My hands began to tremble, my heart beat rapidly, my knees weakened… I knew that diamonds had finally been made by man."

- Dr. Tracy Hall, Journal Entry, 1954.

Dr Hall was working at GE when he wrote this.

The company patented the invention and made $$ billions off it over time.

Want to guess how much Dr Tracy hall made from this invention? Take a guess.

(correct answer at the bottom)

Point being that Synthetic diamond aren’t a new phenomenon, but something happened in 2016-2018 when LGDs took off.

What the h*ll happened?

Where does the Indian LGD market stand today?

Which part of the value chain stands to gain the most?

All that in today’s article. But First…

Disclosure: 90% of the research for this article is based on the work from Akshay Jogani & Sagar Arya at Xponent Tribe, a Mumbai based PMS. Thanks Akshay for your contribution to First principles Investing.

The Rise of LGDs

You got the memo. LGDs are killing it.

Since 2016, Total world sales from LGDs have grown at 60% CAGR.

India LGD sales have grown at a 40% CAGR.

Dr Tracy hall produced the first man-made How back in 1954 so What the F happened in 2016. Why did LGD just take off then?

How Patent Expiry Fueled the Lab-Grown Diamond Boom💎

LGDs are “grown” using two techniques :

HPTP : High Pressure, High Temperature - Mimics how real diamonds are created. A “seed” diamond is subjected to high temperatures and high pressure to form a larger diamond.

CVD : Chemical Vapor Deposition is an entirely different process vs HPTP. This method grows diamonds by placing a carbon-rich gas (like methane) in a vacuum chamber, where high energy breaks the gas into carbon atoms. These atoms then settle onto a diamond seed, crystallising layer by layer into a real diamond.

CVD method dominates the Gem-quality LGD market with a 65-75% Market share.

HPHT and CVD evolved on completely different tracks. HPHT was a brute-force miracle by Tracy Hall in 1954 while working at GE.

CVD was a slow-burn innovation from materials science that later adapted to diamonds — and unlike Hall, most CVD innovators fought patent wars, not just for lab space.

For years, CVD (Chemical Vapor Deposition) technology — the backbone of lab-grown diamonds (LGDs) — was protected by patents held by early pioneers like Element Six (De Beers), Apollo Diamond, and IIa Technologies. These patents limited global manufacturing and kept LGDs expensive and niche.

But starting around 2017, and accelerating by 2020, most of these key patents either expired or were invalidated (notably in a high-profile U.S. case involving IIA Technologies vs De Beers owned Element six ).

Once the intellectual property barriers came down:

✅ Thousands of players, especially in India and China, jumped into LGD manufacturing.

✅ Machine costs dropped, tech became commoditised, and capacity exploded.

✅ Prices of LGDs fell ~75–85%, making them accessible to a broader global market.

This triggered an 8x growth in the LGD jewellery market — from ~$2 billion in 2018 to $17 billion in 2024.

Today, LGDs are no longer a tech innovation story — they’re a scale, supply chain, and branding game. This becomes even more evident as we study the Diamond value chain.

Value chain

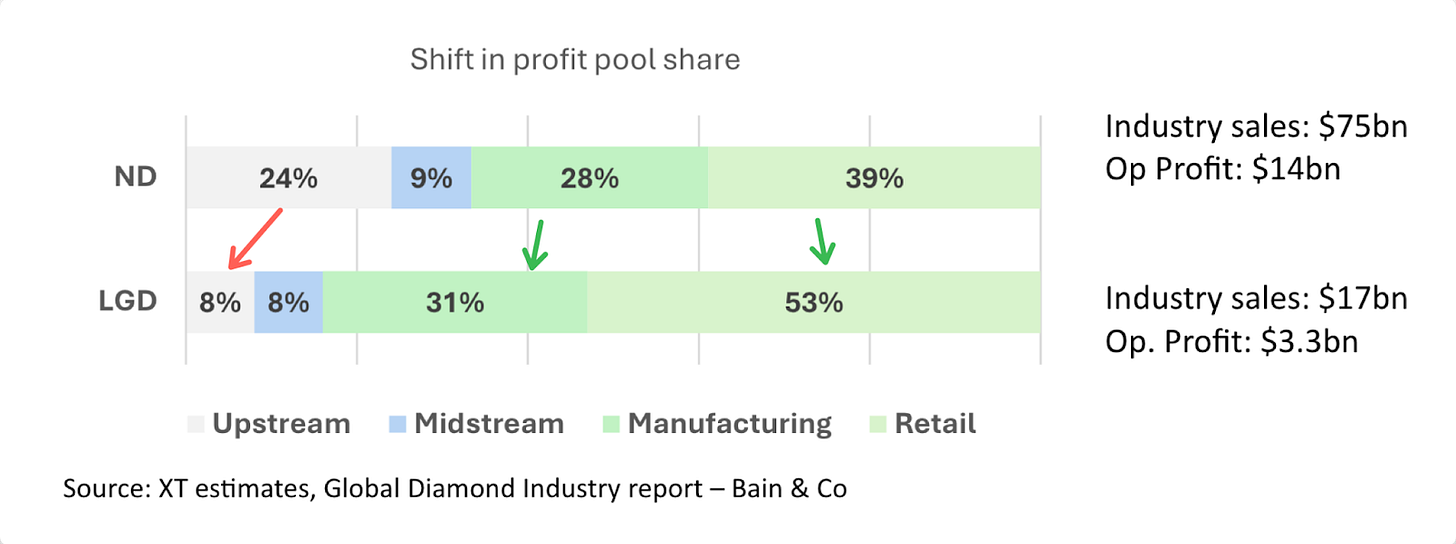

The major change has happened in “upstream” segment. Whereas ND’s are “mined”, LGDs are “grown” in labs. The democratization of LGD growing technology and expansion on the supply side has led to a sharp deterioration in pricing for upstream players.

Whereas De-beers & Alrosa controlled two-thirds of the supply chain of the Natural diamonds for decades - a key to maintaining pricing discipline (& profitability), LGD growing is a much more crowded playground.

This has led to lower pricing power and a shift in profit pools from upstream - Mining/Growing towards downstream - Jewellery manufacturing and retailing.

Based on an understanding of unit economics, pricing seems to have bottomed out.

Unit economics

Based on the following assumptions and estimates by Akshay & Sagar at Xponent Tribe, the pre-tax ROCE for an UPSTREAM setup with a minimum 25 reactors is < 7%.

Hardly juicy enough to encourage capacity additions.

Further down the value chain, if we estimate unit economics of the Mid-stream Diamond cutting and polishing setup, the numbers are not inspiring here either.

“Assuming a selling price of $115 (~Rs. 9,900)/ carat in the wholesale market implies gross margins of ~12%. Assuming some cost of selling, midstream activity is a single-digit margin business with a 4-5 month WC cycle. Overall, the return on capital on converting a rough diamond to a polished one is sub-15% as well.

In the midstream segment, ~40% of the total cost is labour, ~40% is COGS, and the rest is certification and operating expenses. Labour is inflationary, and we have established that the cost of rough diamonds is close to its trough. Hence, a large part of the costs are now sticky and unlikely to decline further.”

With the estimated cost of production for 1 carat of CVD produced LGDs have shrunk significantly from Rs 56,250 to Rs 8,750 the room for further decline seems limited.

Goldiam is one of the largest LGD growers in India. Through its ORIGEM brand, it plans to rapidly expand its LGD Jewellery retailing business and it too believes prices are at a bottom.

In August 2024, Kiran gems - India’s Largest Natural & LGD diamond manufacturer announced a 10 days production halt in an effort to contain production, kind of like OPEC halts production to support prices. Not that Kiran gems has the kind of cred OPEC does but that was the intention.

It’s no secret that the diamond market has been under stress - both ND & LGDs have performed poorly in fact.

That’s why, we believe that based on estimates of unit economics and commentary from listed players, barring technological break-throughs, prices may have bottomed out and as the LGD industry also consolidated - a recovery might be around the corner.

Goldiam, Senco Gold & International Gemmological Institute (IGI) are some of the key players to watch for in the Indian LGD segment.

Want to help our readers learn more about the segment? Drop your comment in the section below.

Click to visit Xponent Tribe website

FYI - Dr Tracy Hall was rewarded with a $10 US Savings bond.

Regards

Rahul Rao, CFA

Found this article a deep dive into the diamond sector.

Thanks for the research article on Diamond. It sparkles. Can you please help me with the contact of the Xponent Tribe.