The last Valuation note on Suzlon was dated 8th November 2023.

At the time the order book was ~ 1900 MW, and the co’ was valued at ~50,000 Cr.

The conclusion we reached at the time was that :

“…..but it appears things have moved much ahead of a reasonable buying range”

A market Valuation of ~50,000 (8th November 2023) implied that the market was factoring in 2-3 years of future profits into the current price, with a resultant 2 year Forward Multiple coming in at ~47X 👎🏼

Compare this with Sanghvi Movers valuation estimates, where on February 22nd, 2024, we had written that :

“If 1 year Down the line PAT growth is 30% or higher, and there is visibility for Robust Orders even beyond that, Current Valuations are ~ 20X P/E”

The difference in Valuations was glaringly obvious!

But let’s come to what’s up with Suzlon - TODAY!

Since November Order book has grown like crazy! The current order book stands at 3200 MW, a 2X jump since September 2023.

That sounds pretty awesome right? Yes BUT….

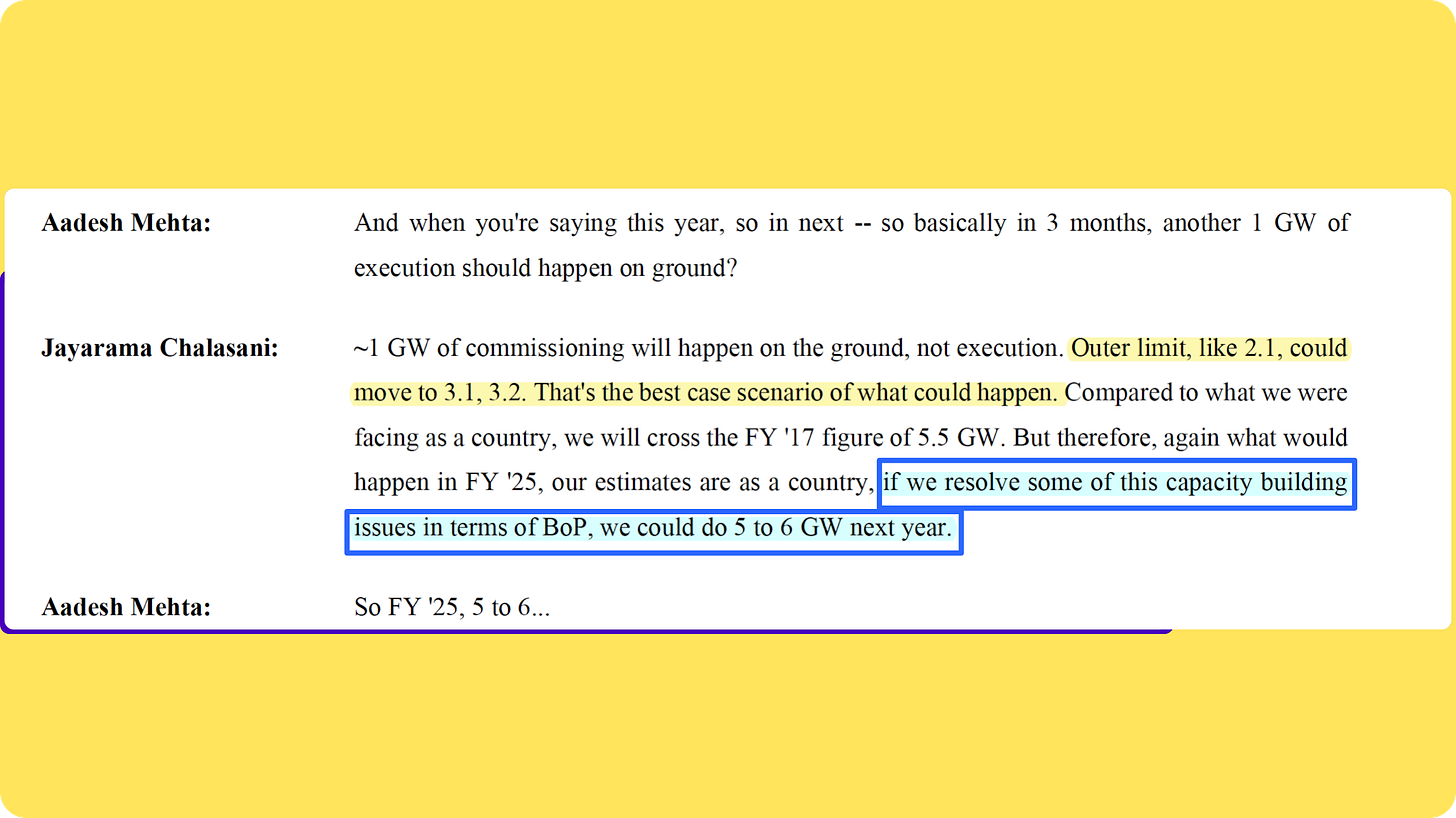

It appears that its Customers (IPP - Independent Power Producers) are running into execution problems - Land Acquisitions, Grid Connectivity, and a shortage of EPC guys (such as Sanghvi Movers).

This means that it facing difficulties (for now) deliver its Turbines to the site.

Here’s what this means :

For 9 months of FY24, it has executed orders (MW) of ~437 MW vs. ~ 482 MW in 9MFY23.

That’s lower than last year Sir!

📝 If we take last year’s deliveries of 664 MW as a proxy for How much Suzlon can deliver per Quarter, the number is ~150 MW per Quarter. [664/4]

📝 If we take the maximum deliveries per Quarter they’ve done this year, it’s 170 MW (Q3FY24)

📝 If we take the maximum Quarterly/yearly deliveries they’ve done in the last 5 years, it comes to ~ 200 MW/Quarter & 808 MW/year

🌟 This means the upper limit of Turbine Deliveries (in MW) based on historical evidence is ~200 MW/Quarter or ~ 800 MW/year

This has serious implications for the valuations, as we shall see in a few seconds.

🌟 Additionally, It also tells us that the current pace of Turbine Deliveries (600-650 MW) is inadequate. I

In fact, Suzlon must deliver 600 MW/year just to break even on the EBITDA level [CFO statement in Q3FY24 concall]

If we combine the above pieces of information and use that to estimate future deliveries & profitability for FY25 & FY26, the 2-year forward multiple is STILL 47X !!

Essentially, if Suzlon does the BEST (800 MW @ 5.5 Cr Revenue / MW ) they’ve done so far, it would not be enough to justify its current valuations!

Of course, if you have an unusual insight into why deliveries will far outpace the 800 MW or even 1000 MW, that would give you the ‘edge’ in this case.

Given, that I do not possess such foresight, we conclude that while the order book is important, even critical, its value is constrained by Suzlon’s and the Wind Energy Ecosystems’ ability to execute the projects.

Of course, the Industry is hopeful for improvements, hell, even counting on it bigtime BUT that is iffy, at this point.

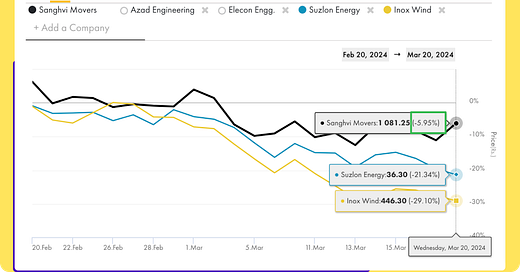

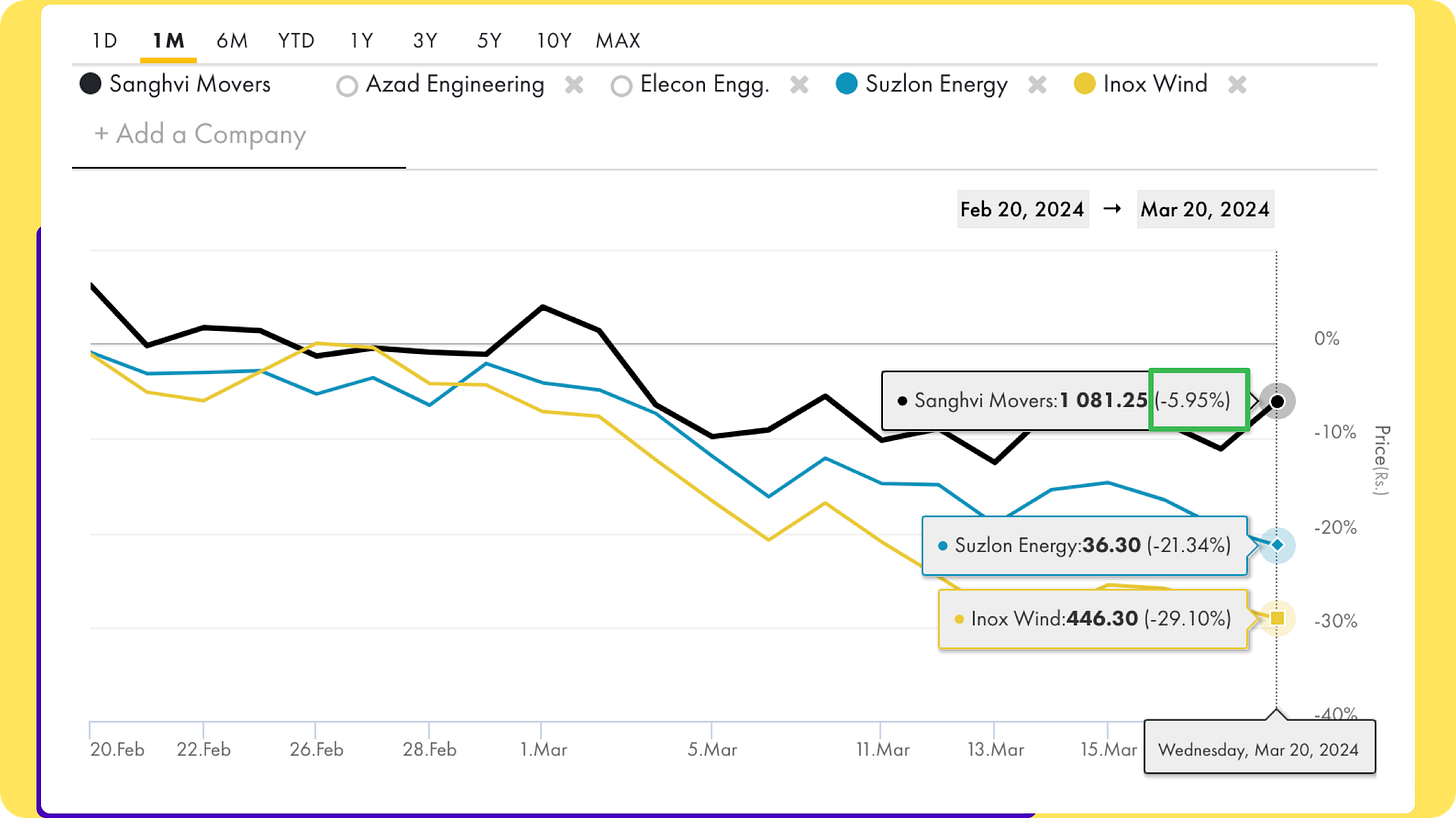

In summation, we conclude that if Sanghvi Movers is valued at a 1 year Forward P/E of ~20X vs Suzlon at a 2 year forward of ~ 47X, it’s highly likely that Risk Reward Ratio is far more favourable for Sanghvi.

Valuation link to Sanghvi Movers (Update: 22nd Feb 2024)

that’s possibly why relative to Suzlon & Inox wind, Sanghvi Stock has shown a lot more stability.

Would love to hear your thoughts in the comments below!

Rahul

Disclaimer

Nothing you read here should be construed as investment advice. I do not know your circumstance so please treat the above as nothing more than my personal opinion, which is subject to change without prior notice to you. Please do your work and consult your financial advisor. I may own positions in all stocks, sectors and indices discussed and can exit them without notice.

Nice post, thanks for sharing. I like the the way you linked Sanghvi Movers for valuing Suzlon.

One sent thought from my old reading on Wind Energy is that major issue is capital required for the project and second part is the demand is going to come from hybrid with the solar project which want to optimize the land.

Until the company able to deploy better system to generate efficient return it is very risky line.