The Making of Money

and why stuff gets 'expensive' over time.

In a bizarre yet ingenious scam, a gold trader was paid 1.3 Cr in fake currency notes…notes With Anupam Kher’s picture on them.

Who says you can’t be a crook AND have a sense of humor?!!

Besides, fake notes are not a new phenomenon and Incentives to forge notes is high.

Net profit margins of a hypothetical ‘Fake Notes LLP’ would be higher than the most successful corporations in the world. No joke, Ask RBI.

In FY24, it spent around 5100 Cr on printing notes. These notes had face value of close to 1.29 Lac Cr!! That’s a profit of about 1.24 Lac Cr.

96% PAT Margin! (Why are we not listing RBI? :P)

This is called seigniorage. French origin word. who cares.

It gets better though. RBI does NOT always print money physically, oftentimes it will simply create money digitally. The PAT Margins on that are, well, Go figure.

Anyway, the Anupam Kher news along with a series of media articles highlighting how there was a ‘lack of deposits in the banking system’ and some counter arguments from wizards like Mr. Neelkanth Gupta, got me thinking :

How is money even created

How does that impact inflation,

Is a slowdown in deposits in the system actually because “Everyone is investing in the stock market” etc.

Notions like these sent me down a rabbit hole.

What I found next, Shattered the very fabric of reality in which we exist.

Not really. But it took me 3 weeks to put this together. So, you better subscribe !!

How is Money Created?

Contrary to the popular belief that Money is created by RBI, a far larger sum is created by commercial Banks (SBI, HDFC Bank, Axis Bank etc.)

Yes, Commercial Banks create money.

It’s like Coca-Cola. The HQ in Atlanta (think RBI) ensures the supply of ‘Syrup’. The bottlers (think Banks) then, mix it up with water, sweeteners etc.

The bottling and distribution in this analogy is handled by our Commercial Banks.

So, the creation and distribution of Coca-Cola is a joint venture between the Coca-Cola company and its bottlers. Between the RBI and Commercial Banks.

But how does this work?

First, let’s talk about what’s in the ‘syrup’. At this point, we’re only what is in the syrup, not how the syrup is made.

The ‘syrup’ can be referred to as ‘Base money’ or ‘Reserve money’ or ‘Monetary base’. Let’s stick to calling it ‘Base money’ for this article. Okay?

So, what is this ‘Base Money’?

You may have heard terms such as M0, M1, M2, M3 etc. These are measures of money supply in decreasing order of liquidity from left to right.

M0 is the Base money, the ‘source code’ of money supply. This is what RBI creates.

M0 = C + D = (C)urrency in Circulation + (D)eposits with RBI.

This is the Syrup baby. There is about 46.6 Lac Cr of M0 in the system as on September 2024.

75% of Reserve Money (M0) is comprised of currency in circulation or CiC. This includes notes in circulation, coins and RBI’s own bitcoin – CBDC (Central Bank Digital Currency). This totals to 34.78 Lac Crore is currency in circulation as of March 2024.

(FYI I have a course on How to analyse Banking/NBFC stocks. It helps pay bills so please consider signing up 🙏🏽)

Cash Management Business - A Side Note

CMS Infosystems, Radiant and other cash management companies rely on cash in circulation. Despite a slowdown in CiC growth, cash very much remains a feature of our financial system. But saying cash in circulation is growing (which it is) sounds awfully similar to when in 2017, a bunch of value investors (including myself :p) were saying that a vernacular newspapers circulation was actually increasing.

Whatever way you put it, cash/notes is likely to go down in the future. How slow, how fast? I don’t know.

So even though currency in circulation is going up, as the bar chart above suggests, the pace of addition of cash in circulation has slowed down to a 10 year low of 4.1%. However, the slow CiC growth of 4.1% in FY24 is also impacted by the removal of Rs. 2000 notes from the system in May 2023.

Currency to GDP ratio is also declining since 2021 while digital payments are on the rise. Do these factors suggest cash management business face a terminal risk? What if CiC as a % of GDP decreases but still continues to increase on an absolute basis? How long until we stop using cash completely?

Sorry to disappoint you, I don’t know but these are good questions to think about if you’re betting on cash management businesses.

Coming Back. CIC is RBI’s liability. Therefore, it shows on the Liability side of RBI Balance Sheet. You will notice that the CiC shown in the left side of the Balance sheet matches with the Liability of the Issue Department of RBI.

(That’s what “Balance” Sheets do Rahul, move on)

But what is this 34.7 Lac Cr backed by on the Asset Side? Back in the day, fiat currency was backed by Gold. But In 1973, Uncle Nixon abolished the gold standard. The Rest is history.

Now, INR is backed by the USD – The World’s Reserve currency. That’s another story for another time.

95% of our INR currency is backed by Foreign currency Assets (USD Bonds) and the remaining by 308 Metric tons of gold (and a negligible amount by coins).

You would have noticed Gold prices are rising. One of the reasons is Central Banks buying Gold like its Dhanteras all year round. This reflects weakening confidence in the USD. This too, is another story for another time.

About 22% of Base Money (M0) comprises of Deposits.

This is officially (jargon rocks) referred to as ‘Bankers’ deposits with RBI’. This is the CRR – Cash Reserve Ratio, which is currently 4.5%. This means that for every Rs. 100 of deposits, 4.5 must be maintained with RBI. It shows up as ‘Bankers Deposits with RBI’ on the central Banks balance Sheet. Banks earn 0 Interest on these deposits.

CRR is extremely critical to How Money is created. It is the bed-rock of the Fractional Reserve Banking System. Wait, What’s that?

Fractional Reserve Banking

Remember we said there is syrup and then there is Coca-Cola. There is Base money, created by Banks and there is money ‘created by Commercial Banks?’.

We already discussed what ‘Base Money’ i.e – The Syrup is made up of. (M0 = C+D)

Fractional Reserve system is the underlying process that explains how ‘Coca-Cola’ is made by Commercial Banks.

Contrary to the simplistic notion that deposits fund loans, the actual process entails that loans create deposits.

Here’s how.

The Central Bank creates ‘Base Money’. That becomes a deposit with the commercial Bank. It loans out 90% of the amount (Assuming 10% is the reserve requirement). This process repeats.

If Reserve requirement is 10%, the Total money supply created from 100 INR of ‘Base Money’ is 1000.

If Reserve requirement is 20%, Total Money supply created from 100 INR of ‘Base Money’ is 500.

So, essentially, the formula is : Money Supply Created from 1 unit of Base currency = (1/Reserve requirement). A Step by Step explanation is provided below.

The fundamental point is that there is a ‘Multiplier effect’. One man’s deposits is another man loans. One man’s loan is another man’s deposits. It’s a circular process.

Source: Modern Money Mechanics

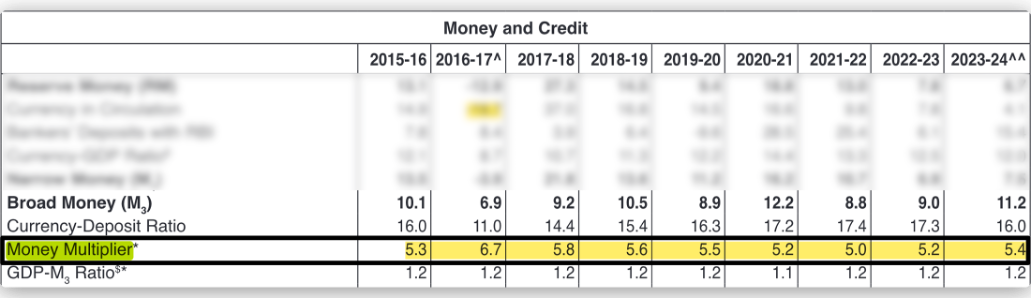

India’s Money Multiplier is around 5, reflecting a reserve requirement of around 20% (CRR + SLR = 4.5% + 18% = 22%)

You see as the Credit growth has picked up since FY22, the Money multiplier has gone up from 5.0 in FY22 to 5.4 in FY24. More loan create more money.

“The process by which banks create money is so simple that the mind is repelled. When something so important is involved, a deeper mystery seems only decent” - John K Galbraith (Economist, Author - A Short history of Financial Euphoria)

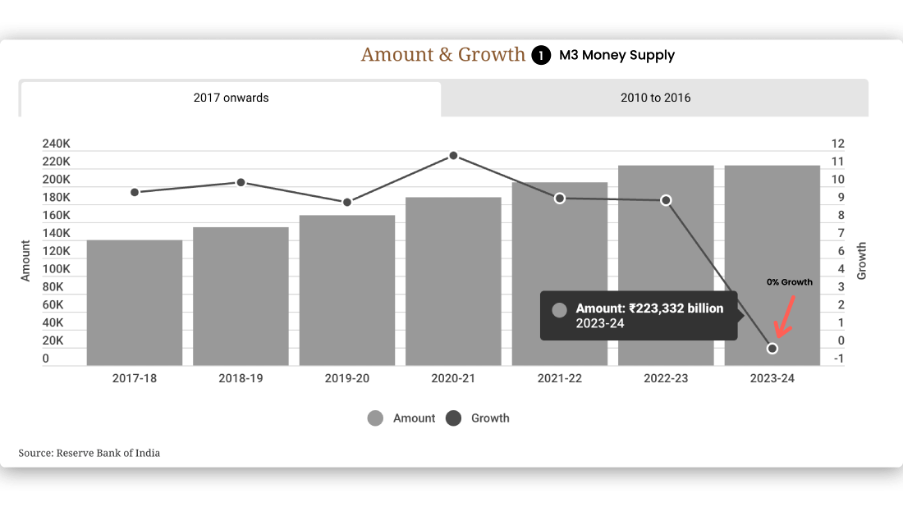

This implies that if M0 = 46.6 Lac Cr (Sept. 2024 end), the broad money supply (M3) should be around 5X as suggested by the ‘Money Multiplier’ above.

M3 in September was 259.5 Lac Cr. That’s 5.6X !

You will notice that while M0 has been largely flat, M3 has increased since March-April 2024, most likely reflecting the ‘Money creation’ happening on the Banks’ part.

But, What is M3? (A simplified Model)

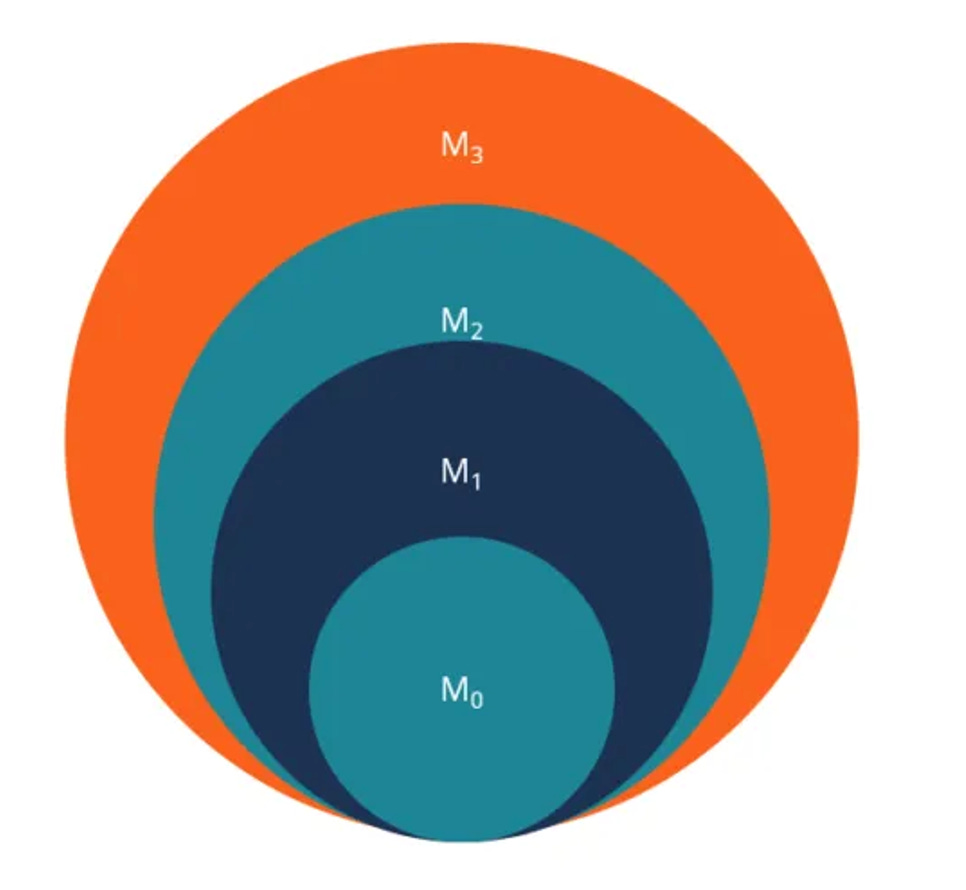

M0: Reserve Money (Currency + Bankers’ Deposits with RBI) i.e C + D

M1: Currency + Demand Deposits + Other Deposits with RBI

M2: M1 + Savings Deposits with Post Offices

M3: M1 + Time Deposits with Banks

In essence, M0 to M3 represent a progression from the most liquid to the broadest forms of money, with M0 being the most liquid (base money) and M3 being the broadest (total money in circulation).

We can visualise measures of money supply like this.

And if Milton Friedman was right about inflation (he’s not completely right) when he said..

Then this implies that to curb inflation, RBI would want to control Money Supply? The fact that M3 was flat over the last FY suggests RBI’s intention to bring down inflation (No surprise here).

Unfortunately, inflation is back up to 5.49% in september after declining for the better part of AY 2024.

Frankly, the real process is far more complex than controlling money supply etc. Let’s see how this plays out.

If nothing else, atleast we understand the first principles of how money is created. Most people will go through their life not knowing a fundamental truth about our society. You’re not one of them now.

Obviously, I need to better understand the exact mechanism RBI uses to manage Money Supply needs and the impact it has on inflation etc, how this connects to Banks and their business, to microfinance and its NPA (interesting right?). But, that’s a story for another time.

Until then,

Rahul