On 3rd October 2023, Vedanta Ltd’s Market cap was around Rs 87,000 Cr.

Its 65% shareholding in It’s crown jewel - Hindustan Zinc - India’s leading Zinc player with 80% market share - was valued at just 83K Cr.

It got more interesting.

On 23rd October 2024, The Hindu Business Line reported (read sub-headline)

Essentially, all its other businesses were being valued at Zero. For Good reason. But…

First, what are these “other businesses?”

Second, Why were they assigned zero value by Mr Market?

These “other businesses” included (other than Hindustan Zinc’s 65% share)

Vedanta Aluminium - India’s Largest & 9th Largest in the world?

Vedanta Oil & Gas - Cairn India - India’s largest private Crude oil producer.

Not to mention 3 other businesses - Power, Base Mental (Copper), Steel which although are not as valuable as the Top 3 business, were/are not worthless either.

Second, Why were they assigned zero value by Mr Market?

Vedanta's business was under pressure in 2023 due to concerns about Vedanta Resources Ltd (VRL)'s debt and its impact on Vedanta Limited. Here's a breakdown:

VRL's High Debt: VRL had significant debt, approximately $5.9 billion as of June 2023, which needed to be serviced through dividends and brand fees from Vedanta Limited.

Refinancing Risk: VRL had substantial debt maturities, with maturities of approximately $1.2 billion in Q3 & Q4 FY24.

Dependence on Vedanta Limited: VRL's debt servicing heavily relied on Vedanta Limited's payouts, putting pressure on Vedanta's financials.

Vedanta Limited's Leverage: Vedanta Limited's net leverage was 3.4 times as of March 2023, due to supporting VRL's debt.

Moderating Profitability: Lower commodity prices and slower progress on the aluminium business's capex contributed to lower than expected operating profitability.

As a result stock was down more than 40% since ATH.

Between March 22 and March 24, look at what happened to operating profit (down 20%), interest payments (2X) and net profit (~ ⅓).

By September 23’ Quarter, shit was really hitting the fan with operating margins hitting a 12 Quarter low of 19%.

In this backdrop, the company announced the demerger of Vedanta Ltd into a total of 6 listed companies (including Vedanta Ltd). I think a large part of the motivation was to get a good valuation and sell off the relatively unattractive businesses and pare down the debt. To that end, the co’ also sold a stake sale in Hindustan Zinc.

However, plans to de-merge were in sharp contrast to its plans to delist in October 2020, which failed to materialize. The co’ had offered to buyout public shareholders at 87.5 per share, which thanks to LIC and other large shareholders was duly rejected. LIC tendered its shares at 320 per share instead of the paltry 87.5/share Vedanta offered.

Value unlocking or unlocked?

Thanks to improvement in the business (commodity prices) in Q3FY24 and more certainty around refinancing the upcoming debt (Q3 & Q4 FY24), Vedanta stock shot up.

Further “value unlocking”, atleast in the short term is predicated on the performance of the individual businesses, which are cyclical for the most part.

The 3 core businesses - Zinc, Aluminium & Oil & Gas are commodities whose prices fluctuate, which means EBITDA and profitability fluctuate, which means that waiting for ‘value to unlock’ might mean being exposed to significant volatility.

Bear in mind your time horizon and your style will determine HOW you value the company. For example, I’m focused on determining if at listing, I’m going to get an immediate profit.

This matters to me because I am looking/willing to put a large percentage of my portfolio in a few bets but those that have a very high probability of success. At my portfolio level and with the amount of time I invest in the game, that approach is beginning to make sense to me.

On the other hand, If you’re someone who’s more interested in some particular business on a longer term basis and are not as “active” you probably won’t be a stickler about what happens on the day the 5 vedanta sisters are listed, as long as on a 1-2 year basis you see significant value, right?

This is a key point and I want you to understand my context before I approach this valuation exercise.

Cool?

So for me, Unless my position is hedged (using Vedanta puts for example), there is an exposure to volatility.

Despite what Vedanta’s demerger rationale statement reads i.e - ‘value unlocking’, focus on individual business blah blah, IMHO performance of Individual businesses are likely to be far more volatile.

Isn’t that one of the reasons why it combined all its businesses in the first place? Interestingly, the rationale provided is pretty much the same - merge or de-merge !

(Another key motivation to merge these various businesses was to de-list the business (2020), which did NOT play out.)

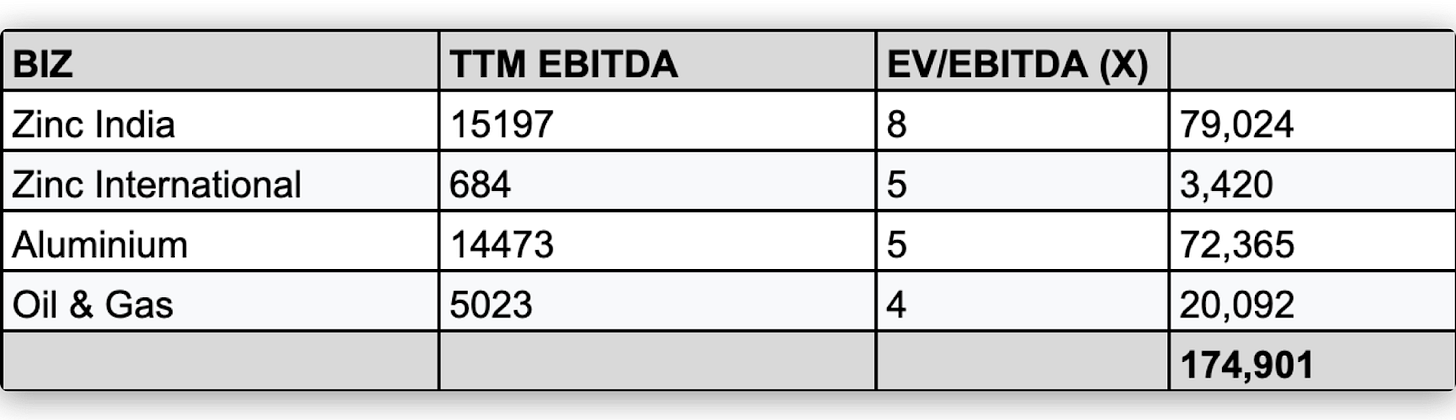

Finally, here are some estimates of what de-merged vedanta might look like :

#1 - Borrowed Valuation Estimates (ICICI securities Report)

According to an ICICI Securities report, Vedanta’s SOTP valuation results in a Total value of 600/share or a Total M.cap of 2.34 Lac Crore vs the current Mcap of Rs 1,65,000 Cr.

Juicy, but wait before you get too excited…

98.5% of this per share valuation is coming from the 3 core businesses outlined earlier - Zinc, Aluminium & Oil & Gas.

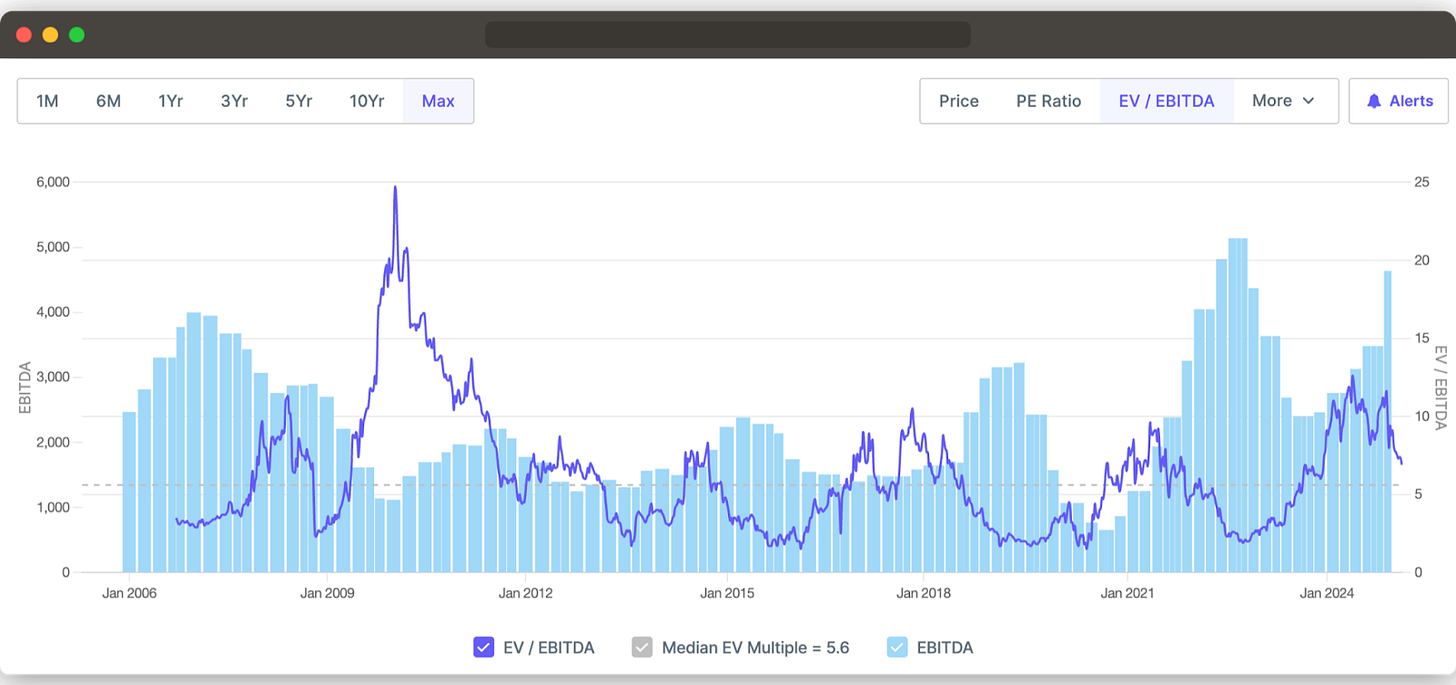

At this point in time, knowing what I know I think the above multiples are rich. I think so because like I said because they’re based on TTM EBITDA & EBITDA Multiples. That’s a little iffy because :

TTM EBITDA might not sustain in the near term (3-6 months)

EBITDA Multiples themselves are Bullish and will NOT sustain if outlook for commodity prices changes.

I am evaluating Vedanta as a “De-merger play” and Want a high degree of certainty that the value of parts, when listed, will be higher.

Although, Zinc & Aluminium businesses have some serious triggers that are worth further study. But, given the variation in EBITDA associated with commodity prices there can be significant variation in operating profits.

See what I mean below :

If you negate 2021-2022 commodity price hike as this was one-off, Current prices are nowhere close to being below 10 year median or whatever. Had they been trending downward or lower than median etc, as was the case around June 2023 Quarter, buying at the point would offer far more margin of safety. (FYI : I bought around October & November 2023 @232/share and exited around 430/share)

What this means is that basically I cannot (in my opinion) play this as a ‘Demerger play’ as I was initially thinking of it because it's hard to say what prices would be by the time the 5 vedanta sisters list i.e - over the next quarter.

Basically, from that very rigid (& possibly flawed POV), downside protection is missing, especially when the position has no puts on it

Put option with Feb 25 expiry & Strike price of 420/share cost ~16 rs, about 4% of the Current 425/share, so not very attractive).

Secondly, I believe if you wanted to buy the Zinc and Aluminium businesses, which are extra-ordinary businesses, I am very confident they will be available at cheaper valuations anyway sometime within the next 2 years.

And for that reason, I’m out.

#2 - Conservative Multiples

But wait, let’s try another angle.

Another angle on valuations is that I take TTM EBITDA and use lower multiples to get an estimate.

For Example, the 8X for Zinc India is taken from its historical medium EBITDA multiple of 8.3X

For Zinc International, I just took what ICICI sec report estimates and take it down from 7X to 5X

For Aluminium, I’ve taken NALCO’s long term medium of 5.6X and notched it down to 5X.

For Oil & Gas, I’m kinda just going with the Rs 20,000 Cr valuation for Cairn India (the first stock I ever bought btw)

With the Current M. Cap at Rs 1,65,000 Cr, the current valuation leaves 10% on the table here + the value of the ‘other businesses’ which should be more than Zero.

Whether an estimated 10% GAP based on Current EBITDA + conservative multiples (and assuming Zero value for the rest of the business) is good enough for you or not, is an individual choice.

For me, it's not, especially when I’m not very very sure and hedging costs are significant in relation to the expected profit from the transaction. If I was to buy a particular business such as Zinc or Aluminium which are really really great businesses, I’d rather that they get listed and buy them at a better valuation.

Looking at NALCO’s (India’s largest integrated Aluminium player) earnings history and valuation roller coaster, which is likely to be similar for Vedanta Aluminium, why should I not buy it once it is listed?

Based on this perspective, I see no particular upside to buying before the De-merger.

#3 - The EBITDA movie

If we’re going to value this business from a ‘Demerger play’ kind of perspective, the near-time EBITDA evolution would matter quite a bit.

Imagine you buy based on TTM EBITDA and you think SOTP of 5 listed Vedanta sisters is likely to be 600 vs 425/share today, which as I have outlined above is on the optimistic side.

Then, over the next quarter Commodity prices dip as they often do and your EBITDA is looking shittier than when you made this calculation and possibly the near term future looks terrible too. Meanwhile, the unhedged Vedanta you bought at 425/share is trading at say 400/share (for example).

Been there, done that. No Thank you !!

Thanks for reading, Drop me a comment if you think I’m being stupid about something (PLEASE !)

Rahul

Note: We have relied on data from www.Screener.in and www.tijorifinance.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Rahul Rao has been Investing since 2014. He has helped conduct financial literacy programs for over 1,50,000 investors. He helped start a family office for a 50-year-old conglomerate and worked at an AIF, focusing on small and mid-cap opportunities. He evaluates stocks using an evidence-based, first-principles approach as opposed to comforting narratives.

Disclosure: The writer and his dependents DO NOT HOLD the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Thanks for the write-up! Reminds me of a Munger quote: “A man has a wonderful horse with an easy gait and good looks. However, occasionally the horse becomes dangerous and vicious, causing significant harm. The man asks his veterinarian what he should do about this problem. The vet replies, “That’s a very easy problem, and I’m glad to help you. The next time your horse is behaving well, sell it.””