South Indian Bank - Quarterly 🩺 Diagnosis

📝 A Review of the Last 3-4 Quarters and what's to expect in the near future.

A Rising Tide lifts all boats.

The Rising Tide is the Banking Sector, South Indian Bank is the Boat.

Highlights

🌟 NIMs to remain under pressure. Unlikely to meet 3.5% guidance for FY24

🌟 Cost to Income is high ~ 62% versus peers (Federal Bank, Karur Vyasaya)

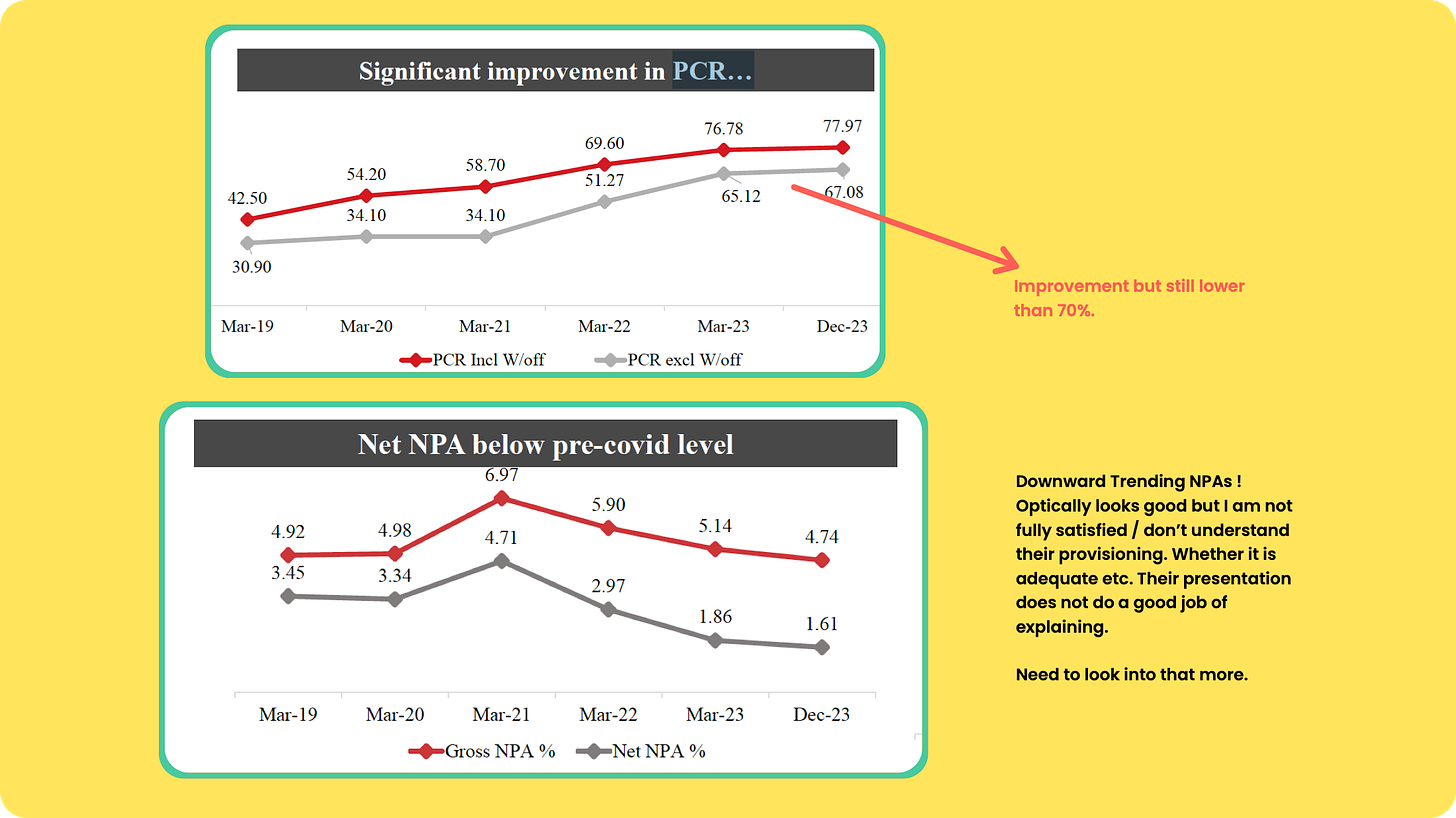

🌟 NPA & Credit Costs have been trending downwards

🌟 ROA Target of 1% for FY24 looks unlikely 👎🏼

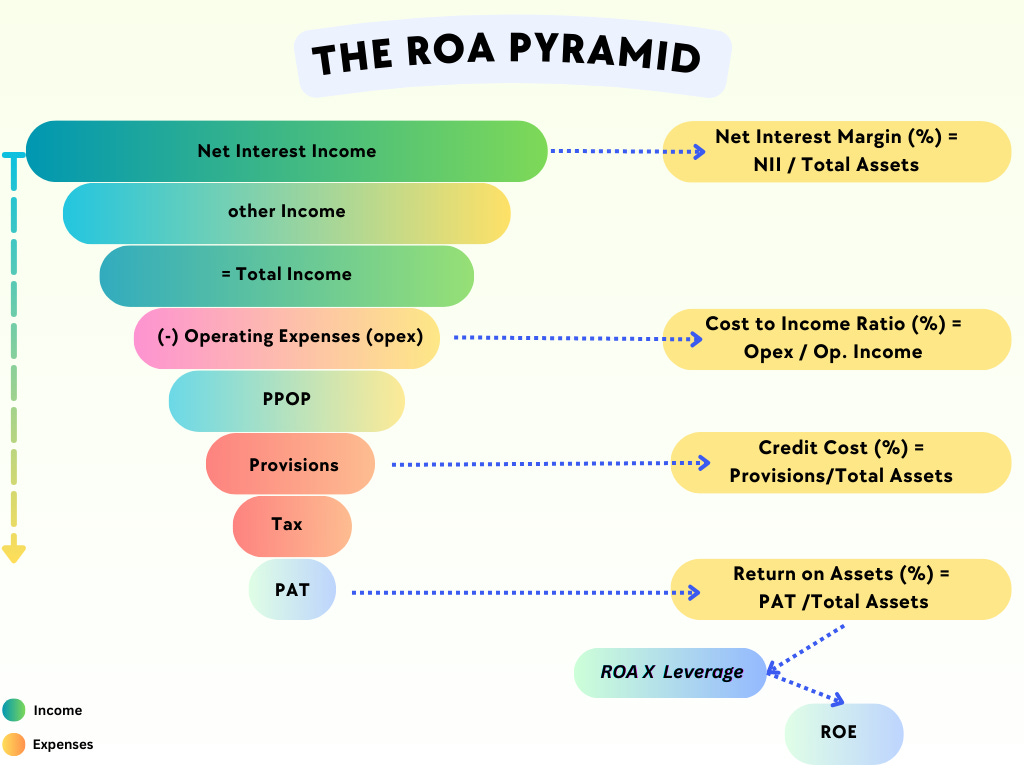

We use the ROA Pyramid (shown below) to Analyse a Bank, explained in more detail in another post

According to the ROA Pyramid model, there are 3 main Ratios, which contribute to a Bank’s ROA & ROE.

NIM - Net Interest Margin

Cost to Income Ratio

Credit Cost

That’s why in this article we’re going to analyse South Indian Bank with the help of these 3 ratios, and the factors that drive them.

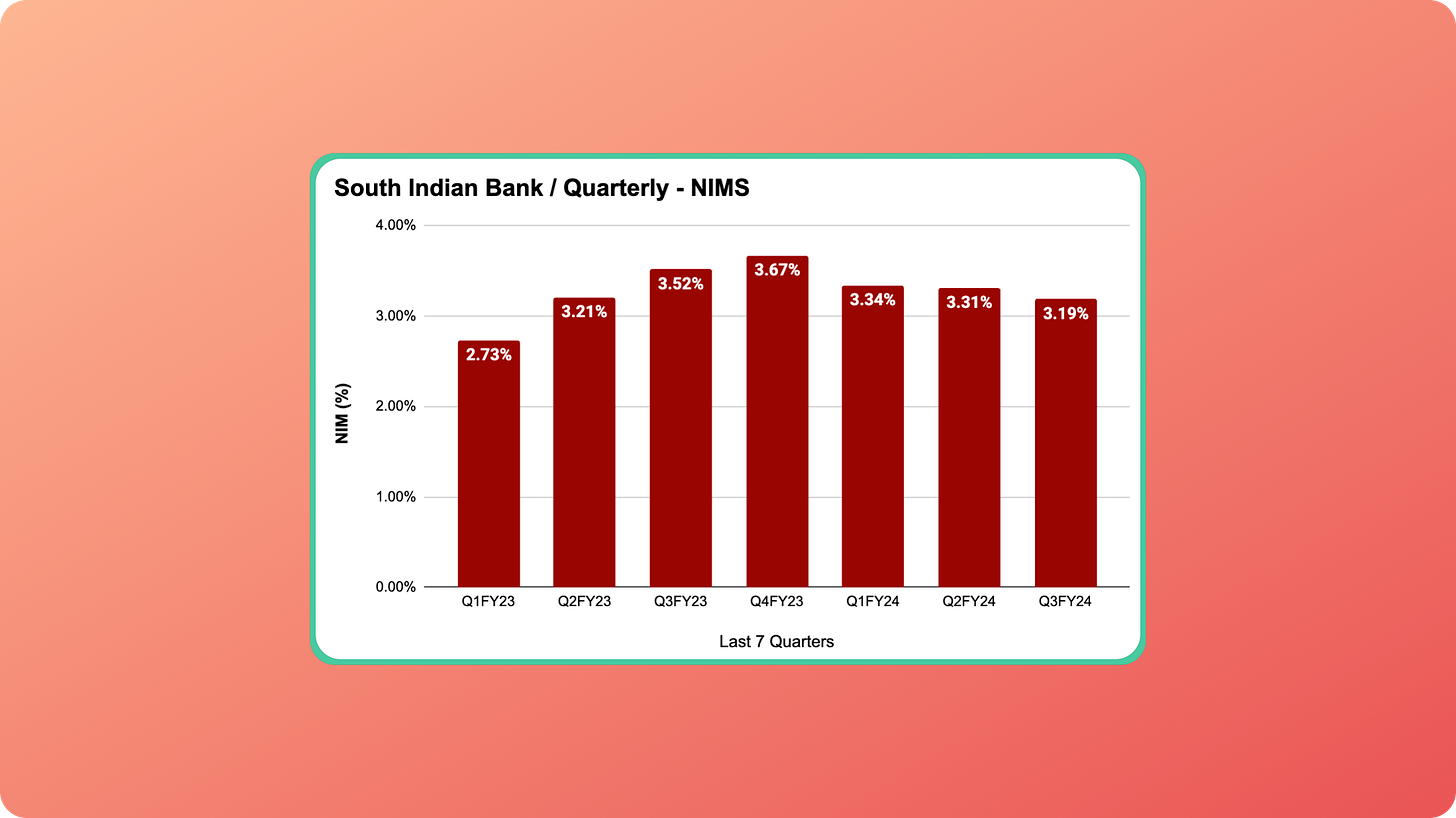

👉🏽 Net Interest Margin ( NIMS )

NIMs are like the Gross Profit margin for a non-banking business. An expanding NIM leader to a higher profit & vice-versa, assuming everything else remains constant (which it never does).

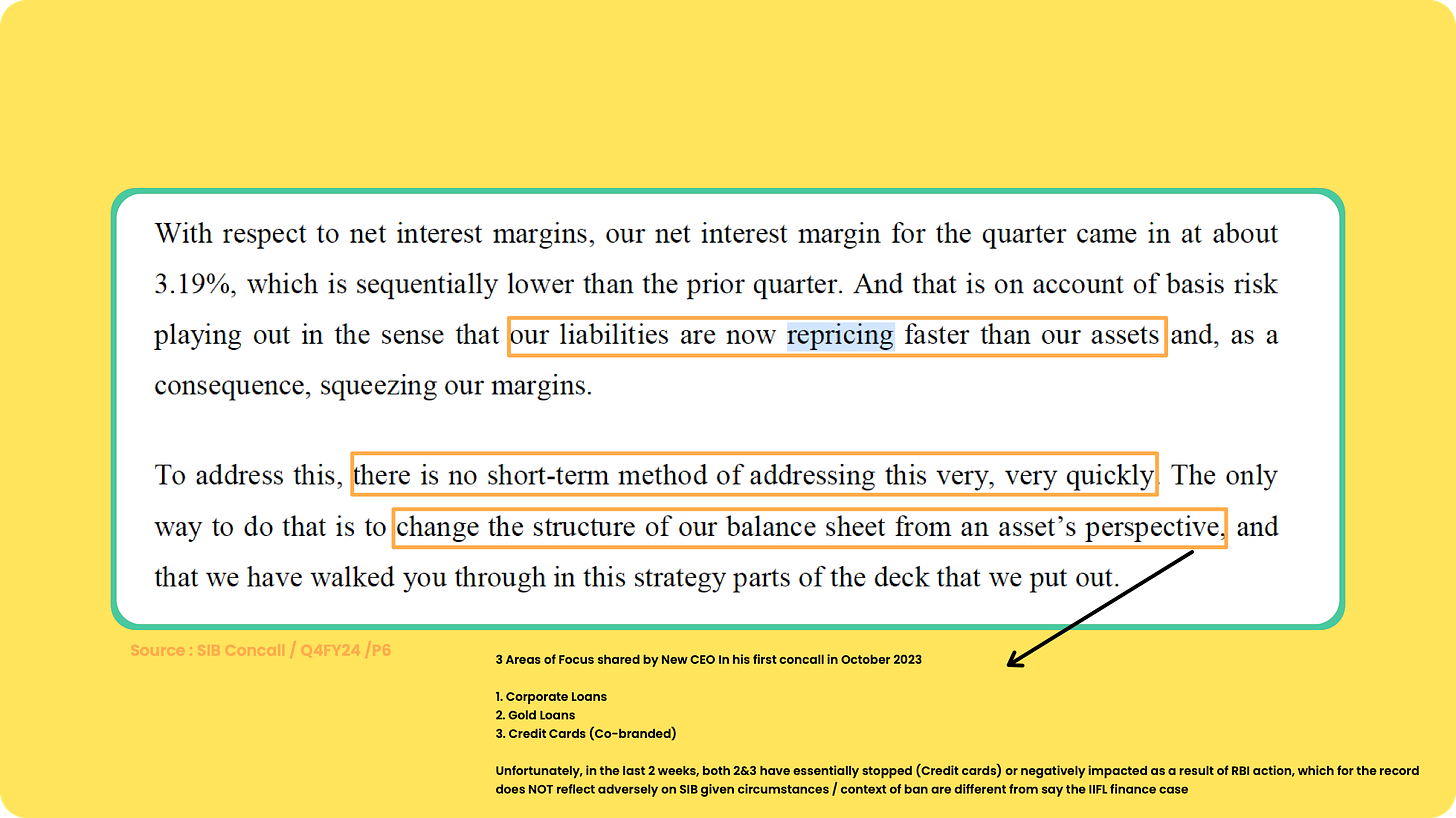

Ideally want your NIMS to expand NOT contract. At SIB and for the banking sector overall we’ve seen 3 quarters of shrinking NIMs and this trend is likely to continue.

For the 2-3 Quarters, NIMS will continue to remain under pressure because :

Cost of Funds will increase faster than Loan Yields because 1/3rd of the deposits are NRI liabilities that were booked at lower Interest rates are coming up for repricing in this quarter.

As a result, the Cost of funds is rising faster than Yield on loans.

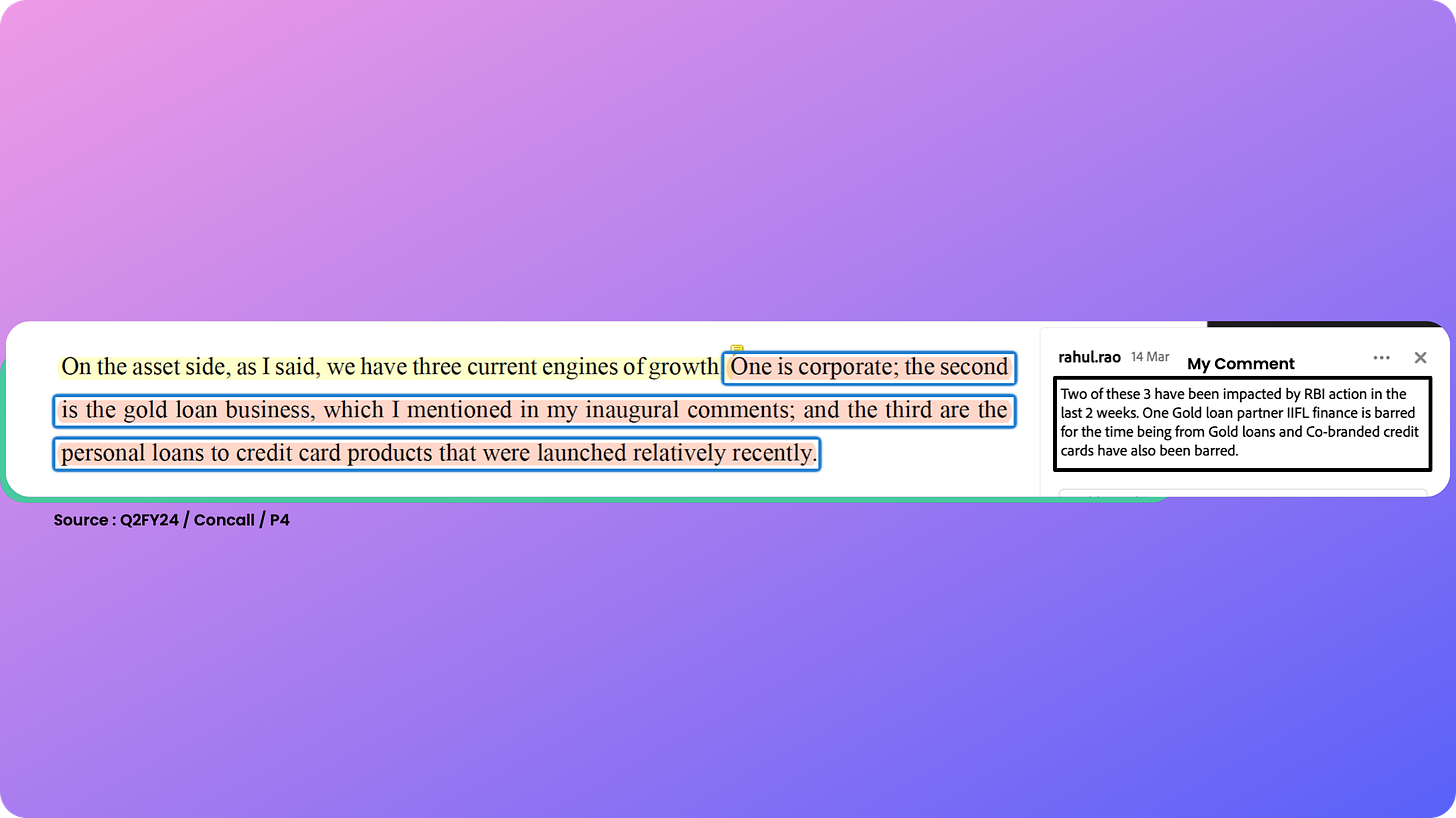

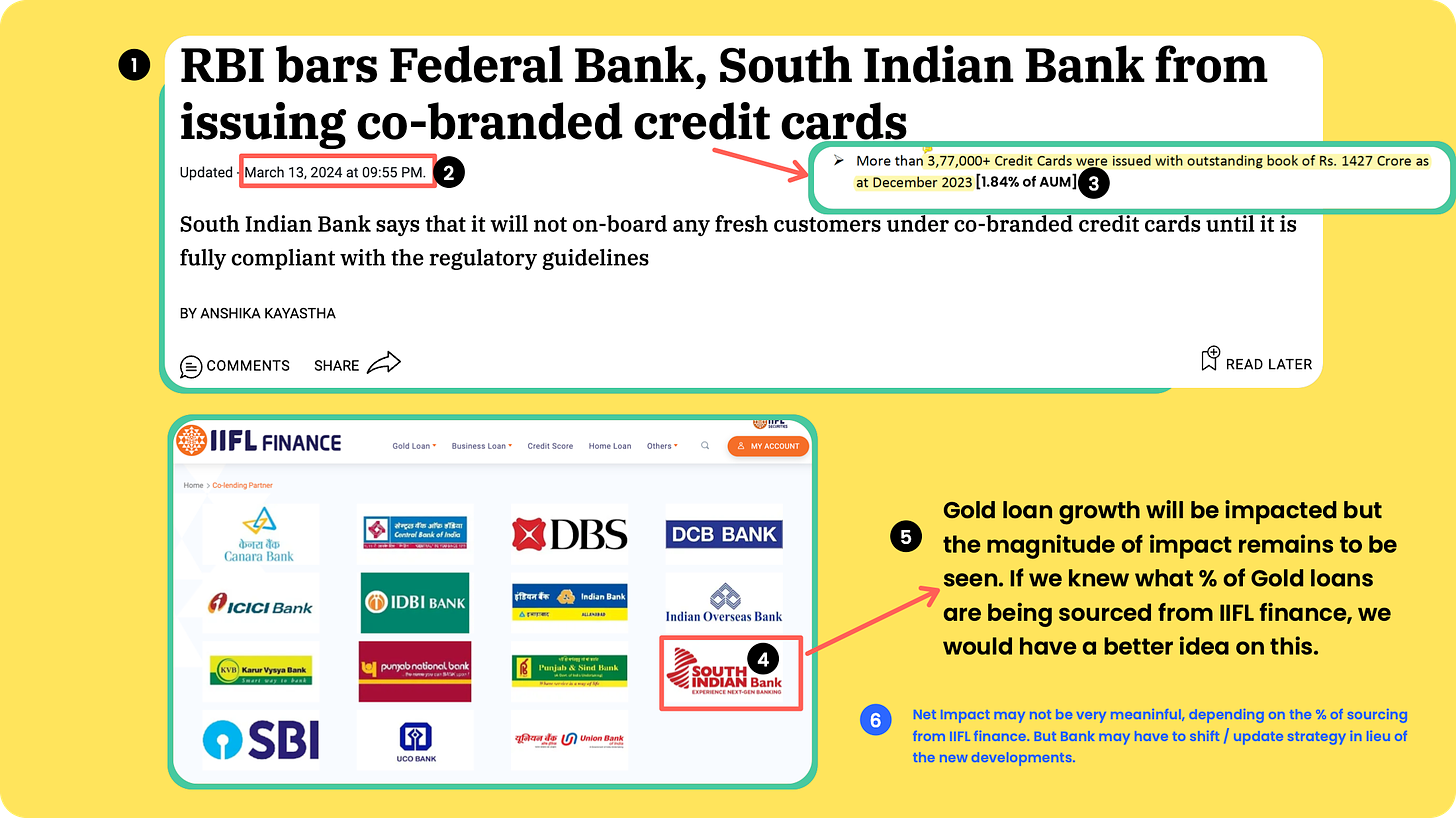

Focus Growth areas (Gold loans & Credit cards) of the bank have been impacted because of RBI action, putting downward pressure on the Yields.

Since NIMS is a function of :

RBI driven Interest Rates

Yield on Loans - Cost of Funds

and since both factors are either unpredictable (RBI Rate stance) or constrained (Yield is constrained by recent RBI action and cost of funds by repricing), it is likely this compression in NIMS might continue until either of these factors change favourably for the bank.

👉🏽 Cost to Income Ratio (~62% for December 2024 Quarter)

CI Ratio is higher vs. peers, however, the bank has outlined a strategy that involves increasing the productivity of the branches (What else !).

How effective the strategy is remains to be seen.

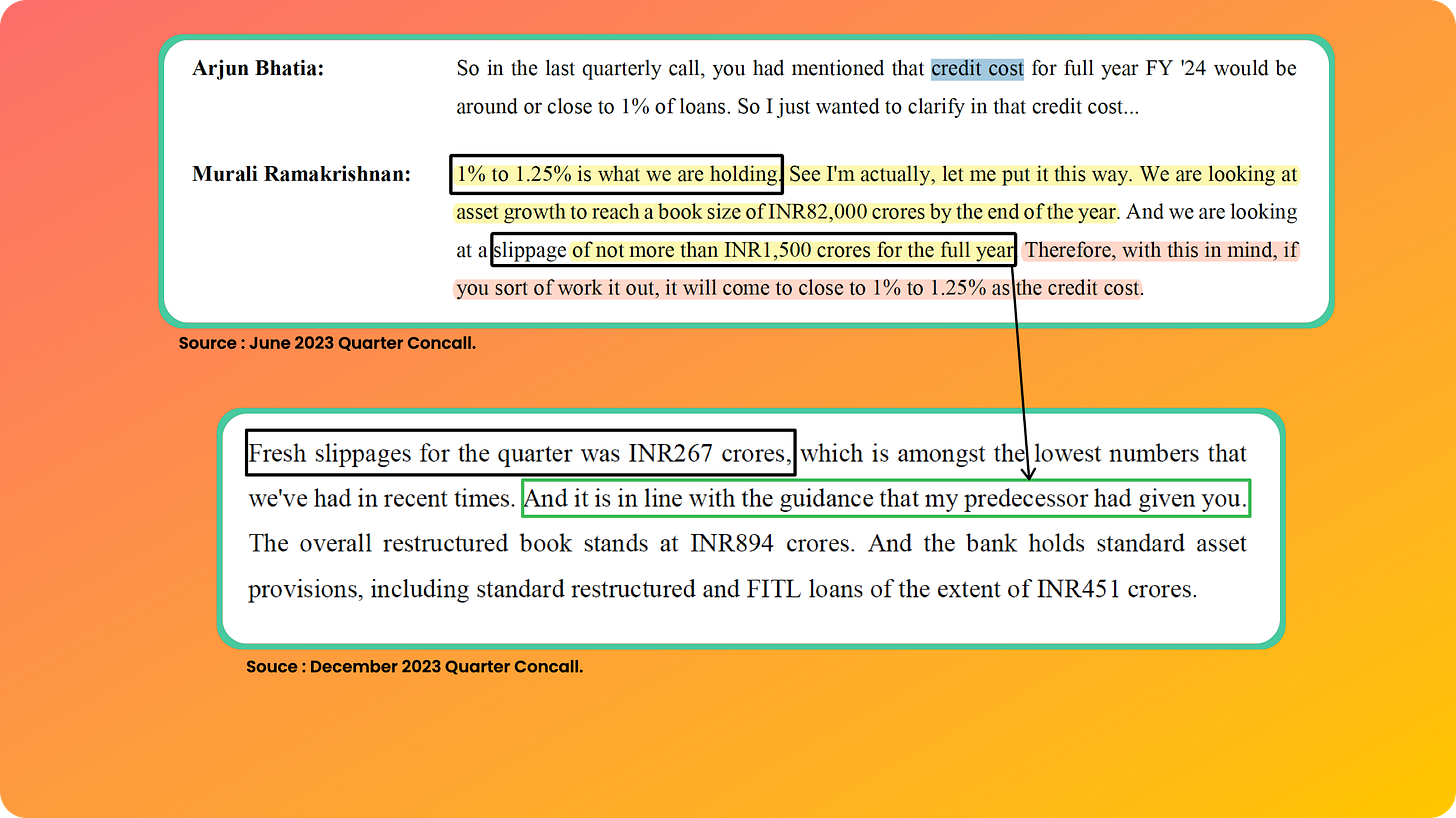

👉🏽 Credit Cost (FY24 Guidance of 1-1.25%) - On Track!

Credit Cost is the provisioning expense Banks must take on the P&L to “provide” for bad loans.

Lower the % of Total Loans “slipping” into NPAs, lower the Credit Cost, lower the hit on P&L, higher the Profit and🌟 Given the importance of Credit Cost to a bank’s P&L, It is no surprise that banks are highly incentivised to misrepresent (even manipulate) NPAs and provision numbers🌟

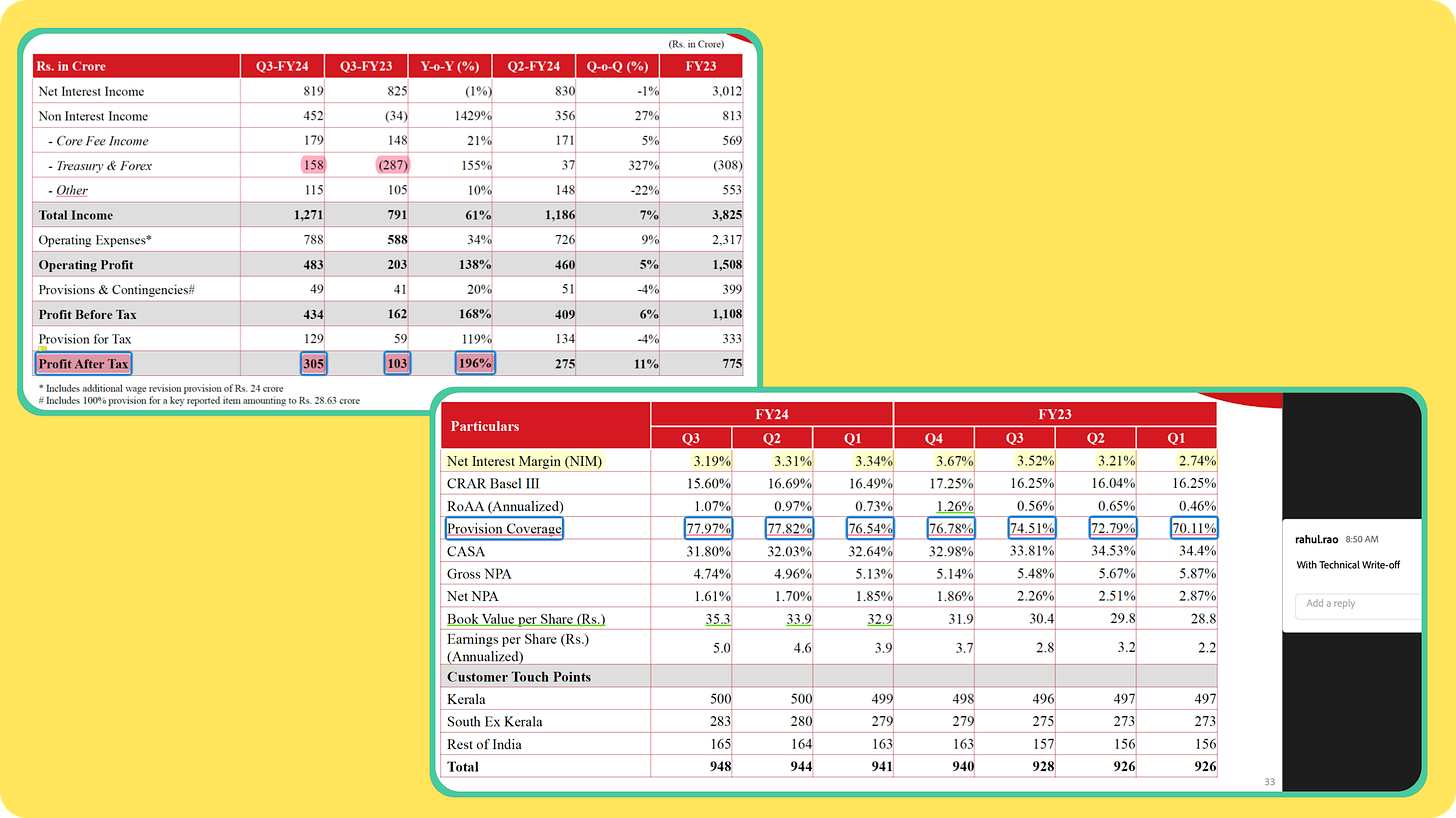

For SIB, NPAs and provision metrics have trended downwards over the last many Quarters. PCR (what % of NPAs are already provided for) has also improved.

If we take Management’s commentary at face value, the chances of “surprises” seem low.

As a net impact of NIMs, CI Ratio and Credit Costs, it would be challenging for the bank to hit the 1% ROA Target for FY24.

RISK/Doubts 🚩

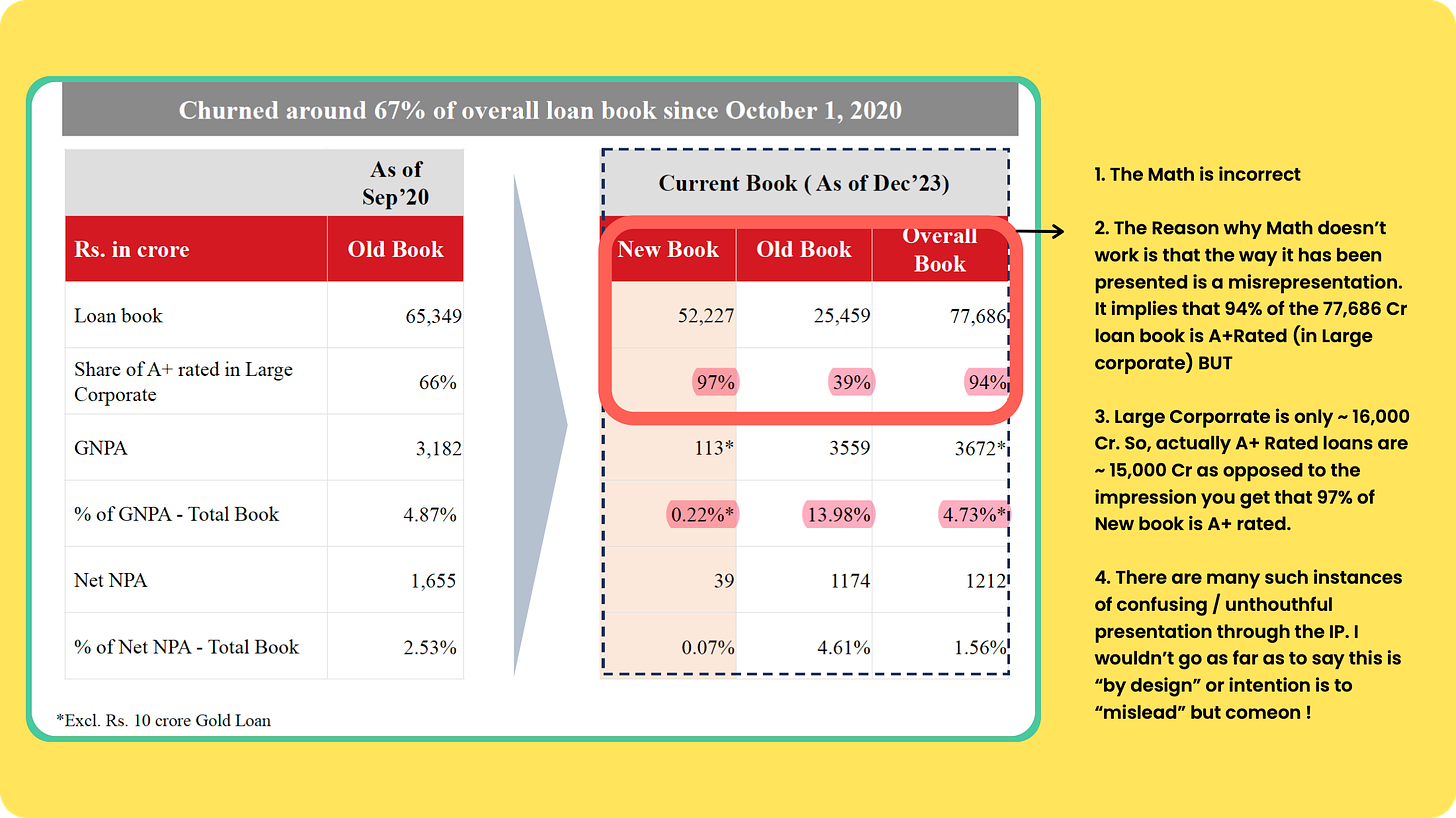

SIB presentations are terrible in Quality. There are a few such instances of confusing/erroneous communication throughout the IP. For example :

For the Hardcore types: You can DM me to get an annotated pdf of the Q3FY24 IP with my comments/doubts/notes.

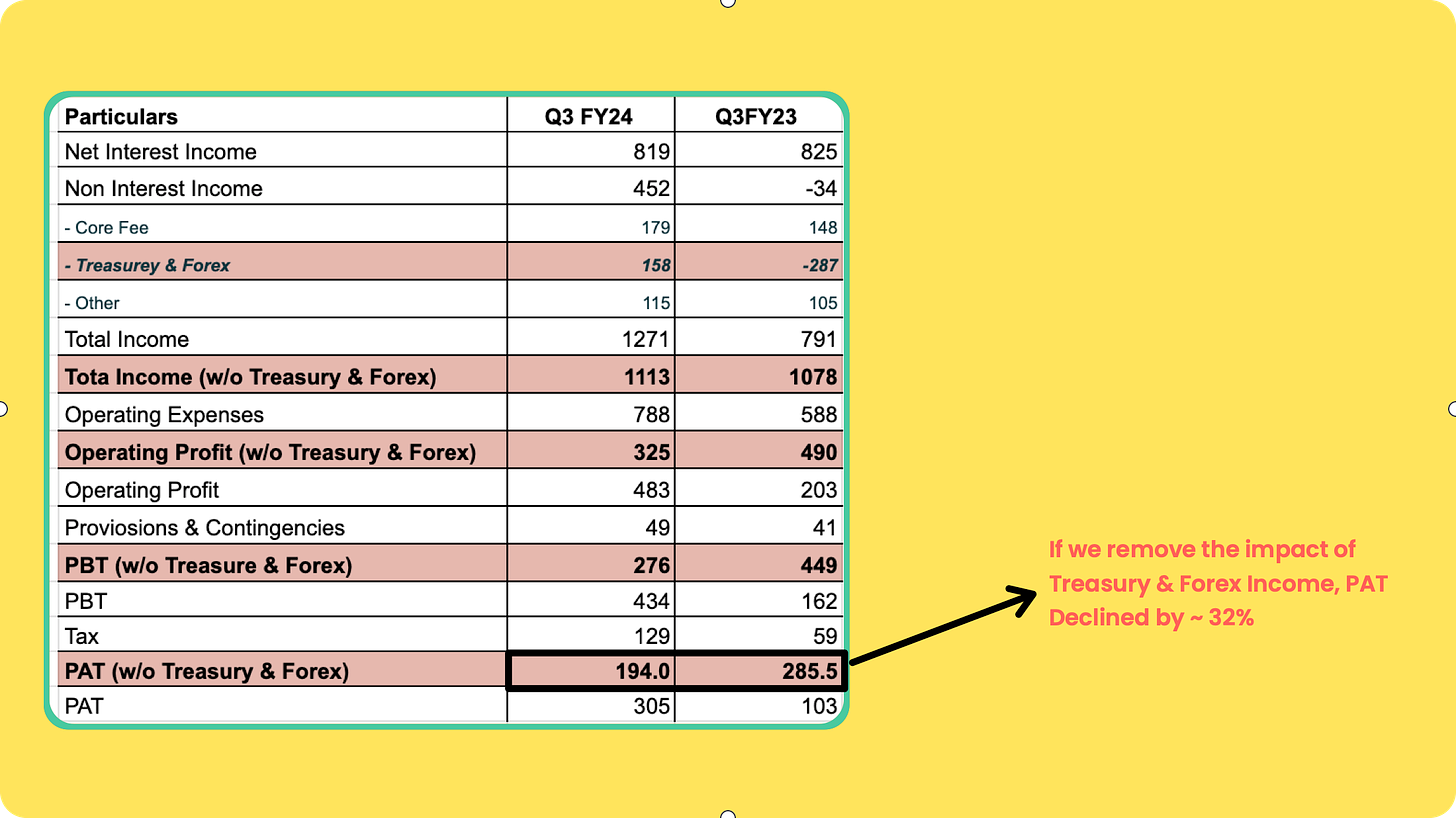

PAT Growth was q-o-q was 197%! ❌

Here’s another perspective. Treasury Income is non-core income and can lead to volatile PAT movement. If we remove the impact, PAT declined y-o-y by 32%.

RBI Action adversely impacted 2/3 Growth areas outlined in their strategy leading to an impact on growth, at least in the Short term.

👉🏽 Summary Financials

While I remain invested and have participated in the Rights Issue as well, many questions remain unanswered at this point.

Look forward to hearing your thoughts in the comments

Rahul

Disclaimer: Invested. Biased. Not Financial Advice. Please.

Hi Rahul. Very well researched and articulated.

"For the Hardcore types: You can DM me to get an annotated pdf of the Q3FY24 IP with my comments/doubts/notes.". Could I please get the annotated pdf? How do I DM you? Or should I just post my email ID in the comments here?

Is this the cheapest bank or the most well run bank?

I know that it got the best bank award for using Tech-that anyone can do, spending a bit of money on good IT fellows.

I wonder what makes a good bank-the organisation or the bankers involved in risk assessment!