Ola Electric can’t get it up.

It’s Market share & stock price, both are tanking.

Despite a visionary leadership, often compared to Elon Musk , it’s been a disappointment.

It’s losing market share. Bajaj & TVS have grabbed a 40% combined market share in FY25, from 7% in FY22.

It’s set a new benchmark in service, as many of us witnessed over the last few months (through entertaining X battles).

In response, Ola’s visionary leadership decided to transform operations via Project Lakshya - cost cutting & Project Vistaar - distribution network. This was in Q3FY25.

Under Lakshay, the company aims to cut monthly fixed costs to INR 110 cr from 178 cr average monthly in Q3FY25 to 121 cr (provisional & unaudited lol) in April 25.

The company announced that it would hit an Auto EBITDA operating breakeven at 25,000 units per month, down from 50,000 units per month.

Ola electric mobility Ltd, therefore, is expecting to make at least 110 cr / 25,000 = 44,000 per unit (before fixed costs).

Ola’s realisation per unit (sales (cr)/units sold) in FY24 & FY25 was 1.5 Lac & 1.3 Lac respectively.

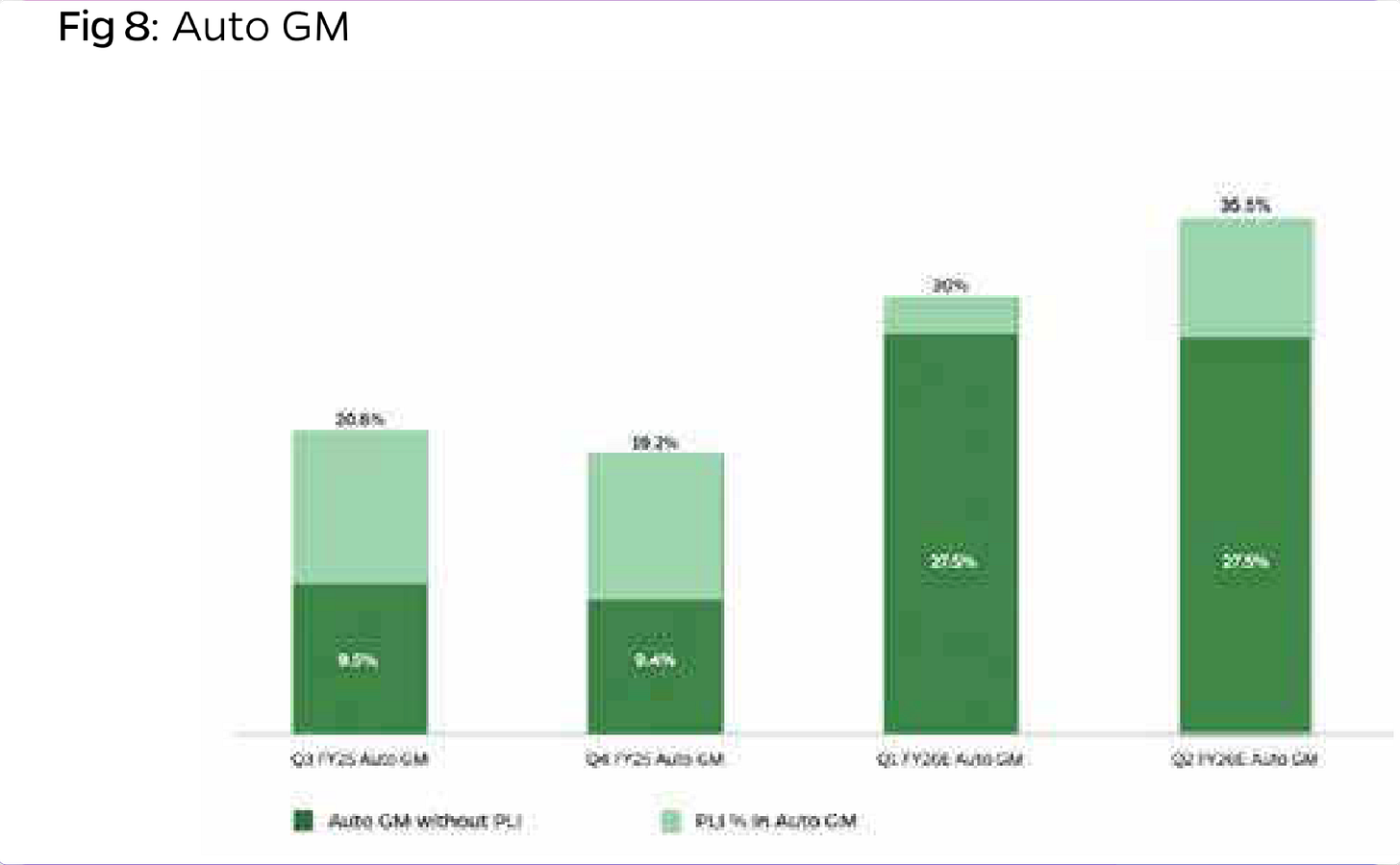

This implies (not directly stated) that it is expecting to make 28-34% of Sales before fixed costs.

Is this gross margin?

Because it also said its targeting a Gross margin of 36% + in Q2FY26 (including 9% PLI benefits).

This is supported by 11% lower Bill of materials for its Gen 3 scooters, higher realisation from Roadster bike and its “vertically integrated” model.

I’m finding it hard to be as optimistic as the visionary leadership of the company. But that’s what makes them visionaries, they see what plebs like me can’t.

It’s not that 36% GM is outside the realm of possibility, just the sharp increase in 2 quarters rests on a lot of ifs.

For one, the company is factoring in a 9% PLI to get to 36.5% but even the “25,000 units per month to breakeven” is looking a little difficult for the company if VAHAN dashboard data is to be believed.

Faced with a significant operating losses, no operating cash flows to support operations, and dwindling (but healthy) unencumbered cash and liquid investments of ~Rs. 3,100 crore as of March 31, 2025 (including funds earmarked for subject matters as per the IPO), the company decided to raise INR 1700 cr through NCDs, CPs etc.

It’ll be interesting to see who’s willing to lend to the company, and on what terms.

Then, there’s Project Vistaar: The company added 2400 touch points between Q3 and Q4FY25.

Making it the largest EV distribution network. All at a capex of “120 Cr”, which comes to is 5.2 lac per “touchpoint”.

While I admit i don’t know what a “touchpoint” constitutes and how they added 2400 of them in about 3 months (wow), 120 cr (capex) figure:

A. If at all true, seems low.

B. Does not reflect the true opex increase (obviously).

It’s like the story from 1964 (Jacobellis vs Ohio) when a judge ruled on whether a film (Les Aments i.e The Lovers) shown in a theatre in Ohio was ‘hard core pornography’ or not.

The judge basically said : I can’t define pornography, but I know it when I see it.

similarly, I can’t explain why this 120 cr seems odd, but I think it is.

It could just be my ignorance about how things work in the auto industry, in which case please feel free to educate me in the comments section.

The bottomline is (non existent for the company) that If :

Company is unable to scale up its Sales volume

Unable to raise sufficient capital, the company could find itself in a very ‘delicate’ situation.

We sincerely hope, the company is able to turn a corner - 16,72,130 Investors are betting on that happening.

Best wishes to visionary leadership.

Rahul Rao, CFA

EV has not taken off in India as say in China or other countries. China already has 50% share in 4W electric.

In India cycle rickshaw has taken off and little in scooters and premium 4Ws

Good work Rahul!