Coal based power isn’t going anywhere.

Image Source: https://www.downtoearth.org.in/

Disclosure: No Holding as on 21st Feb 2025.

While Non-coal based power makes up more than 50% of “Installed capacity”, Coal based power accounts for 72% of India’s “generation capacity”

The reason for this dichotomy is that Renewables have low Plant load factors - PLFs i.e a 100 MW of Solar or Wind will produce only 20 MW of power, Tops !

Meanwhile, Coal can go as high as 90 MW (or 90% PLF) for private Thermal plants.

The national average as the graph below shows is around 68.5%

This is why it’s unlikely that Coal is going anywhere in the next 5 years.

But, let’s assume that India is all about the Paris Agreement, we care about climate change (more than Energy security?), question is :

What needs to happen so that Coal power generation is reduced to 50% by 2030?

To bring coal’s share to 50% while meeting a 5% annual growth (Assumption) in demand over 5 years, India needs an additional 483.5 TWh of renewable energy, which translates to:

166 GW of solar

55 GW of wind

12 GW of hydro & others

Total New Renewable Capacity Needed: ~233 GW (Current ~ 210 GW)

(See calculations in Appendix)

Interestingly, this is around the number GOI is targeting. Meaning, GOI itself knows it’s going to be a slow path to weaning India off Coal.

But that is no surprise. We all knew coal was expected to go down slowly. Right?

The surprising part is : In August 2024, the Ministry of Power declared that by 2032, we would need an additional 80GW of Thermal based power to meet energy requirements.

There are more than 30GW of Thermal power plants under construction.

So, despite going Gung-ho on Solar and Wind - All credit to the MOP and MNRE and GOI, it seems they are seeing some challenges in weaning off Coal. Atleast, their actions suggest so.

I think this is a departure from the earlier narrative. There’s no denying that thermal Power has its own set of issues - Environmental damage, High cost, long time to come online etc but It’s becoming evident that Coal is likely to continue playing a lead role in India’s Energy mix.

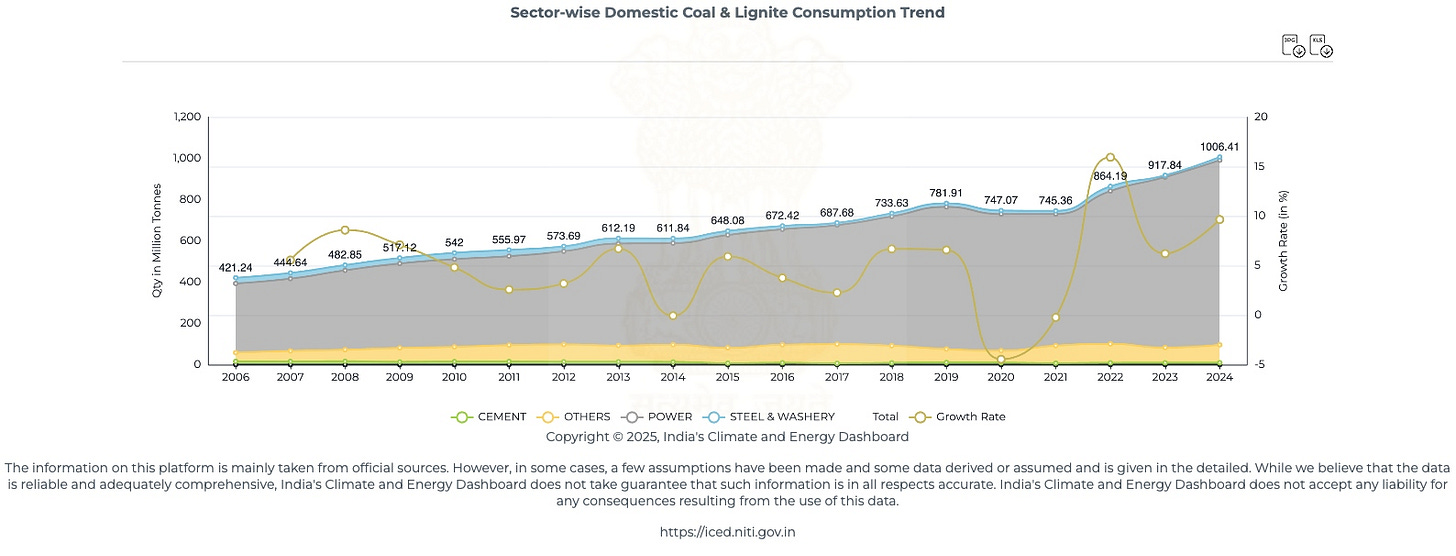

Assuming Coal is here to stay, and not only to stay to grow but as evidence suggests, Grow ! Then Coal mining is here to stay because 80% of Coal mined in India is used in Thermal power plants.

Enter coal India.

Since 80% of coal is is used as fuel in Thermal power plants, Coal demand is linked to the health/growth of Thermal power plants in India.

This is the primary reason why for much of the last 10 years leading up to 2022, Coal India production growth was largely stagnant. There have been little to no net capacity additions of Thermal (coal based) power.

From 2016 onwards, the net Thermal power addition fell from from 20GW per year to 5-7 GW per year.

This was a direct consequence of the “coalgate scam”. The Coal Gate Scam was one of India’s biggest corruption scandals, exposing the irregular allocation of coal blocks between 2004 and 2009. The CAG report (2012) estimated a massive ₹1.86 lakh crore loss to the exchequer, citing favoritism, lack of competitive bidding, and hoarding of resources.

In 2014, the Supreme Court canceled 214 out of 218 coal block allocations, disrupting coal supply chains. Many private players failed to develop their mines, forcing power and steel plants into crisis. India’s reliance on Coal India Limited (CIL) surged, and coal imports spiked from 17% in 2011 to 25% in 2015.

Reforms & Recovery

Coal mining in India has undergone a major policy shift, moving from a restrictive model to an open, competitive bidding process. Since 2014, auctions allowed private participation for captive use, and in 2020, commercial coal mining was fully opened to private players. The first auction under this regime saw 18 coal mines allocated.

Commercial coal auctions follow a two-stage online bidding process, ensuring transparency and efficiency. Unlike earlier, there are now no restrictions on sector, use, or price. Liberal terms, 100% FDI via the automatic route, and a revenue-sharing model based on the National Coal Index make the process attractive.

So far, 10 rounds of auctions have successfully allocated 113 coal mines. Details are as follows

Two beneficiaries of private coal mining, among many others possibly are :

Sarda Energy - Whose dormant coal mine is not supplying coal to its recently acquired Power plant from SKS Power.

Prakash Industries - A steel player that recently started sourcing coal from its own mines, which is likely to “reduce costs significantly”

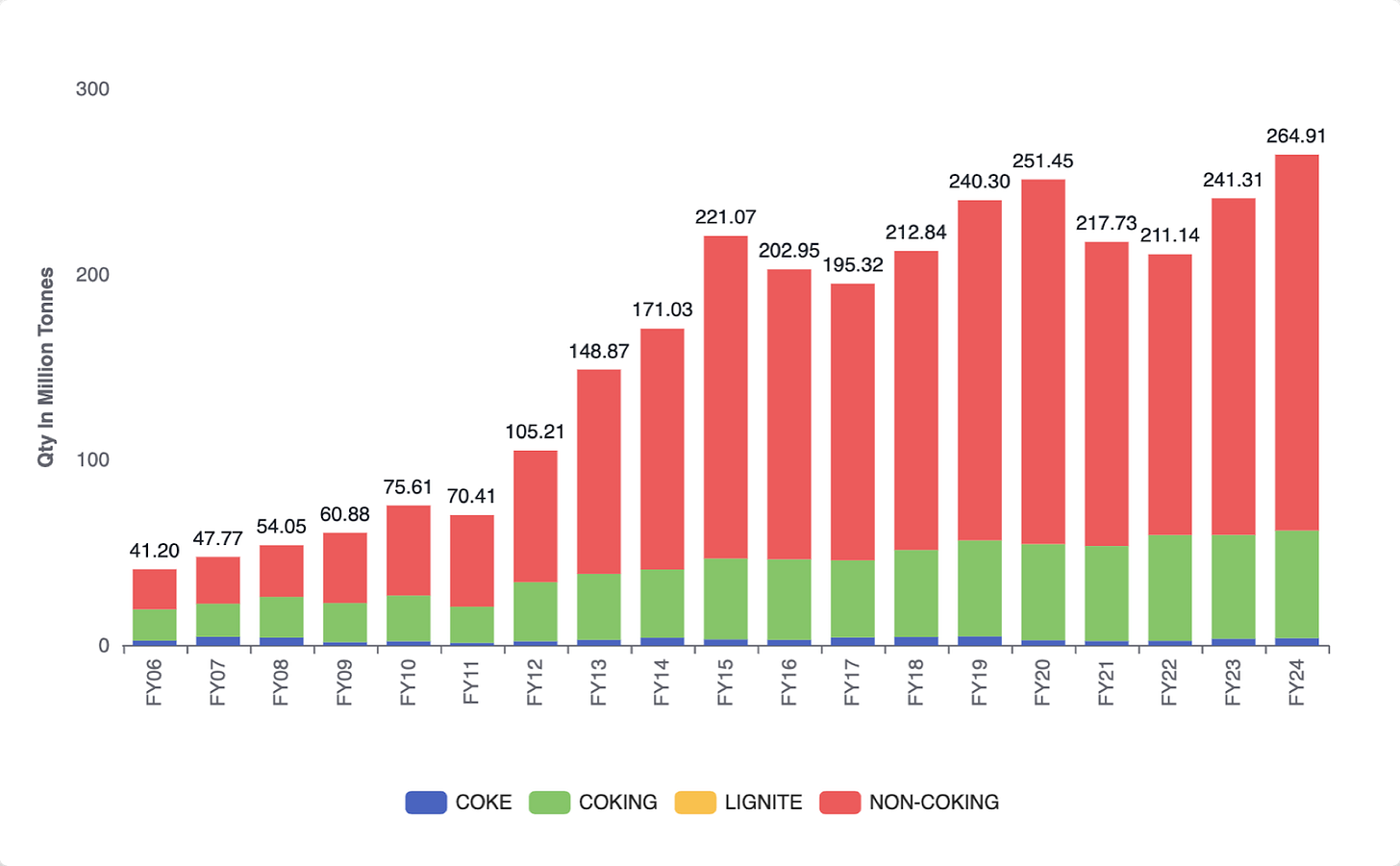

Despite major reforms in the coal sector since 2020, we import about 20% of our coal requirement.

WHY?

The blunders of the previous decade had many consequences, chief amongst them was the rising coal imports to make up for lower production on behalf of Coal India. A bulk of the imported coal is non-coking (does not produce coke when burnt) which is used in Thermal power plants.

But that’s not the only reason. India Non-coking coal is also NOT as energy dense (low Gross Calorific value - GCV) compared to say Indonesian or Australian Coal. No Wonder Adani has been tried to operationalise the Carmicheal mines, Australia for a good 10 years or more until 2021, when the supply finally started. The GCV of Coal from these mines is around 4950 Kcal/kg.

That’s a Grade - G7 (there are 17 grades of Coal according to the Ministry of Coal, categorised according to the GCV. Higher is better)

So while foreign mined coal is higher grade, its also significantly more expensive than local coal.

Checkout the latest import prices (link)

Owing to the “Coalgate” scam and lack of domestic production being low, high cost imports increased sharply since 2011-2012 and continue to remain high.

In contrast, want to guess the price at which CIL supplies to Thermal power plants in India? At Rs 1500/ton (called - FSA - Fuel Supply Arrangement prices). Yep.

Obviously, there are more than 20 grades of coal and higher grades are more expensive but even so CIL provides coal to our Thermal plants at FSA rates, which are significantly lower than market rates.

How do FSA prices work? That’s another conversation but the bottom line is that while imports might remain, it's possible that GOI’s renewed focus on Thermal Power is likely to push Coal mining.

As a result of Issues in the power sector getting sorted out (to some extent), coal production has increased, especially since 2022.

The rise in production is a direct consequence of higher power demand and a desire on India’s part to lower coal imports. It’s also a consequence I believe of the inability to scale up renewable sources of energy as quickly as India would like and the challenges associated with it.

As previously mentioned, the pipeline for upcoming Thermal Power exceeds more than 50 GW. We need Coal to power these plants, to power our nation.

The First beneficiary of GOI’s new found enthusiasm for Coal mining could be Coal India - Given that it still accounts for more than 75% of Total coal mined in the country.

Coal India

Coal India is a Monopoly. Therefore, coal demand & supply impacts Coal India closely.

It controls 80% market share through 8 subsidiaries situated in various parts of the country. Production numbers have seen an uptick since 2021.

These numbers were partially owing to the coal shortage pressure.

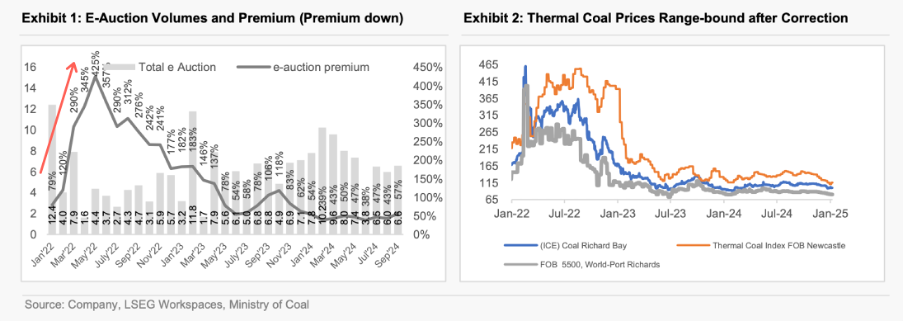

Owing to pressures in FY22, inventory with power plants which is meant to be 30-40 days had dropped to 4 days. In that context, E-auction prices were trading at a significantly higher spread vs FSA prices.

Although E-auction Quantity sold by Coal India is only 10% of Total quantity sold, a significantly higher spread adds to the operating margin and profit margin with a multiplier effect given the operating leverage inherent in a high fixed cost business such as Coal mining.

As a consequence of pricing as well as volume changes, Coal India went through a spectacular period where PAt more than doubled in 3 years.

Pricing has now reversed and sales volumes have tapered over the last 9 months, and inventory levels at power plants are sufficient.

Even the the inventory at Coal India seem sufficient as of December 2024 end, which is likely to keep pricing lower.

This begs the question : Was the March 21-24 period an exception or does it point to a permanent change in Coal India’s fortunes in the foreseeable future?

Over the last 9 months, prices have contracted from a high of 1836/ton in FY23. Volume Growth is a meagre 1.45% on a 9 month basis.

The Stock price is getting beaten over the last 7 months but that’s not unique to Coal India. Essentially, Coal India’s stock price is where it was in 2012 ! Ouch !

We believe things have changed for the Coal mining Industry for the better, Coal India does NOT deserve a 6.9X price to Earnings because that valuation assumes there will be 0 growth. We believe growth will be 6-10% and will several cost cutting measures in place, such as plan to cute workforce by 5% every year, Coal India might deserve a slightly higher premium. Maybe not 15x but certainly NOT 6-7X.

Meanwhile, Dividend yield was 7.2% at the time of starting our research on CIL. It’s now around 6.97%.

This could be an interesting value bet but again, this is NOT a recommendation. It all depends on your style and your own inclinations as an investor. All I’m saying is, CIL might not be such a dud after all. Worth a deeper look I’d say.

Regards

Rahul

Appendix :

Regulatory changes pushing Coal production Post 2020

Streamlined Bidding Processes:

Amendments to The Coal Mines (Special Provision) Rules now facilitate online bid security submissions, thereby simplifying the auction participation process.

This shift reduces administrative burdens and enhances the ease of doing business for companies involved in coal mine auctions.

Transparent Coal Allocation:

The Ministry of Coal has mandated Coal India Limited (CIL) to conduct auctions for coal linkages, ensuring a transparent and fair process for allocating coal resources.

This measure promotes competition and efficiency in the sector by ensuring that coal resources are allocated transparently through auctions.

Optimized Resource Utilization:

Policy amendments, such as those to the New Coal Distribution Policy, support transparent transactions of coal from closed or discontinued mines.

This ensures resource optimization and maintains economically viable operations by facilitating the use of coal from mines that are no longer operational.

Private Sector Participation:

The coal sector was opened to commercial coal mining by private players in 2020, encouraging broader participation in the industry.

The initial auction led to the allocation of 20 coal mines, marking a significant step in diversifying the sector.

Incentives for Coal Gasification:

The government has modified the Price Notification for coal to make the ROM (Run-of-Mine) price of the Regulated Sector applicable to Gasification Projects.

This applies to projects commissioned within seven years, incentivizing investments in cleaner coal technologies and promoting sustainable practices.

SHAKTI Policy:

The SHAKTI (Scheme for Harnessing and Allocating Koyala (Coal) Transparently in India) policy aims to create long-term demand for coal through transparent allocation.

This policy ensures coal supply to various categories of power plants, supporting energy security.

E-Auction Mechanisms:

Approval of e-auction mechanisms aims to streamline and enhance operational efficiency.

Coal Logistics Plan and Policy:

Aims to develop a technologically enabled, integrated, cost-effective, resilient, sustainable, and trusted logistics ecosystem for coal evacuation.

Focuses on increasing rail's share in coal transportation to 87% by FY30, reducing road transportation, and cutting rail logistics costs by 14%. This is expected to lead to annual cost savings of ₹21,000 crores and lower CO2 emissions. The plan also involves developing inland waterways and a smart coal logistics dashboard for real-time reporting and analytics.

The First beneficiary of GOI’s new found enthusiasm for Coal mining could be Coal India - Given that it still accounts for more than 75% of Total coal mined in the country.

To estimate how much renewable energy is needed to bring coal usage down to 50% of total power generation in India in 5 years, we can follow these steps:

Step 1: Define Assumptions

Current total power generation in India (2024): ~1,750 TWh

Coal’s current contribution: ~73% of total generation (~1,277 TWh)

Annual power demand growth rate: 5%

Time horizon: 5 years

Step 2: Project Total Power Demand in 5 Years

Using the formula for compound growth:

Future Power Demand=Current Power Demand×(1+growth rate)n\text{Future Power Demand} = \text{Current Power Demand} \times (1 + \text{growth rate})^n Future Power Demand=1750×(1.05)5=2,233 TWh\text{Future Power Demand} = 1750 \times (1.05)^5 = 2,233 \text{ TWh}

Step 3: Target Coal Contribution (50%)

To bring coal’s share down to 50%, the absolute coal-based power generation in 5 years should be:

Coal Generation Target=50%×2233=1,116.5 TWh\text{Coal Generation Target} = 50\% \times 2233 = 1,116.5 \text{ TWh}

Step 4: Required Renewable Energy

The reduction in coal-based power from current levels:

Coal Reduction=1277−1116.5=160.5 TWh\text{Coal Reduction} = 1277 - 1116.5 = 160.5 \text{ TWh}

Since total power demand is increasing, the additional renewable capacity required will not only compensate for coal reduction but also meet the additional demand.

Total Renewable Needed=Additional Demand+Coal Reduction\text{Total Renewable Needed} = \text{Additional Demand} + \text{Coal Reduction} =(2,233−1,750)+160.5= (2,233 - 1,750) + 160.5 =323+160.5=483.5 TWh= 323 + 160.5 = 483.5 \text{ TWh}

Step 5: Estimate Required Renewable Capacity

If we assume an average capacity factor of:

Solar: 20% (~1,750 full-load hours per year)

Wind: 30% (~2,630 full-load hours per year)

Hydro & Others: 40%

Let’s assume 60% of the additional renewable energy comes from solar, 30% from wind, and 10% from other sources.

Solar Capacity Required

Solar Energy Required=60%×483.5=290.1 TWh\text{Solar Energy Required} = 60\% \times 483.5 = 290.1 \text{ TWh} Solar Capacity=290.11.75=166GW\text{Solar Capacity} = \frac{290.1}{1.75} = 166 GW

Wind Capacity Required

Wind Energy Required=30%×483.5=145 TWh\text{Wind Energy Required} = 30\% \times 483.5 = 145 \text{ TWh} Wind Capacity=1452.63=55GW\text{Wind Capacity} = \frac{145}{2.63} = 55 GW

Hydro & Others Capacity Required

\text{Hydro & Other Energy Required} = 10\% \times 483.5 = 48.35 \text{ TWh} \text{Hydro & Other Capacity} = \frac{48.35}{4} = 12 GW

Final Summary

To bring coal’s share to 50% while meeting a 5% annual growth in demand over 5 years, India needs an additional 483.5 TWh of renewable energy, which translates to:

166 GW of solar

55 GW of wind

12 GW of hydro & others

Total New Renewable Capacity Needed: ~233 GW

Thanks for the write-up! Another thing to note is Coal India's fortress of a balance sheet - they have around INR 300 Bn in net cash with barely any debt. This further secures the dividend, even if they have a few quarters with lower earnings.

Rahul you can also have a look at other companies in coal value chain. I feel if coal production goes up then the other companies would benefit as well e.g underground mining equipment makers, other state/private mining companies.