Last updated: 27th March 2025, 7:31 pm

Many years ago, an unknown fund invested in Kaveri Seeds.

Disclosure: Invested as on 27th March 2025. Read full Disclosure at Bottom 🔻🔻

Special Thanks to Mr. Jatin Khemani of Stalwart Advisors 🙏🏽 for his guidance related to this article.

Between 2012-2015, the stock went up 10X and the fund manager - Samit Vartak of Sage-one advisors shot to the SMID (small & Mid-cap) Hall-of-fame.

Sadly, the party ended in December 2015 when the Government included Cotton under the Essential commodities Act.

This allowed the GOI to control the price of cotton Seeds !

So, what?

So, 70%+ of Sales for Kaveri Seeds came from Cotton seeds. It was among the Top 3 suppliers of cotton Seeds in the Country with a Market share of 18% in 2015.

At the time, many cotton seed players were selling at ~ Rs 1200-1600/packet (450 Grams).

Sorry, said the Government and set a Pan-India MRP of 800/packet of Bollgard-2 Seeds (Read: BollWorm Guard 2 or BG2).

It also fixed the Royalty paid to Monsanto - the technology owner of Bollgard-2 seeds and one of largest seed companies in the world.

But why did the Government feel the need to control prices & slash royalties?

🌱 Monsanto & The Bt Cotton Revolution in India

In 2002, a quiet revolution began in Indian agriculture — and Monsanto was at the center of it.

India approved the first genetically modified seed - Bt cotton, developed by Monsanto to fight the bollworm pest, which had long plagued Indian cotton farmers. Few could have predicted the scale and speed of what came next.

What Changed?

✅ Adoption was explosive

From less than 2% of cotton acreage in 2002, Bt cotton spread like wildfire, accounting for over 90% of all cotton acreage by 2013, or roughly 11 million hectares.

Farmers who once relied on multiple pesticide sprays each season now had a biotech solution baked into the seed.

✅ Yields climbed

The average yield jumped from 302 kg per hectare in 2001 to over 550 kg/ha by 2013.

✅ Production surged

India’s cotton output rose from 13.6 million bales in 2002 to a record 39.8 million bales by 2013-14.

This wasn’t just good — it was transformational. India became the world’s second-largest exporter of cotton, moving from deficit to surplus in a single decade.

But then, Sh*t went south. Literally !

From 2006 onward, several Indian states, led by Andhra Pradesh — and eventually the central government in 2016— imposed price controls on Bt cotton seed packets.

Why?

“Protecting Farmers’ Interests”.

The high “Trait fee” (Royalty) payable to Monsanto, ranging from 10-20% of Total price per 450 Gm packet of Rs 1200-1600/packet was considered too high and Andhra Pradesh was the first one to act.

Later, In 2016, at the insistence of Nuziveedu Seeds - One of India’s largest seed players and other stake-holders, the central government slashed the trait fee (royalty) payable to Monsanto.

This triggered a legal battle between one of India’s largest seed companies Nuziveedu Seeds & Mayhco (Monsanto & Maharastra Seeds JV), questioning Monsanto’s right to claim Patent over its Genetically modified (GM) seed technology.

In response, In July 2016, Monsanto withdrew its application for approval of Bollgard III (BG-3) cotton seeds in India.

There was politics, there were protests, there was drama. 🍻

Eventually, in 2019 the Supreme Court backed Monsanto’s patent claim and its right to receive royalties previously agreed upon. But the damage had been done.

Monsanto has since not filed or expressed an intention to file for BG-3 technology. It did, however, file an application for a BT-HT (Herbicide tolerant) cotton variant in 2022. No approval yet.

Meanwhile, what do you think happened to India’s cotton productivity? Let’s see.

1. Total Area under cultivation has stagnated since 2016.

2. Yield per Hectare is down ! (Surprising)

But you say, Thank GOD ! At least the poor cotton farmer can afford quality seeds…Well, Nope !!!

Cotton yields are declining, resistance to pests is declining, not to mention a black-market for hybrid seeds has popped up, where farmers are paying 1.7X the control prices, albeit with no legal recourse in case crappy seeds are sold.

There are other kinds of perverse incentives created by artificial price controls. For example, in 2023, Traders in Telangana created artificial shortage of this ⬇️ brand of artificial seeds, which in lieu of higher trust reposed in it by the farmers, were being sold for as high as Rs 1200 - 2000 per packet (Official rates are Rs 853/packet)

Interestingly, farmer unions are going as far as to provide “illegal” BT-HT (Herbicide Tolerant) cotton seeds to farmers !

In short, It’s a total sh*t show !

But. Wait.

Why is Uncle Ken buying Kaveri seeds?

🌱 The Fate of cotton Seed companies

Kaveri Seeds was a leader with an 18% Market share in Cotton Seeds in 2015 when the price controls kicked in.

After 2 ball-busting years, management decided to reduce cotton seeds contribution to Total Sales.

The pivot was long and slow.

From 55% to 25% (as on Dec-25), it took just 10 years ! ✌🏽

Not only has Kaveri weaned itself off the cotton Seed business but the contribution of non-cotton seeds (now 75%) are growing well.

Kaveri Seeds is once again hitting the 1000+ Cr Sales market after 10 long years supported by this non-cotton high growth segment.

While it has many crops in its portfolio, about 75% sales come from Rice, Maize, Jowar, Bajra and Sun-flower.

Both Rice (Hybrid & Selection) & Maize, which account for bulk of the Non-cotton segment are growing well and are expected to continue doing well.

Why should they continue to do well?

3 Broad factors contribute to Top-line growth for a Seeds company.

Increasing Acreage : Higher acreage or area under cultivation = demand for more seeds.

Higher Quality/yield seeds : Farmers only switch from existing seeds if they see a visible difference in performance - Higher yields, better protection, shorter turnaround, lower water/fertiliser requirement etc.

Stable / Increasing Crop prices : Stable or increasing prices incentivise farmers to sow those crops.

Other forces that drive any particular crop are Government incentives and farmer beliefs (GM Crops are bad / GM crops are good etc) drive the above to some extent.

Let’s see the underlying trends shaping up in the non-cotton crop portfolio of Kaveri Seeds.

🌽 Maize (Corn)

Kaveri has an 8-9% Market share in Maize Hybrid seeds. This is likely to increase on the back of good performance by its newer hybrids.

The share of Maize in Total sales is also inching up.

Maize as a crop is doing well because :

Good replacement for High Water guzzling crops - Rice & Sugarcane.

Increasing usage as Bio-fuel - Ethanol blending.

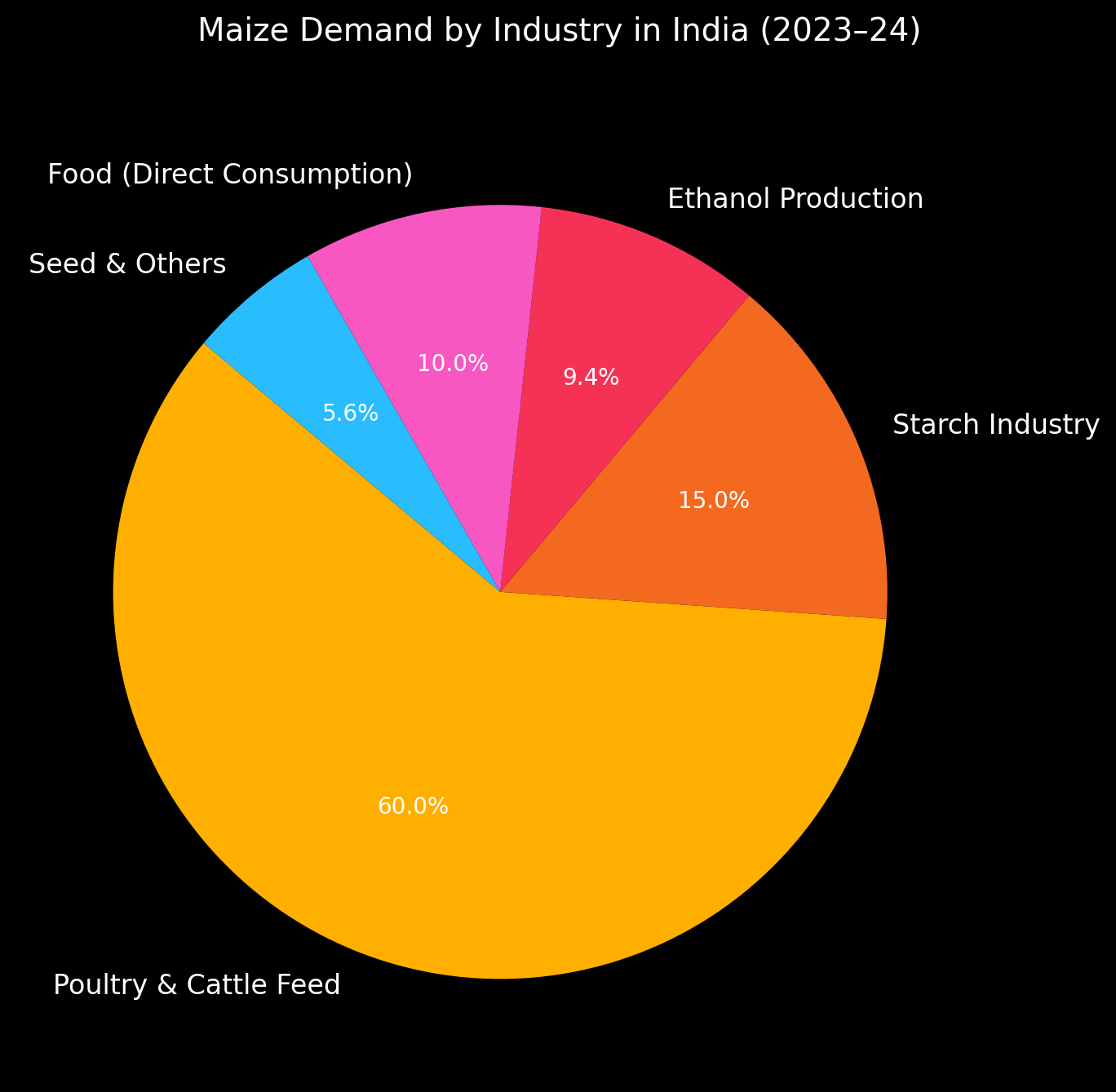

First, let’s see some basis stats for Maize.

Maize (corn) production is rising sharply.

Of the Total production of 37.6 Million Tons, about 60% or 22.4 Million Tons is harvested in Kharif Season, according to data from Ministry of Agriculture (sourced from IndianData Hub).

Other sources suggest that upto 80% of Maize is sown in Kharif.

The point is that :

A. Production is surging (why? - Discussed below)

B. India level data suggests bulk of cropping happens in June-July, which means major chunk of yearly sales show up in Q1 for Maize.

C. Actual Kaveri data shows while Q1 is lumpy, it accounts for ~50% of Maize sales, not as high as 60-80% suggested by India level data. This suggests that 50% of Sales for Kaveri comes from Rabi Crop.

Whatever. Not important but cool to know.

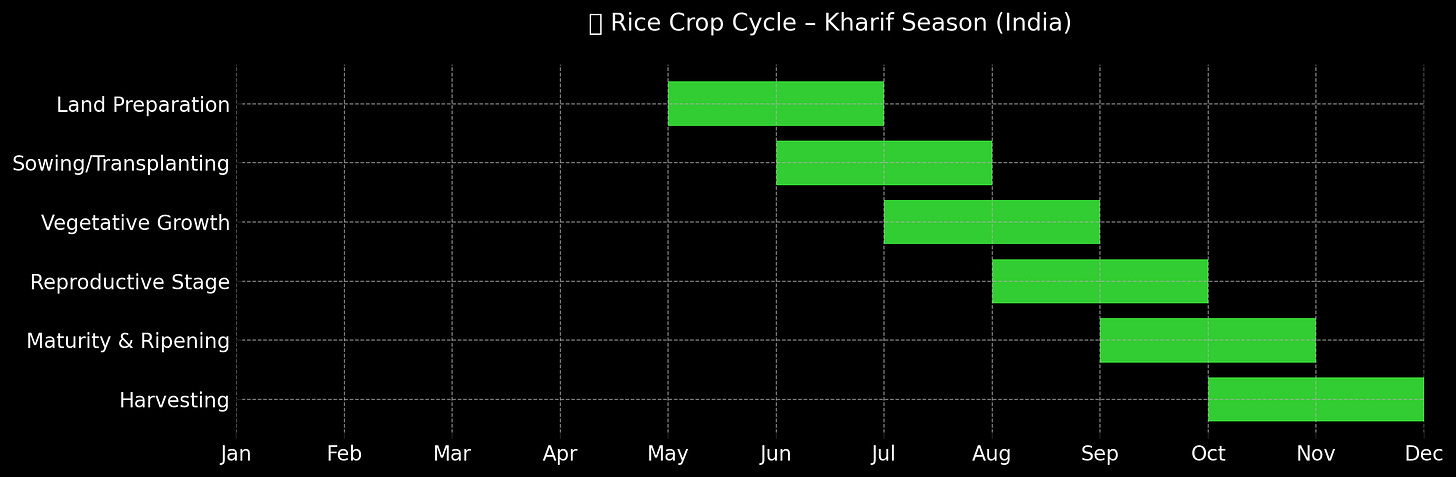

As for the lumpiness, here’s a visual explaining why Q1 is always going to be a big quarter for the company, not only because of Maize but because Rice is even lumpier.

If we look at other vectors relating to India Level Maize data i.e - Yields and prices, they have been rising sharply too.

Yields - 3,351 Kg / Hectare (2024)

Supported by higher Price/Quintal i.e - MSP - 2225/Quintal or 22.25/Kg)

Side note: Guess what’s happening to Poultry farms/related businesses, whose raw material (maize) is going up: Margin Compression (Example: Venky’s India)

Okay, Maize is doing well, has done well, but why should it CONTINUE to do well?

🌽 Government is Focusing on Maize - Why?

The government's growing emphasis on maize stems from its versatility, rising industrial demand (Ethanol blending), and its potential to replace water-guzzling crops like paddy.

In in January 2024, the Indian government implemented a significant policy shift to boost ethanol production from corn:

It Increased Procurement Price of corn-based ethanol by 29%, setting it at ₹71.86 per litre.

This adjustment aimed to diversify ethanol sources, reducing reliance on sugarcane.

Short Term Impact of the Policy Change:

Surge in Corn Demand: The higher ethanol prices incentivised distilleries to use more corn (3.5 MT in FY24), leading to increased domestic demand.

Shift in Trade Dynamics: India transitioned from being a net corn exporter to a net importer, with imports estimated at 1 million tons in 2024, primarily from Myanmar and Ukraine. (Source: Reuters)

Pressure on Other Industries: The poultry and starch sectors (Gujarat Ambuja Exports), major consumers of domestic corn, faced higher prices and supply constraints due to the increased diversion of corn to ethanol production. (Source: Reuters)

This strategic move aligns with India's aggressive goal of achieving a 20% ethanol blend in gasoline by 2025-26, which was originally targeted by 2030.

If Government statements are to be believed, we’re progressing very well (I haven’t verified the claim) :

🌽 Why Maize for Biofuels (and not Rice or Sugarcane)? Read Appendix 1.0

In addition to the macro trends supporting Maize, Kaveri’s commentary over the last few quarters have been very strong for the segment. For example:

The company is "very bullish on ... Maize and expect both volumes and realisations to go up in the years to come" - Q1FY25.

“The government has initiated ethanol projects, which will give a good way for maize” - Q1FY25

"We see very good growth in maize, like it is 10% to 12% growth in terms of the volumes for the next year. And the maize acreages are also going up. As a crop also, maize looks very good going forward". - Q3FY25

My problem is that Karnataka is one of the highest maize producing state and their recent policies (MFI, Regulating Theatre prices etc) are very idiotic.

Now, this is borderline conspiracy theory (Risk) on my part but whose to say if maize continues to do well, Karnataka government will not regulate seed prices? or some other foolish measure? and why just Karnataka, what if Madhya Pradesh or any other state does it? (Speculative)

Okay, I’ll stop. Let’s move on to Rice…

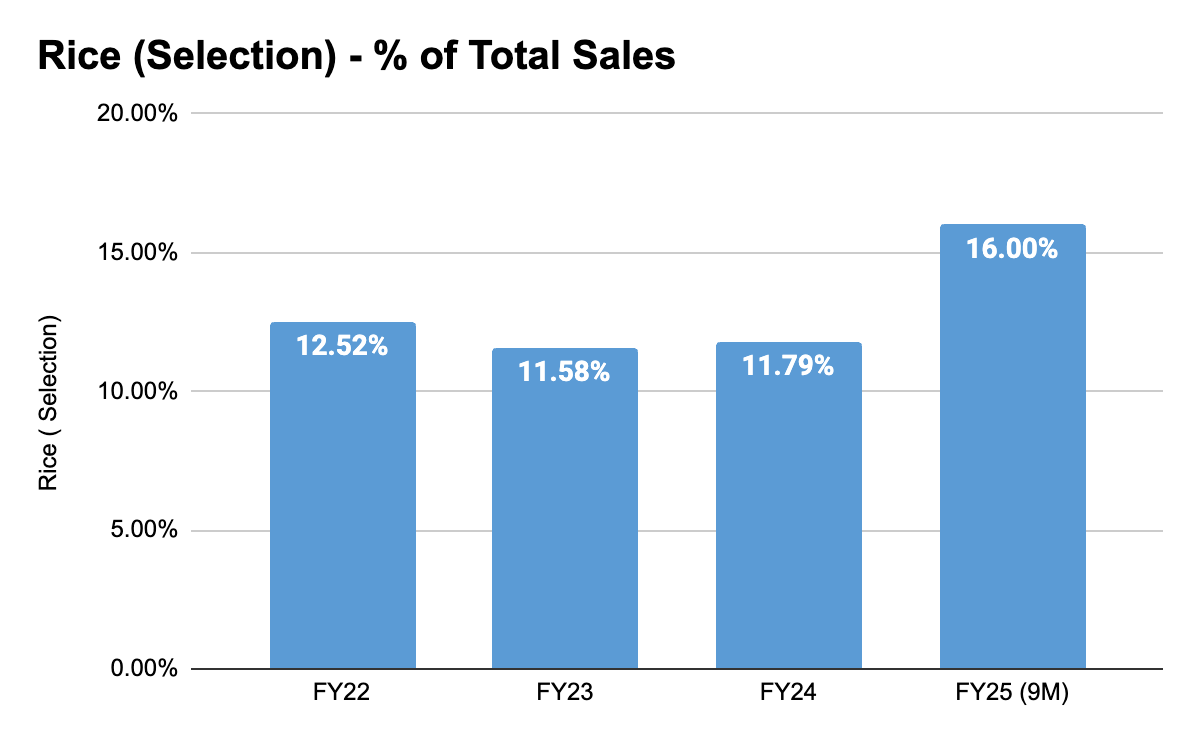

🍚 Rice (Hybrid, Selection)

There many different types of rice. Kaveri classifies its seeds as Selection & Hybrid.

Combined, they accounted for 40% of sales in 9M FY25 leading upto December Quarter.

Broadly, Selection rice is stable, farmer-friendly, and low-cost — perfect for low-input conditions. Hybrid rice is maximising but comes with a price — higher seed cost and management intensity.

Rice is again a predominantly Kharif crop with upto 80% being sown during kharif.

If you look at the Harvesting timeline and correlate this with arrival months at mandi in chart below, you will see that bulk of the rice arrives October, November & December.

For a seed company, since sowing happens starting May, June, July - bulk of sales for Kaveri seeds Rice segment is booked in Q1FY25.

For the Rice segment, sales are even more lumpier compared to Maize with nearly 90% sales getting booked in Q1FY25.

While the adoption of hybrid rice has been slower than initially anticipated, the seed replacement ratio (SRR) in rice has been increasing and currently stands at 60-70%.

An SRR (Seed Replacement Rate) of 60–70% for rice means that 60–70% of the total area under rice cultivation is being sown using certified, high-quality, or hybrid seeds, while the remaining 30–40% is still using farm-saved seeds (i.e., seeds saved by farmers from their previous harvests).

Kaveri believes that the introduction of pipeline hybrids in standard rice could potentially lead to a pick-up in adoption, fueling further growth.

And this is where my research runs dry. for now.

I think the next step in the research would be to understand and assess Kaveri’s Rice seeds, their performance vs competition and regional market share.

1. Financials - All Eyes on Q1FY26 !

A visual analysis of yearly financials does NOT highlight the prospects of the Non-Cotton segment growth.

It also doesn’t reflect the fact that cotton seed biz itself can make a comeback in FY26. I did not talk about the improving prospects of cotton itself (despite price controls the biz is profitable) and why it was down in FY25 because of supply issues and increased input prices.

The story looks good enough even without cotton such that an improvement in the cotton seed biz remains a nice “optionality”.

One of the best things about the company from a shareholder friendliness angle is that despite low growth in sales and earnings over the last 10 years. The company has been reducing shares outstanding by doing a buy-back EVERY SINGLE YEAR SINCE 2018. This has boosted EPS by 25-27% more than organic EPS growth.

It also tells you, promoters are less likely to cheat public shareholders.

This is the kind of sh*t Uncle Ken loves.

Unfortunately, buybacks no more have an edge over dividends after the recent taxation changes and we’ll see what the board decides going forward.

2. Quarterly growth explains Growth Trend better !

There is something so beautiful about this chart. Other than the fact that correlates movement of stock price with quarterly EPS (First principles of Investing :)), it also highlight the growth which is NOT visible looking at the yearly numbers level.

3. Tell-tale signs of impending Growth

Increasing Current WIP : The co’ is investing in capital assets. Processing units, Cob drying facilities, R&D - partly expensed through P&L and partly capitalised. (Need to dig deeper, understand more).

Employee Count Increasing : Sales, operations and Marketing employee count increased meaningfully in last 1-2 years.

Positive commentary from Management

I don’t assign a VERY HIGH value to management statements for various reasons but management sounds bullish on maize and rice, both.

The Company is “very bullish on both Maize and Rice and expect both volumes and realizations to go up in the years to come. Increase in volumes in both Maize and Rice have resulted in good growth rates in revenues” - Q1FY25

In Q2FY25, “hybrid rice volumes increased by 18% and revenues increased by 28%. Selection rice volumes increased by 20% and revenues increased by 34%, while maize volumes increased by 9% and revenues increased by 24%.

In the Q4FY24 investor presentation, it was noted that the company “witnessed an increasing trend of vegetables segment doing well on both volume and revenues front on account of increasing share of new variants launched during the year”. This points towards a positive growth trajectory for the vegetable seeds segment.

Valuations

P/E Ratio at 20-21X is about 30% above its long term median.

But, the last 10 years do NOT reflect its improving prospects and may not be a good benchmark.

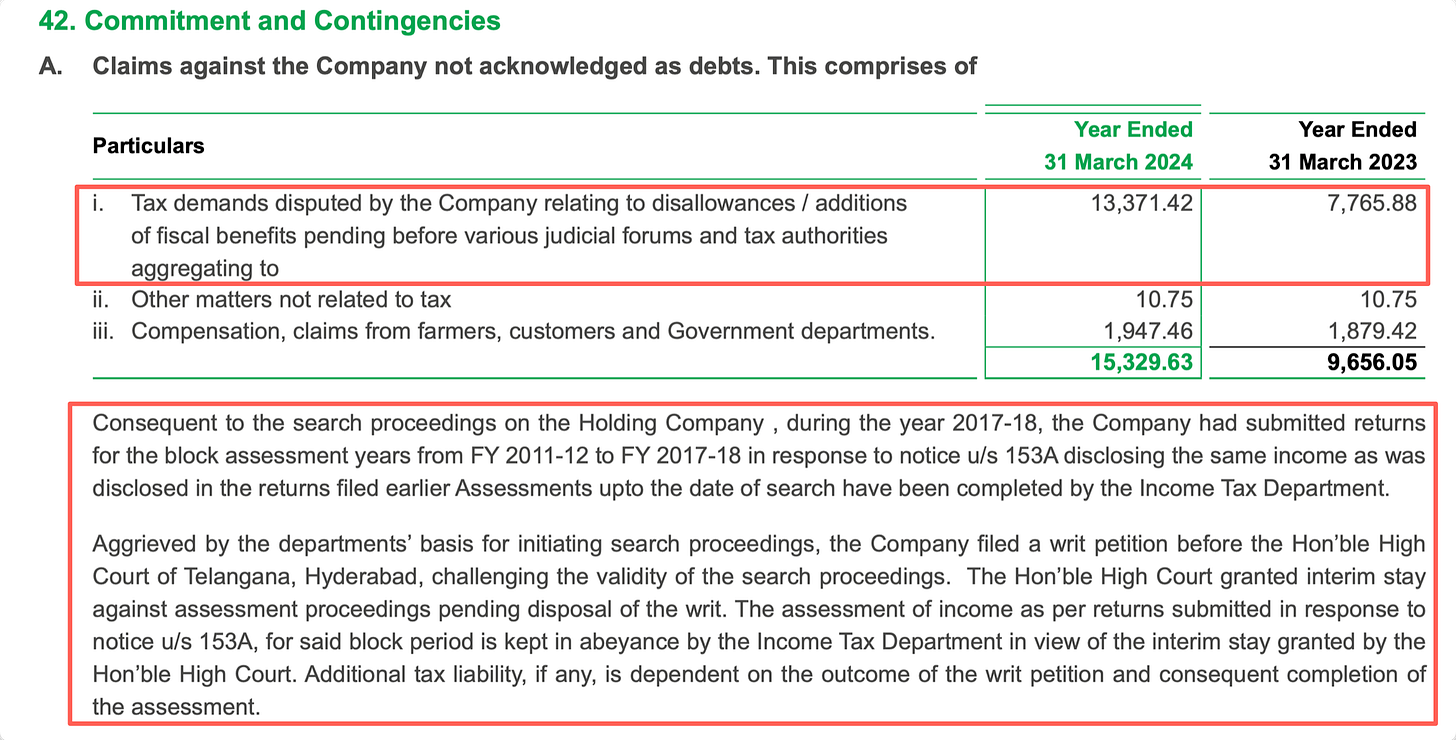

If PAT growth is 15%+, which management is guiding for in the “years to come”, perhaps a multiple of 20-25 may be justified. Perhaps, the current PE Itself is much higher if we account for the Contingent Tax related issues.

5. Risks

There seems to be a significant difference in how the company assesses its tax liability and what the income tax department thinks.

Low Tax Rates

Contingent Tax liabilities :

Fresh Tax notice (Just in today - 27th March 2025)

While I’m still trying to learn the softer aspects related to these tax issues (Thank you Mr. Jatin Khemani, Stalwart Advisors), they’re concerning.

If the company is indeed is liable to pay 133 Cr of Tax, it could wipe out a large chunk of FY24 PAT (300 Cr) and about 8.6% of Total Net-worth.

In conclusion, I believe that in any given year expectations might fall short because so much beyond the company’s control i.e - Weather. And since bulk of the sales are front-ended in Q1, a major weather challenge - Heat waves, poor monsoon etc can de-rail growth plans.

There is also the issue of Tax demands.

For the above reasons, the company’s results are likely to be choppy.

Hope this has been insightful

Thanks

Rahul Rao, CFA

Note: We have relied on data from www.Screener.in and www.tijorifinance.com throughout this article. Only in cases where the data was not available, have we used an alternate, but widely used and accepted source of information.

The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. If you wish to consider an investment, you are strongly advised to consult your advisor. This article is strictly for educational purposes only.

Rahul Rao has been Investing since 2014. He has helped conduct financial literacy programs for over 1,50,000 investors. He helped start a family office for a 50-year-old conglomerate and worked at an AIF, focusing on small and mid-cap opportunities. He evaluates stocks using an evidence-based, first-principles approach as opposed to comforting narratives.

Disclosure: The writer or his dependents Hold shares in the securities/stocks/bonds discussed in the article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Appendix - 1.0

🌽 Why Maize for Biofuels (and not Rice or Sugarcane)?

1. Water Efficiency 💧

Sugarcane and paddy are high water-consuming crops — sugarcane alone needs 1,500–2,200 mm of water per cycle.

In contrast, maize requires 500–800 mm, making it a more sustainable feedstock, especially in water-stressed regions.

2. Crop Flexibility 🌾

Maize is grown in both Kharif and Rabi seasons, unlike sugarcane (long duration of 12-18 months) or paddy (season-bound).

This gives it two harvest windows per year, ensuring steady ethanol feedstock supply.

3. Shorter Crop Cycle ⏱️

Maize matures in 90–120 days, whereas sugarcane takes 12–18 months — maize offers quicker conversion cycles for ethanol producers.

4. Land Use Efficiency 📏

Maize yields more ethanol per hectare per year due to multiple crop cycles and shorter growing time.

Also easier to integrate into crop rotation models without disrupting food security.

5. Lower Government Subsidy Burden 💸

Sugarcane-based ethanol comes with heavy political baggage — fair & remunerative price (FRP), subsidies, arrears to farmers.

Maize, being relatively unregulated, reduces fiscal strain and simplifies procurement.

6. Diversification Strategy 🌱

India's biofuel roadmap (E20 by 2025-26) calls for a basket of feedstocks — maize offers a buffer in case of sugarcane crop failure or surplus.

Appendix 1.1

🏭 Growing Industrial Demand

Over 60% of maize in India is consumed by the poultry and livestock feed industry.

Maize is also a key input for starch, ethanol, brewing, and food processing industries.

With the government pushing for ethanol blending, maize is now being explored as a viable feedstock alongside sugarcane.

🚜 Suitable for Diversification

In states like Punjab, Haryana, and western Uttar Pradesh, maize is being actively promoted as an alternative to paddy to combat groundwater depletion.

Maize requires less than half the water that rice does, and grows well in both kharif and rabi seasons.

The PM-PRANAM and Crop Diversification Programmes include maize as a key replacement crop.

There are are bunch of Govt regulations supporting Maize culativation — See Appendix section ⬇️ to get more details.

Appendix 1.2

Punjab is one of the worst impacted states.

It’s agriculture minister was literally begging the Center to approve BG-3 seeds in July 2024.

With no approval in sight, Punjab is trying to sort out its cotton game by trying to physically combat the whitefly pest.

“A weed eradication campaign has been launched to control whitefly infestations…the campaign targets weeds along roads, canals, and abandoned sites”.

I read your post twice now. Very well researched.

Just found your substack, I must say the work is pretty meaningfully constructed. Thank you for the hard work. Glad to see someone else also diving in credit rating reports and agreeing that they are an underrate source of info. Cheers.