family office for a 50-year-old conglomerate and worked at an AIF, focusing on small and mid-cap opportunities. He evaluates stocks using an evidence-based, first-principles approach as opposed to comforting narratives.

Disclosure: The writer and his dependents hold Orient Cements shares at less than 1% of Portfolio allocation.

NOTES :

IDFC First Reverse Merger Note

The conclusion is that this is one of those cases where the Reverse Merger did NOT play out as anticipated because not only did the differential (arbitrage) go down over time as is expected but also the price of IDFC Ltd, the lower priced security, and IDFC First Bank BOTH went down over the period. So a loss was incurred attempting to profit from this arbitrage. The reverse merger thesis was unsuccessful, highlighting the fact that Reverse Merger comes with a risk. It was also fun to chart out the Arbitrage as a percentage.

Another point is that the transaction closed in nearly 1 year, so you had capital tied up on a losing bet. Another point is that this movement was uncorrelated to the market, which WENT UP !! A better way could’ve been to hedge the position and lock in a profit, the nuances of which are a little alien to me yet.

The real risk lies in the residual inventory of stock ull hold. So in nut shell, it's a play on orient being undervalued or not. If in some ones mind it's undervalued, then only he will go for this transaction, but then - why would he offer his shares in open offer for 8% at 50% acceptance ratio while keeping his 50% exposure for further gains.

However if a person thinks oriend is over valued and hence takes a pint on acceptamce ratio only. The 50% acceptance which gives him 8% on total capital has an assumption that orient price won't fallapost acquisition. And hence the 8% is not at all risk free in that sense.

Your assumptions and theories appear to be accurate across all three cases, and your observations have been duly reported as perceived.

Regarding the IDFC First case, the issue stemmed from weak fundamentals prevalent within the private banking sector as a whole.

In the matter of Orient Cement, I believe it represents an exceptional investment opportunity, particularly given its closer alignment with the Birla group rather than the Adani group. However, your table, indicating a potential timeline of 10 months to navigate prevailing uncertainties, casts a shadow over the valuation differential.