If you buy Ujjivan Financial Services at today’s closing price (30th November 2023), you’re basically buying Ujjivan SFB at ~20% discount.

I should point out this is NOT a risk-free transaction and we shall talk more about that + the merger math but before that…

Let me give you a little bit background on my involvement with Ujjivan SFB. (Disclaimer : I’m invested in the co’ & this should not be considered Investment advice)

Somewhere around Late 2021, I decided to embark on an Intellectual journey which involved Researching the Entire Banking / NBFC sector

Looking back I could’ve been a lot more efficient with the whole process - Hindsight being 20-20

As a part of the process I grouped the Banking / NBFC sector by sub-sectors - Gold Finance NBFCs, Large Private Banks, New Age Private Bank, Small Finance Banks, Housing Finance, Multi Liner NBFCs etc

And while researching small Finance Banks, I came across Ujjivan SFB along with Equitas and AU SFB

Because I had been looking at the entire sector, It was relatively easier to spot why Ujjivan stood out a little bit. (I also invested in Equitas - much later)

Research Tip : Never Research only 1 Stock in a sector. At the very minimum look into the the Top 3 players

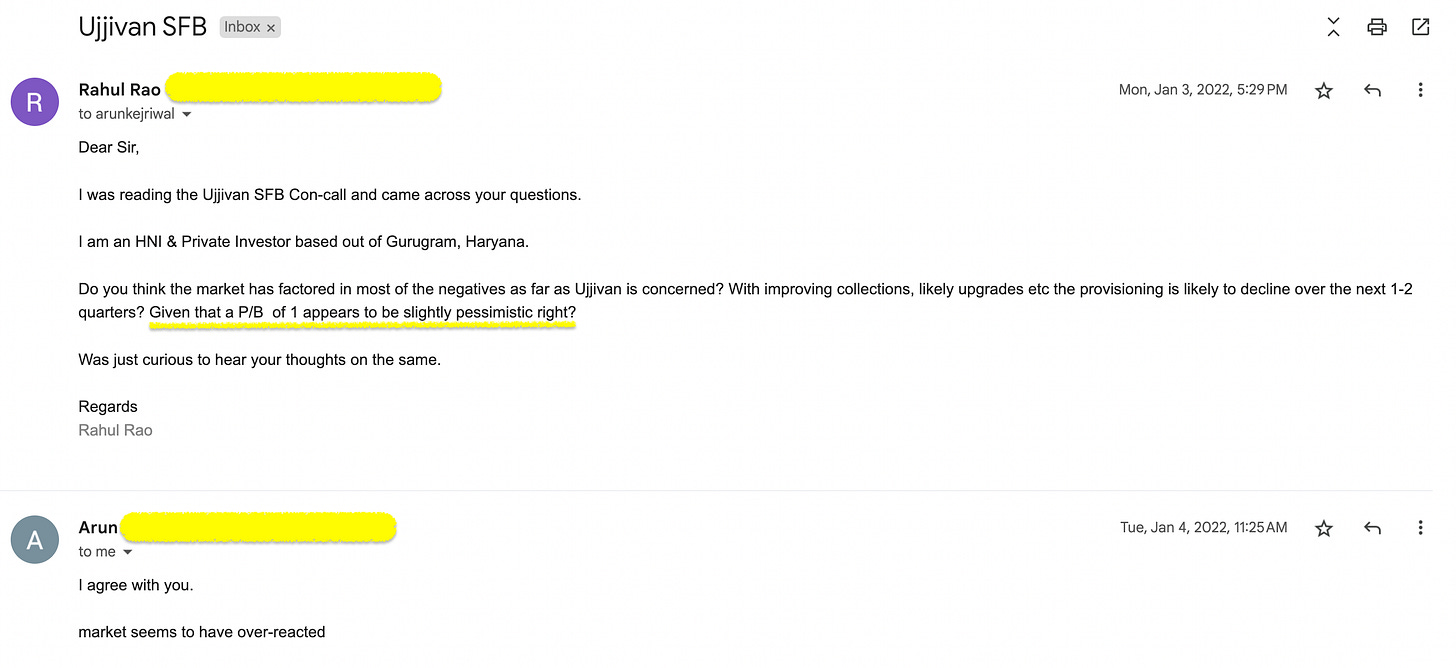

Concerned and curious about this opportunity, I Wrote an email to another investor who I had reasons to believe was more experienced than I, although I have never spoken to him since.

This is what I Wrote in January 2022.

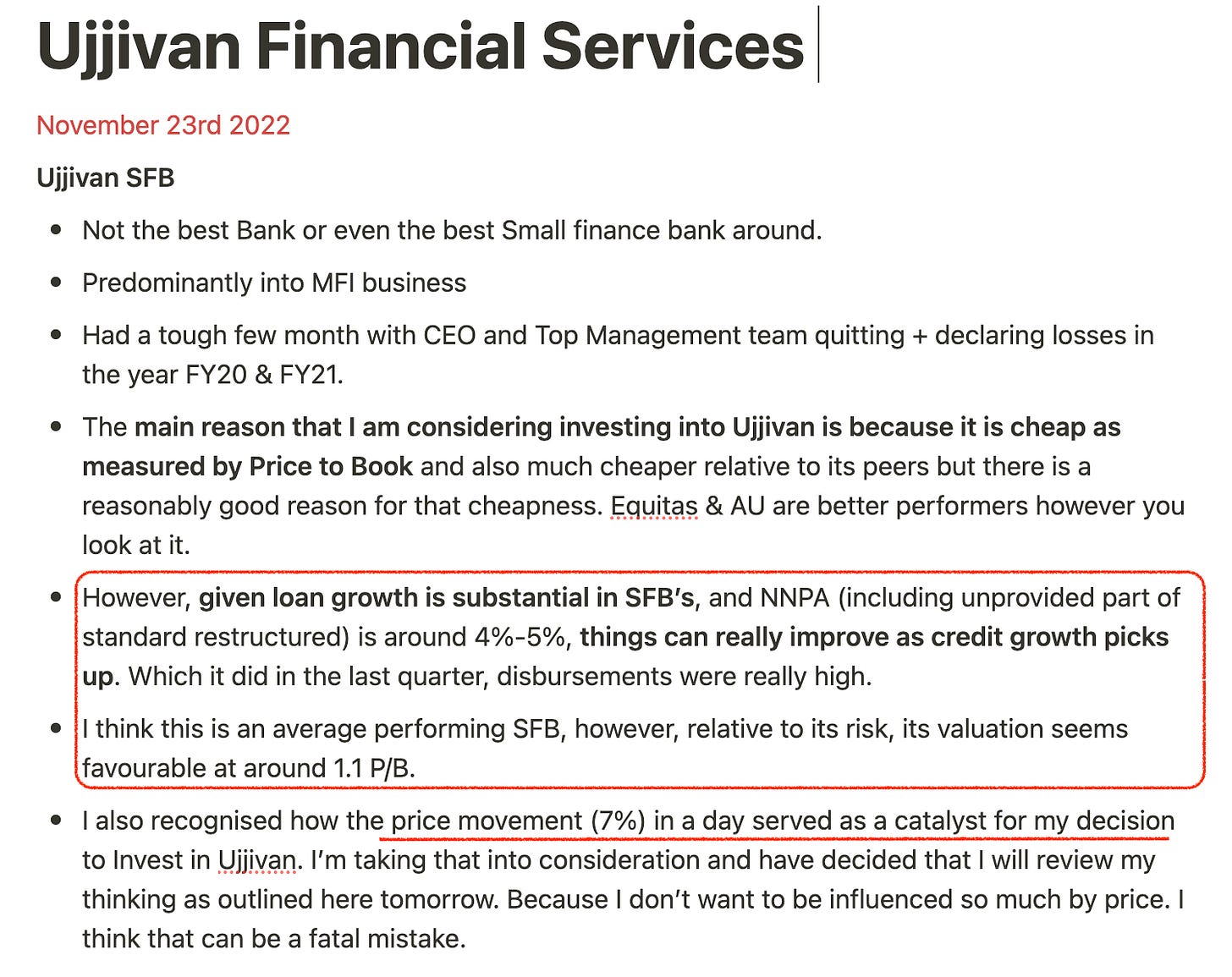

But it wasn’t until November 23rd 2022 that I actually bought the stock and guess what the TRIGGER was that made me buy?

The hint is in my Buy NOTE :

Looking back, the fact that I slept through nearly 11 months and 2-3 Quarter for significantly improved performance before acting on a thesis that seemed reasonably well formed is quite frustrating

This exposes are gaping hole in my tracking process, a lesson I am determined not repeat.

Despite what seems like a blunder, the bet seems to have turned out well.

Much better than my expectations of 20% in a year, as we can see from the Chart below (The Red line shows the price at which I wrote the email)

AND….it wasn’t until August 2023 when the Reverse Merger came into the picture for me personally.

What got me interested?

Subsequently, in the latest con-call (October 27th) the management indicated 3rd November EGM Would be held to get Shareholder approval on the Reverse Merger and they hope to close it by Q4 Latest.

Since then Shareholder approval has been given and we’re entering the final phases of the process.

Every 10 shares held in Ujjivan Financial Services (Hold Co’) shall entitle an investor to 116 shares in Ujjivan SFB

So, here goes some Rocket Science kinda math

10 X Ujjivan Hold Co Share price = 116 X Ujjivan SFB

For a No Arbitrage condition to exist, LHS of the above Equation should be Equal to RHS.

But it’s not, and the differential offers a potential ‘Arbitrage opportunity’

so, 10 X 551.2 = 5512 / Whereas 116 X 56.85 = 6595

Therefore, an Investor may buy 10 Shares of Ujjivan Hold Co for 5512 and get Ujjivan SFB shares for 6595, effectively buying buying Ujjivan SFB at 19.64%

But as we mentioned, there are some risks :

The merger could get delayed. My personal sense on this is it’s unlikely since Shareholder approval is a major hurdle when it comes to these transaction.

Usually one party is concerned the other is getting more than them ( Read Note on Inox Merger to learn more) and usually this is a sticking point as the proposal approaches Shareholder Approval (IDFC & IDFC First Reverse merger was delayed in part because of this)

Share prices of both companies can fall in which case the ~19-20% discount might narrow or erode entirely depending on how much they fall compared to each other

In my experience so far, the most fundamental reason for playing the ‘Arb’ is that you believe Ujjivan SFB is a decent Investment from these valuations. So, any well researched Investor would have the Fundamental research on Ujjivan SFB on lock

Hope this was insightful

Did I miss out anything? Let me know in the comments.

Rahul

Already invested for this arbitrage from 3 months