Are you familiar with the Ship of Theseus?

It’s a thought experiment/paradox on the concept of Identity…

The Paradox is this:

If all the original components of a Ship are replaced gradually over time, one after the other, Would the ship remain the same ship? If not, at what point does it stop being the original Ship?

For a moment, Let’s apply this thought experiment to Indiabulls Housing…All this talk of transformation but has the Indiabulls Housing ship really transformed?

It’s true that…

Promoter has exited

The Board has been revamped

The Loan book appears clean(er)

The Real Estate cycle is back…

even the name of the co’ is being changed to - wait for it……Samaan Capital !!

A name that ironically outlines exactly what it lacks - Samaan and capital.

So is the ‘new’ business the same old or has it truly transformed?

I don’t know!

What I know is that NOT many lending Institutions suffered from High NPAs during one down cycle and maintained Top Quartile NPAs over the next.

#1 - Based on the above observation i.e - History, A long-term turnaround in the Quality of its Lending franchise is unlikely (call me pessimistic).

#2 - Despite the belief that a poor quality Lender can rarely (if at all) change its ‘lending DNA’, the ‘stock’ can still offer an Investment opportunity,

This brings us to the Indiabulls Housing Ltd - Investment Thesis, as we know it.

The current thesis on IBHL rests in P/B re-rating to a bare minimum of 1X Book Value from the current 0.5-0.6X.

Of the 6 Big Arguments leading to the Thesis, 3 are signals. Since I am sceptical of ‘Signals’ I have classified them as such to be put under the lens, later in this report.

🏁 Let’s break down each of these points :

Is co-lending a Signal of Trust? How does co-lending Work?

First, what is co-lending and how does it work?

The Reserve Bank of India (RBI) introduced the co-lending model in November 2020 to improve credit flow to underserved sectors and enhance financial inclusion.

Basically, Banks and NBFCs collaborate to provide loans, sharing Risks and responsibilities and this relationship is predicated on two fundamental truths :

NBFCs have reach where Banks don’t!

Banks have low-cost money which NBFCs don’t!

For Banks, Co-lending is a lead generation exercise to an extent, which also allows them to simultaneously fulfil their Priority Sector Lending obligations. NBFCs Originate loans using their customer networks, contributing around 20% of the loan amount while Banks Provide 80% of the funding, leveraging their low-cost capital.

Sharing is caring until it comes to Credit & Risk Appraisal! That’s where the challenge is!!

Banks & their partner NBFCs have to agree on how to profile the risk, what would be the expected NPA etc because all of that goes into ‘pricing the loan’.

It’s unlikely the higher quality players would jump into a relationship that forces them to jointly evaluate risk with IBHL…it got no SAMAAN to speak of! Besides the fact that the bigger names would not have much use for Samaan’s “reach” or “network”, it also wouldn’t make a good match.

You’ll see what I mean in a minute.

Before that, there’s another little issue of misrepresentation or error.

By April 2024, Co-lending AUM* was close to ~ 1 Lac Crore.

*(based on CRISIL data : 100 NBFCs representing 90% Sector AUM)

According to CRISIL, this 20% is set to grow at a faster pace, so yes there seems to be an opportunity in co-lending BUTT…

If Co-lending AUM until April 2024 was ~1 Lac Cr and 20% is Home Loans and Samaan Capital has disbursed ~20,600 Cr then is Samaan the ONLY Home loan provider which is doing co-lending?

This cannot be the case since at least about 1/3rd of ~100 NBFCs in CRISIL’s data have “Active Co-lending books”

There seems to be a disconnect here!

Either Samaan is showing inflated figures (most likely error), including both its disbursal (20%) and the partner banks’ (80%) as the Total in its presentation slides? or there is some other discrepancy. It could be an error on my part but I have yet to plug this to figure out this discrepancy. Let me know in the comments if you know something about it.

Now, let’s look at the Banking Partners Samaan Capital has partnered with because the presupposition is that these “names” are lending Samaan its renewed credibility! At least according to investors right?

Have a look at this list of these “distinguished” banking institutions.

Do either of the partner banks inspire “Samaan” or “Trust”? If the above list had a face, they’d look like this :

Do bear in mind this is a matter of “Interpretation” rather than fact so my biases are playing a role here but as far as ‘Signal Strength’ goes: Weak!!

Co-lending certainly might help with growth but to say co-lending increases the “level of trust” Samaan now enjoys amongst the banking industry would be a little far-fetched.

Marquee Investors own the majority of the business! Surely, they must have done their due diligence!

While the increase in Marquee shareholding in June 2023 was possibly a strong signal back then, lately this group has been reducing its shareholding. Especially post the rights issue.

Matthew Cyriac, the former Co-head of Blackstone India has reduced his shareholding from 3.9% to < 1% (or fully exited)

so has the shareholding of FII’s and DII’s.

Quality of Signal: While the quality can be important. As of today, it is reversing.

The Real Estate Cycle is back!

I have nothing to say on this point, except that yes Real Estate cycle has indeed reversed and that’s likely to add tailwinds in terms of the growth of the Home Loan book.

To better understand the Housing Loan market, please read this post (later) :

The old promoter has exited the company!

Fact. Sameer Gehlaut has exited the company. However, the interpretation of this move is interesting.

And this is again a matter of my opinion (not fact) but….Was everything that went wrong with the co’ Developer loan book (Wholesale book) solely and exclusively the promoter’s doing?

While it’s true that a leader can make all the difference in any type of business, especially a lending institution, Is it also true that the business heads who undoubtedly aided this ‘tainted promoter’ have suddenly transformed into an ethical and competent bunch of executives??

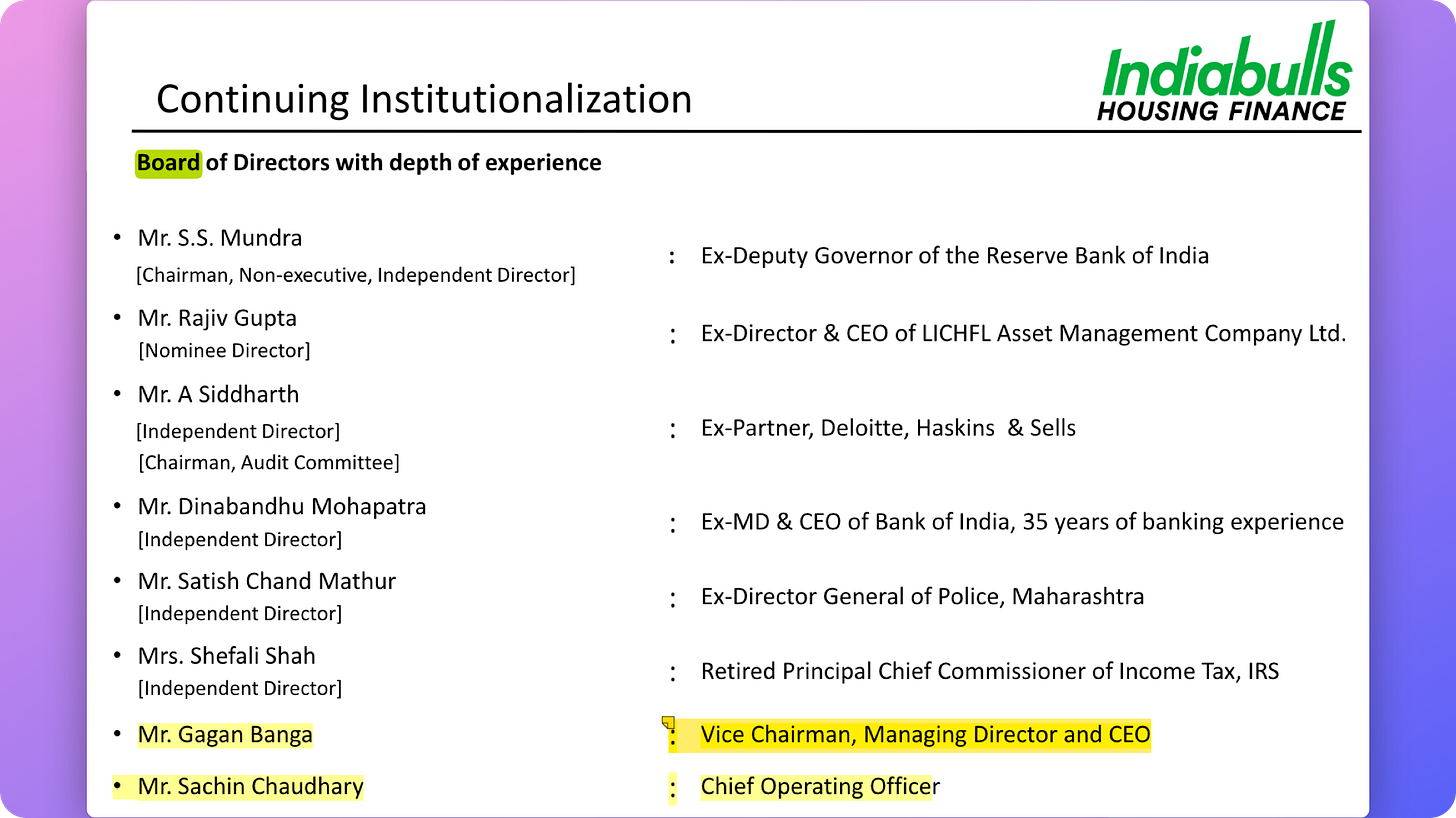

Gagan Banga - CEO & MD & Sachin Chaudhary - COO, for example have remained with the company for years, despite the departure of Sameer Gehlaut (Ex-promoter).

Surprising that they have being allowed to remain with the company.

The Board, however, has been “Institutionalised” for whatever that is worth.

All the negatives have been factored in! Look at the P/B Ratio!

So far we’ve talked mostly about the ‘softer aspects’ of the Thesis i.e. - Signals etc. Now, onto some financial metrics.

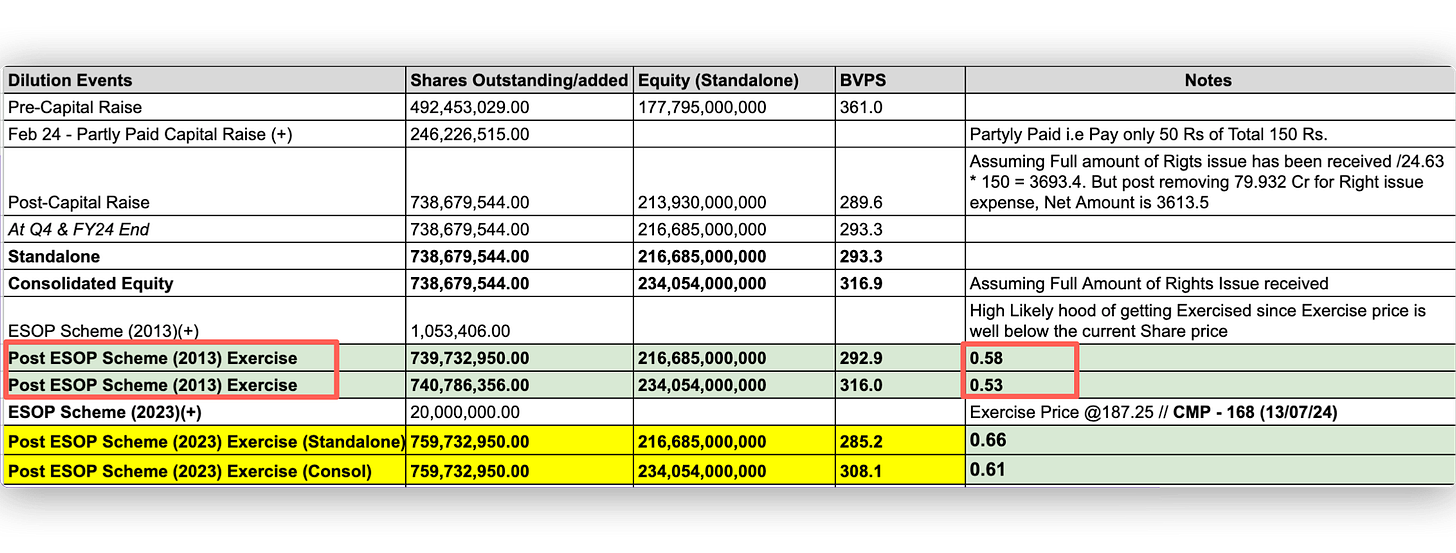

The current Thesis acknowledges the above shortcomings, however, at a Current Reported Price/Book of ~ 0.69 (STL) vs ~ 0.63 (CONSOL) [16th July 2024]…”All negatives seem to be priced in”

Let’s do one better. If we factor in that the full amount of Rights Issue (22nd July is the record date) has been received along with the ESOP (2013) Conversion

= P/Bx ~ 0.58 (STL) vs 0.53x (CONSOL) 🔫

This tells us that the optical P/Bx is higher than the P/Bx after accounting for the Rights Issue & ESOP(2013) dilution, assuming that the Book Value itself is indeed reported accurately AND IS NOT some kind of the “imputed book value” 😋

Sadly, this assumption is fairly questionable (According to me)

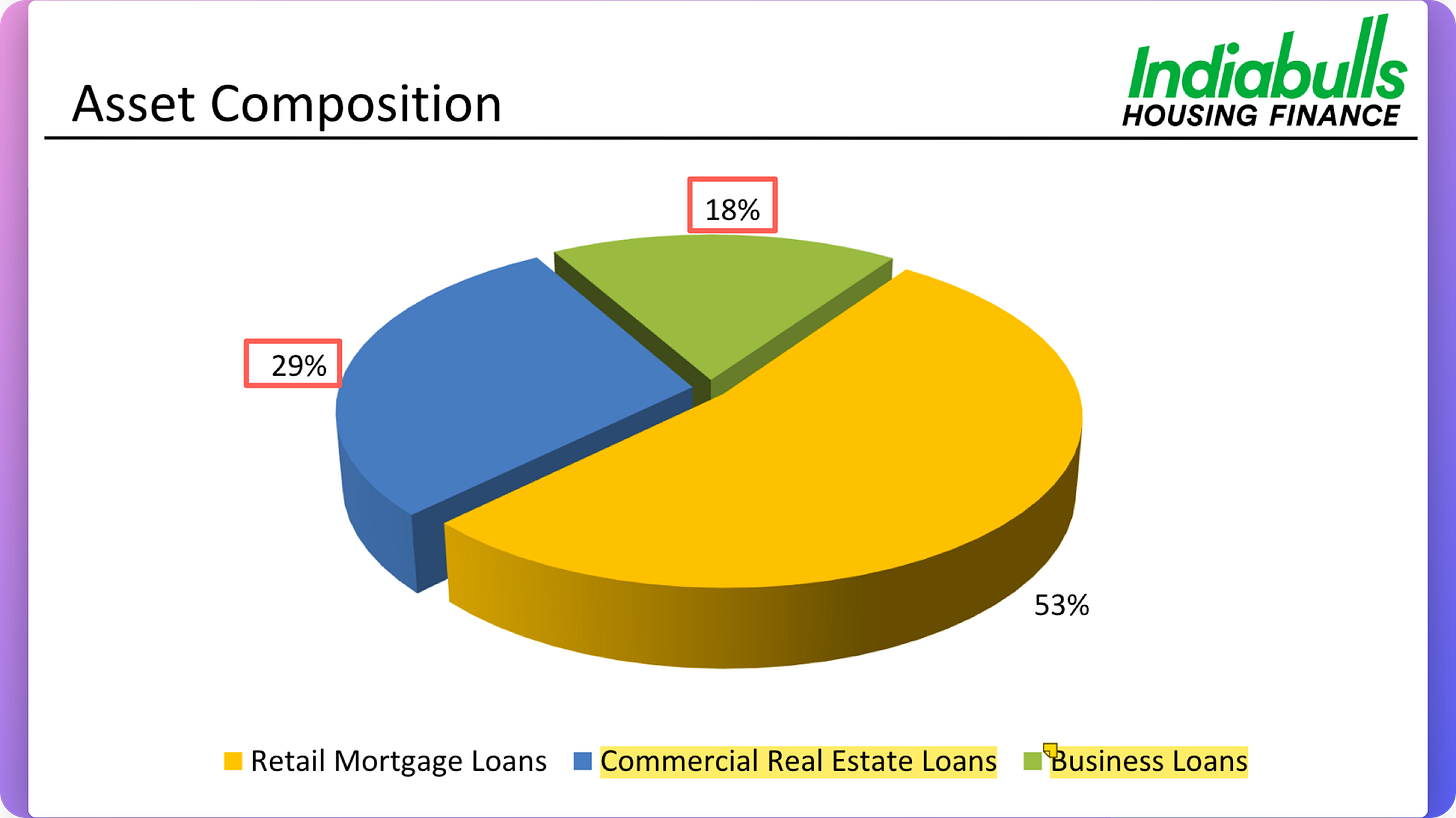

For one, the Investor Presentation reports inadequate data on ~47% of the Non-Home Loan book.

The co’ does not provide segment-wise NPA and DPD data.

It has tried to “direct” investor attention towards Home loans and the fine quality of Home Loans they have ‘securitised’ and sold down! (bundled and sold as assets to Banks/Large Investors).

🟢 The quality of these loans along with the reputation of Investors such as Oaktree and HDFC Bank who are buying these loans, gives confidence in the Retail home loan segment of the business (Finally, a Green Flag).

However, the fact remains that ~47% of their loan book is Commercial Real Estate and Business loans and we don’t know how vulnerable these segments are. It does offer clues.

According to a news article, It has a legacy Loan book of 25,000 Cr (March 2024), which the management is hopeful of “running down” to under 5,000 Cr by FY27

My somewhat educated estimate is that the NPAs are significantly higher than for the Home loan segment.

And this is where the “imputed provisions” data point comes in. Those in favour of investing in the co’ say that imputed provisions more than cover up for all the bad news along with any “surprises” in the CRE & Business loan segment.

But are Imputed Provisions of “3.5X of Gross NPAs” really what the co’ wants us to believe?

There are 3 sub-parts to this cushy looking “Imputed provisions of 3.5X of Gross NPAs” figure :

btw, if you don’t know what “imputed” means you’re not alone. It means “Assumed or estimated”. So, these are “assumed provisions”? Or do they mean the recovery on these provisions is “estimated or assumed”? Strange choice of words.

So..

Existing Provisions: GNPA is 2.69% and Existing provision is 2.5%….but if 2.5% of the 2.69% of GNPA is provided for, how is the Net NPA 1.52%?

Or is it that these “Existing provisions” are separate from the ones used to calculate the NPA numbers?

Secondly, Expected Recoveries of 4000 Cr from 10,000 Cr pool of written of Assets. Recovery rates according to management have been ~60% of Written-off assets. So, on this point have nothing to complain about 🫱🏼🫲🏻

As part of Yes Bank Bail-out, its AT1 Bonds worth ~8300 Cr (IBHL owns 830 Cr worth of these bonds) were written down. Bombay High Court had quashed this move by by RBI & Yes Bank Administrator, terming it “illegal” and the Supreme Court has stayed HC’s order. The matter is in the Supreme Court and while I am not a legal expert, the recovery of this amount is at best “imputed”. I would not Count on this !

Although, the recovery rate of 40% on a pool of 10,000 Cr seems reasonable given the secured nature of these loans, the nature, extent and timing of recovery of the other two items in these “imputed provisions” seem more open-ended.

Finally, my opinion on the IBHL Investment case is this :

IBHL may have changed its name but as long as management remains the same, a structural “transformation” seems unlikely.

At a Price/Book of ~0.55-0.6x, most of the crap IBHL stands for/is associated with has been priced in - Albeit, the current Book Value can be trusted.

The co’ needs to be more transparent with the non-housing loan book which comprises 47% of the Loan book.

Look forward to hearing your comments ! Thanks for reading :)

Rahul

Disclaimer : Invested. [UPDATE - 19th July 2024 | Exited the position]

Disclaimer

Nothing you read here should be construed as investment advice. I do not know your circumstance so please treat the above as nothing more than my personal opinion, which is subject to change without prior notice to you. Please do your work and consult your financial advisor. I may own positions in all stocks, sectors and indices discussed and can exit them without notice.

I would quote Warren Buffett 'Turnaround seldom turns'. Banking is more about DNA, it's very hard to switch from bad to good lender.

On the question of investors. Plutus wealth has been increasing their stake and infact they bought 1% today - https://x.com/bigbulldeals/status/1750559470252646737 however why the company is calling PP shares pending money ahead of time is puzzling. Do you have any thoughts on the same? A sale or hiding some really bad NPA's.