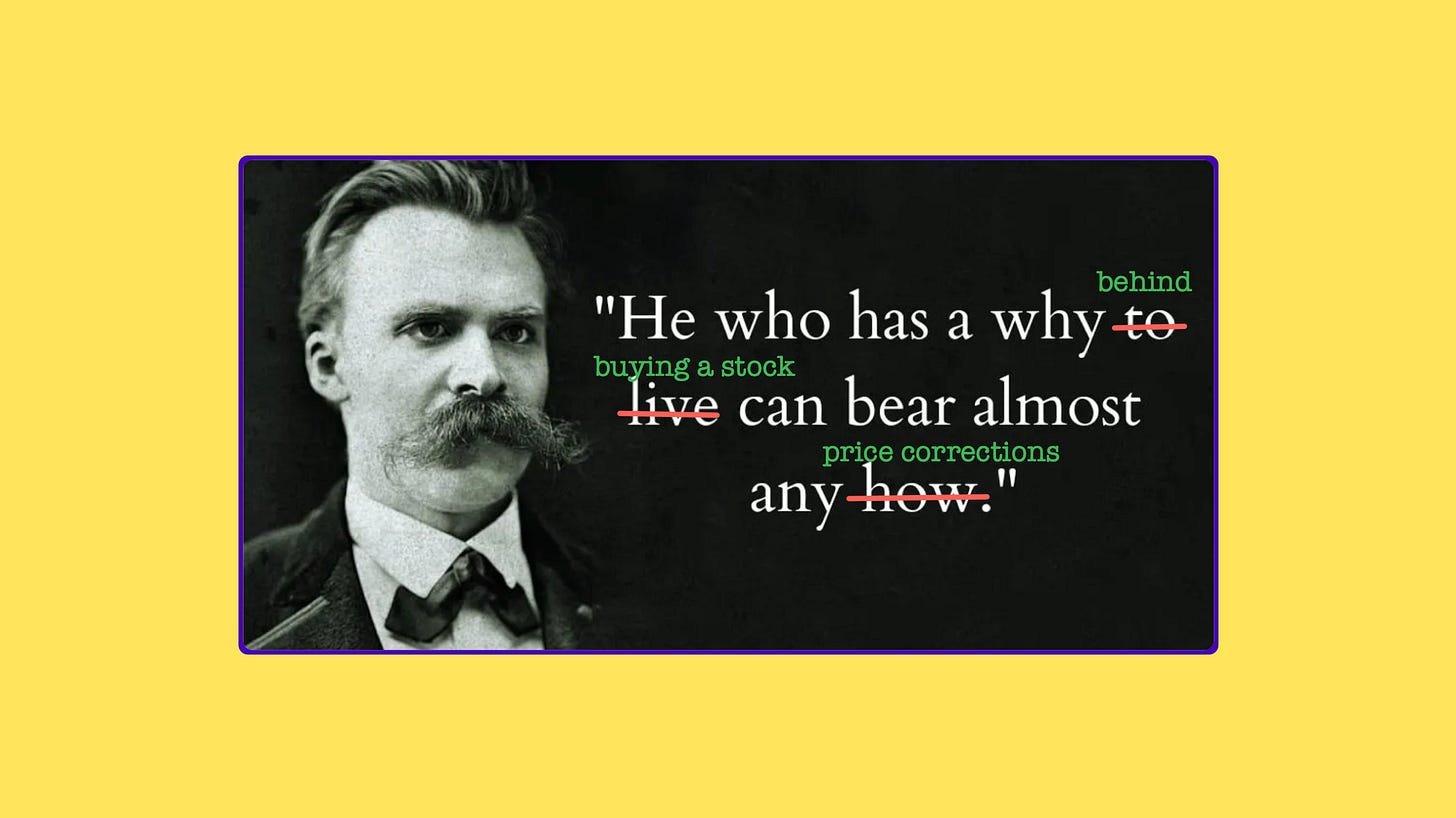

‘Investment Thesis’ is a fancy term for saying: Write down why you’re buying a stock!

It is especially valuable when your stock(s) ‘correct’ by 30-40% in a short period and you have an anxiety attack!

Been there, done that? 🍺

Falling stock prices make most investors nervous. The ones who are less likely to be impacted and instead stay cool, have either :

Forgotten they have a stock portfolio

Have a Clearly written note that states why they bought the stock (Investment Thesis)

That’s why I think an Investment Thesis then is like an Anti-anxiety pill without side effects! and before we get into What a Great Investment Thesis looks like, I’d like to check if you have your prescription :

Do I hear you saying: I don’t write but I know mentally…

🚫 🤡 🫵🏼

(Stop Fooling yourself)

Now let me share a simple and clear-cut Investment Thesis written by someone I’m lucky to call our reader, just like I’m lucky to have you as our subscriber too…

Over to Mr. Pradeep 🙏🏽 !….

I (Pradeep) had written my entire thesis for South Indian Bank to a friend of mine once. This was on exactly 30th Dec 2022. Let me copy-paste the same for you:

"Coming to SIB, one thing to note is that this is a below-average bank that is showing some signs of becoming average.

Generally, below-average businesses trade at such dirt-cheap valuations that even small signs that show some hope of a small level-up can lead to big moves in stocks (re-rating play).

Currently banking as a sector is undergoing massive tailwinds as most of these banks have been able to clean up their NPA mess (forcefully) during the height of Covid lockdowns. The sector is a cyclical one, and all the signs are showing that the cycle has bottomed and the upswing has begun (due to strong credit growth due to consumption demand, upswing in corporate capex as global opportunities have opened up with the world looking to de-risk its supply chains from a China & Europe concentration and India becoming a partner, + decade low NPAs in banks).

Reason why this is important to note is because, once a cyclical sector turns then most businesses in the cycle start moving up. SIB is one of them now. To top it off, SIB has a brilliant CEO at the head, Murali Ramakrishnan, who is an ex ICICI guy, and he is building a new book of pristine quality at the bank. He is undoing all the mess of the old book and is completely turning around the books here.

Generally, an average bank should trade at a Price/Book of around 1. I think SIB deserves this PB as it keeps proving itself to investors. Currently SIB trades at a PB of 0.65. There is likely to be a big jump in earnings here as well, which means the twin engines of Earnings Growth + PE re-rating can kick in here and open the stock up to massive upsides!

All said and done, don't expect SIB to be a buy-and-forget long-term wealth creation sort of business. It's a cyclical play that has everything going for it, and one needs to ride this cycle and know when the time to exit presents itself. I will exit when I feel the profits have maxed out and it trades at my fair value or higher of PB of 1 and above!

Timelines are almost impossible to predict. What I can say in gist is that it's good till the cycle remains in an uptrend + P/B hits around the mark of 1 after earnings have been maxed out.

At the risk of being wrong in my targets, hence I usually avoid giving targets, in my mind I do feel a conservative minimum of Rs. 30 is possible on the stock. But I will exit even if targets aren't met the moment I feel the business isn't moving as I had hoped. So always a risk for someone to follow my moves.

My Average buying price is Rs. 17/share”

Here’s why I (Rahul) like this note/thesis so much:

💛 why Sector is Turning

💛 Has a Clear viewpoint on What the Co’ fair valuation should be (P/B ~ 1) given its improving Circumstances

💛 Why Earnings are expected to improve (Management, Sector Turning, lower NPA, higher PAT)

💛 A Huge Margin of Safety in terms of starting valuation (P/B ~ 0.65)

💛 Why / When he might exit the Investment

Given the above note was Written around December 2022, the situation is vastly different in terms of Risk Reward offered by South Indian Bank and Mr. Pradeep is looking to adjust his thesis accordingly going forward.

Hope this provides a framework for you to begin writing your Investment notes.

Look forward to hearing your comments below :)

Rahul

Disclaimer

Nothing you read here should be construed as investment advice. I do not know your circumstance so please treat the above as nothing more than my personal opinion, which is subject to change without prior notice to you. Please do your work and consult your financial advisor. I own positions in South Indian Bank and may exit without notice.

Such a pleasure reading a post dedicated to my SIB thesis Rahul! Your kind words are much appreciated! 🙏😄