On 17th August 2025, we did an online talk titled - ‘Contrarian Investing in choppy markets’ with Mr. Karan Rajpal (Thank you Karan sir 🙏🏽)

We discussed an entire framework for finding/analysing contrarian bets. However, a key feedback was that few sections could’ve been more specific (i.e - step by step).

So here goes…

A Super-dumb but effective, 4-step framework for finding contrarian stock ideas.

The goal is NOT to find beaten down stocks, the goal is to make money.

The contrarian style of investing naturally gravitates towards ignored, beaten down and make-you-want-to-puke-kind of sectors because that’s where the bargains are. And frankly…

I’m NOT necessarily looking to find something worth buying TODAY. I’m looking for an investment that can start start performing (at least business wise) 3 to 12 months down the line so when it does I’m ready to pounce.

THE “FRAMEWORK”

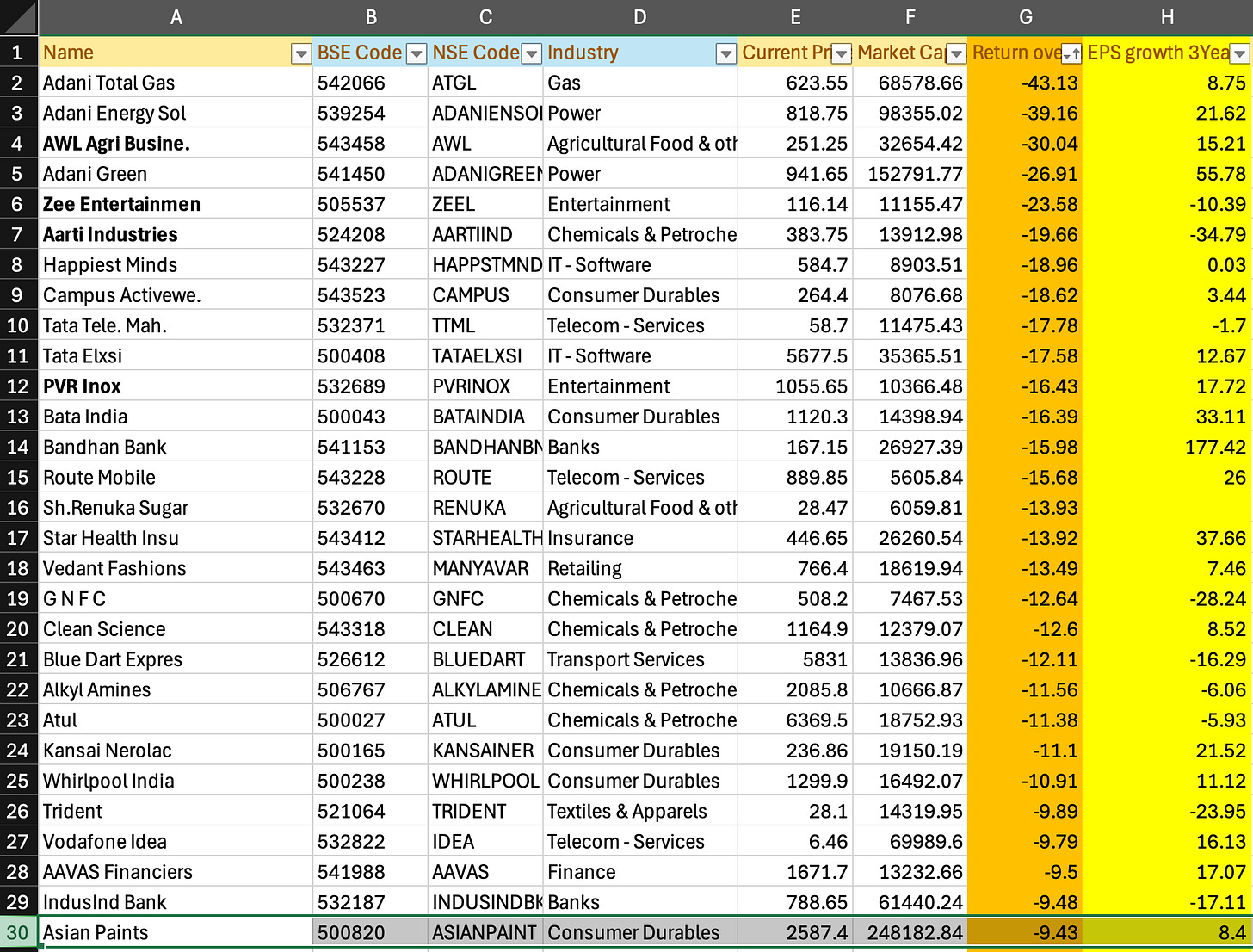

Step 1: Type NIFTY 500 in the www.screener.in

Step 2: Sort by 3 year price returns. Worst on top.

Why? : The worst performing stocks in 3 years basically turn off most sane people, leaving potentially juicy opportunities for weirdos like us.

When I did this exercise very recently (19th August 2025) there were 48 companies that had a No 3-year returns history meaning either they were de-merged or recently listed without a 3-year price history.

I left them out for this exercise. If you like you may go ahead and scan these too.

Here’s a list of Worst 30 (Excluding 48 companies with no 3 year price history) of the NIFTY 500 companies.

Step 3: I run a FPI scan™️ (<10 mins per company) on each one of these companies.

Why? I basically want to get hit by a bat on my face while going through the FPI scan™️. Something should grab ME.

I lay emphasis on the words ME because a different set of companies might grab YOU.

At this point the sole objective is to create a shorter list of stocks where I would like to spend 2-4 hours on.

For this exercise I conducted the FPI scan™️ on 15 of the worst companies filtered by 3 year price returns.

The companies that grabbed ME are boldened in the list above. These were :

AWL Agri business (Adani sold ‘Fortune’ brand to a singapore based company)

Zee Entertainment (Shareholders rejected preferential to promoters)

Aarti Industries (Strong balance sheet in a downturn)

PVR Inox (A turnaround candidate?)

For whatever reason (except that its balance sheet looked the strongest), I went ahead and dug deeper into on Aarti Industries (Disclaimer: No Holding) and guess what, I wrote an article in The Indian Express.

In the article I outline the challenges the company is undergoing on an industry level (china saala) and company specific level (huge capex, low utilisations etc) and “triggers” that can unlock value.

Step 4: Add or don’t add to your watchlist.

A few questions arise :

Q1. What is the FPI scan™️ you mentioned Rahul? How can I use it to quickly size up ideas?

Q2. How do I develop my style so I can judge what GRABS ME?

Well, that’s personal. As far as how to analyse stocks & spotting alpha generating “patterns” are concerned, we’re working on that and will keep you updated.

In a more immediate effort to help elevate your understanding with regards to specific sectors, we’ve been conducting some online sessions recently - Housing finance, power sector (T&D) & Contrarian Investing Workshop.

Similarly, we have an upcoming session on the DEFENCE sector.

Join us? Find out what the hype is about and get a balanced view on the topic by signing up for the session.

Signup link: https://rzp.io/rzp/AlphawealthDefence

Hope the step-by-step is useful. Let me know if you have questions.

Rahul Rao, CFA

DISCLAIMER:

Wrote something along these lines with a more first principles approach around 2 years back:

https://open.substack.com/pub/holisticinvestor/p/contrarian-thinking?utm_source=share&utm_medium=android&r=6xamn